Meta Posts Strong Revenue Result in Q3

The latest performance update from Zuckerberg's social media behemoth.

Meta has shared its latest performance update, showing a small increase in active users across its apps, and a big increase in revenue, in relative terms.

Though its investments in next-level projects remain significant. Here’s a look at the latest numbers from Mark Zuckerberg’s tech behemoth.

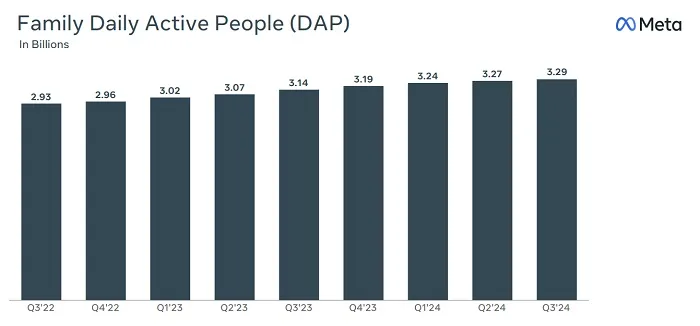

First off, on active users. Meta reports that it now has 3.29 billion people using its apps (Facebook, Messenger, WhatsApp, Instagram, and Threads) every day, which is a small increase on the 3.27 billion it reported in Q2.

Though we’re talking about 3 billion plus people, the scale of which is difficult to truly comprehend.

The population of the world is estimated to be around 8.1 billion, so Meta’s apps are used by almost 40% of the entire planet, every single day. Minus the 1.4 billion Chinese residents (where Meta is banned), and that’s closer to 50%, so the breadth of Meta’s operation in this sense is pretty amazing.

And it’s still growing. Despite its apps presumably reaching saturation point in many markets, Meta’s still seeing more users sign up to its apps, which bodes well for its ongoing potential, and its core ads business.

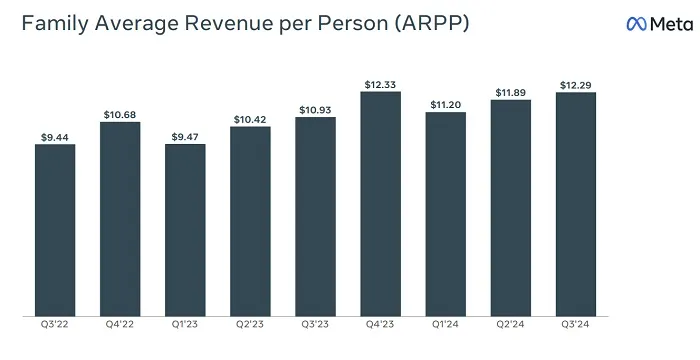

Indeed, Meta’s also driving more revenue, on average, from those users:

Meta doesn’t break down its ARPP results by market like it used to, but as you can see here, Meta’s overall revenue per user is rising, and will increase again amid the holiday rush in Q4.

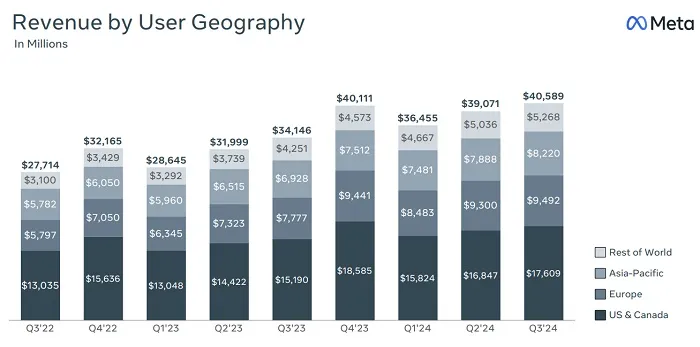

Which will help Meta continue to improve its revenue intake:

As you can see in this chart, Meta remains reliant on North America and Europe for the majority of its revenue intake, though it’s steadily increasing its Asia Pacific market intake as well.

That’s seen it post a strong revenue result for the period of $40.59 billion.

So while Meta is spending a stupid amount on VR and now AI development, it continues to rake in the cash from its main cash cow, by showing people more ads in its apps.

On that front, Meta also reported that ad impressions delivered across its apps have increased by 7% year-over-year. The average price per ad is also increasing (+11% YoY), though the math there is probably not ideal for social media marketers.

Essentially, that means that Meta is presenting more ads to more users in more places. Which means more opportunity for marketers to reach their target audience, but instead of lowering the ad price by adding more placements, it’s actually seeing them rise. I can see why that’s a positive for Meta’s shareholders, and its bottom line. But for advertisers, not so much.

