M’sian startup bags 8-digit funds to bring its child-safe cashless app to public schools

Vircle is a Malaysian startup known for its child-safe cashless solutions. It has secured its seed funding to expand into public schools.

Malaysian fintech startup Vircle announced that it has secured its seed funding on October 31, 2023.

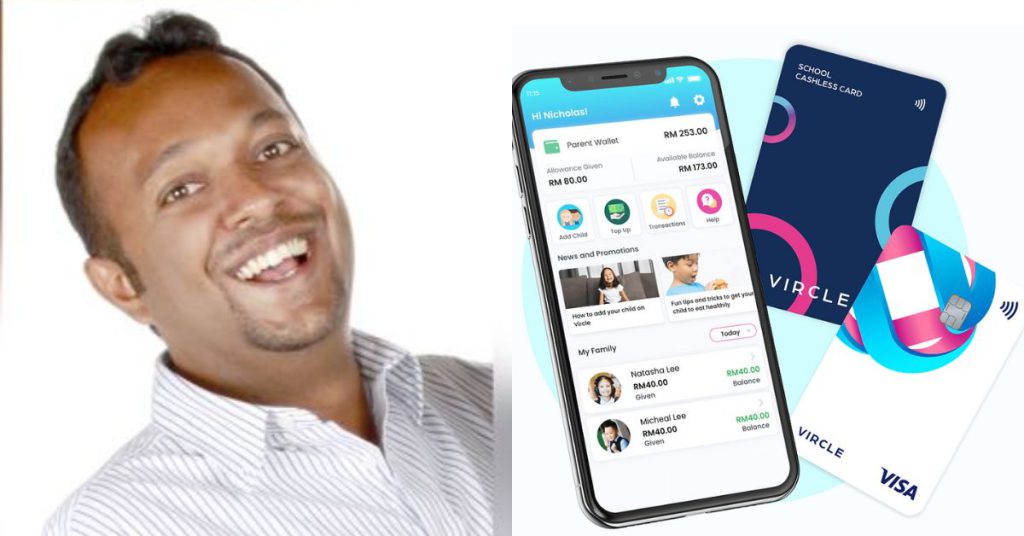

Vircle is a cashless payment solution that aims to teach kids safe and responsible spending in schools as well as out of schools through its child-safe Visa prepaid card.

In an interview with Vulcan Post, Vircle CEO and founder Gokula Krishnan Subramaniam revealed that the total funding raised, inclusive of amounts closed and oversubscriptions that are currently being finalised, is over the eight-digit mark.

This seed round is co-led by Kumpulan Modal Perdana (KMP) and Gobi Partners. KMP is a Malaysian tech-focused venture capital firm owned by the Ministry of Finance, under the purview of the Minister of Science, Technology & Innovation (MOSTI).

Meanwhile, Gobi Partners is an Asia-focused venture capital firm with headquarters in Kuala Lumpur. Its investment in Vircle is under its Gobi Dana Impak Ventures (GDIV) fund, which is a part of Khazanah Nasional Berhad’s initiatives to support local startups.

Prior to this seed round, Gokula shared that Vircle successfully raised funding in 2021, led by 500 Global’s 500 SEA III fund and 1337 Ventures, alongside angel investors.

“That allowed us to grow our minimum viable product to seek a strong product-market fit,” the CEO said.

Image Credit: Vircle

Image Credit: VirclePost-pandemic, Vircle saw rapid growth as well as strong product-market fit in its in-school segment, which in turn encouraged growth in its direct-to-consumer (D2C) product, the child-safe Visa card.

In accordance with this, the startup expedited its seed fundraising, Gokula shared, a process that took almost one year from planning to closing.

On a mission to improve financial literacy

Founded in 2019, Vircle was first designed to help parents nurture healthy eating and purchasing habits of their children in schools. This is done by working directly with schools to integrate Vircle’s cashless school cards.

Today, the finance app has grown to do more than that, with its Visa card enabling children to practise responsible saving outside of school. But its core mission is still to teach children financial literacy skills.

“We live today in a country where over 40% of the adult population have no savings at all and we live pretty much hand-to-mouth,” Gokula explained. “No one thinks enough about the importance of planning, thinking twice about that impulse purchase, or the need to save or invest.”

He continued explaining that for many adults, the first “hard lesson in money” comes upon getting one’s first credit card and missing out on monthly payments.

“At least, for the older generation that was the case,” he said. “But in the current online ecommerce world, our youth are being tempted to go into debt in many creative ways, like BNPL, instalment, etc., which all have hidden repercussions.”

As such, Vircle seeks to provide a safe and early introduction into the cashless world, allowing children to be better-prepared to face such dangers.

Fresh funds for fresh growth

According to the press release, Vircle’s fresh funds will be used to expand its services to public schools nationwide as it continues its journey to bank one million Malaysian children.

Vircle’s in-school solution has mostly been used in international schools. So its introduction into public schools will bring what was predominantly a solution addressing the upper-middle class to the masses.

Image Credit: Vircle

Image Credit: Vircle“When we do public schools, we want to do it right,” Gokula told Vulcan Post. “We understand damn well the complexity of doing schools, something many don’t understand.”

For one, the CEO believes Vircle is equipped with the right knowledge to process a high volume of transactions in a short period. Moreover, the team has also been working to obtain approvals with several states’ education departments.

“We will do it right, scalable, and sustainable,” he said.

On top of the expansion into public schools, funds will also be utilised to grow Vircle’s team and expand its offerings to meet children’s health, wellness, and well-being needs from a product point of view.

“We went from zero to one with a very small team. Now we expand, albeit surgically to meet a scaling phase startup, bringing in more senior folks and targeted competence to go from one to 100,” he said. “It’s all about right team, right time.”

Safety first

In its effort to continuously innovate, Vircle often gets insights from parents’ feedback and their wish lists. One of their biggest concerns is safety, something that Vircle also takes seriously.

Gokula explained, “We are the only Visa prepaid card out there with inbuilt child safe controls and global merchant blocks. We do all the research on high-risk merchants, improper categories