Maybe that’ll improve with more people taking up Meta’s Advantage+ automated ad campaigns, which fully automate ad placement, creative, even budgets and bidding if you choose. Meta says that these ads are delivering better results through enhanced behavioral understanding, and that, at least in theory, could help marketers optimize their ad delivery, and maybe reduce overall costs.

Or just deliver better results, making the more expensive ads worth it.

So, more users, adding to its already massive presence, and more revenue from ads, which, as noted, are also set to rise again in Q4. Everything seems pretty good for Zuck and Co.

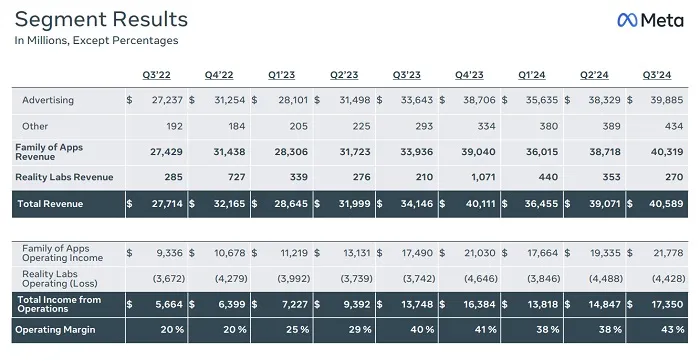

Oh, except this:

Meta continues to lose money on VR and AI development, with its total costs and expenses rising by 14% year-over-year.

And that sinkhole only going to get deeper.

As per Meta:

“We expect full-year 2024 total expenses to be in the range of $96-98 billion, updated from our prior range of $96-99 billion. For Reality Labs, we continue to expect 2024 operating losses to increase meaningfully year-over-year due to our ongoing product development efforts and investments to further scale our ecosystem. We anticipate our full-year 2024 capital expenditures will be in the range of $38-40 billion, updated from our prior range of $37-40 billion.”

In addition to this, Meta’s anticipating “significant capital expenditures growth in 2025” as it works to build new AI datacenters, and other infrastructure for its next-level projects.

Meta’s arguably leading the way on VR, AR and AI development, based on its massive troves of data, its years of development on related projects, and the resources at its disposal. But that does come at a cost, and Meta’s still having to eat those expenses, with none of these projects bringing in meaningful revenue for the company as yet.

But they will. Well, hopefully.

Meta’s AR glasses look set to be a hit, with the company showing off its new AR device at its Connect conference last month.

At some stage, functional AR is going to become a thing, and Meta, right now, looks set to win out when it does catch on and become a bigger trend. And with sales of its current Ray Ban smart glasses on the rise, the indicators do suggest that consumer demand for AR glasses will be significant.

The metaverse is also still lingering as a longer term play, and Meta’s clearly paving the way forward on VR development, while its AI projects are also gaining traction, with Zuckerberg once again lauding the take up of its AI chatbot, which he says it now the most used AI chatbot tool on the market.

Indeed, in his pre-prepared statement, Zuckerberg attributed the company’s strong performance to progress and momentum around “Meta AI, Llama adoption, and AI-powered glasses."

Some of these remain speculative bets, but the signs are there, and they all point to these becoming the new norm for connection and interaction in the near future. It might be hard to imagine people all interacting in VR headsets at some stage, but the progression makes sense, and AI can also play a significant part in that experience, in helping users generate their own custom VR worlds.

As such, while Meta’s current AI tools seem fairly generic, and don’t add a lot to the experiences on Facebook of IG (the rising use of its AI chatbot is likely more indicative of Meta’s scale than the bot’s popularity), I also don’t think that this is much of an indicator as to where Meta’s headed on this front.

So, a good result for Meta, or at least, a largely expected one, with its ad business remaining solid, and its development costs remaining high. I doubt there’ll be a big market backlash against the company, even with those projections of further cost increases, as the future remains pretty rosy for the business.

But the compounding costs will spook some investors, which could prompt a short-term kick back.

BigThink

BigThink

![Reddit Shares Insights into its Rising Influence in Consumer Purchase Pathways [Infographic]](https://imgproxy.divecdn.com/V-kT_B-_RZ8mAMGqZ8rovzJUZZU9Is_XOptK8YoTLRI/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9yZWRkaXRfZnV0dXJlX29mX3NlYXJjaDIucG5n.webp)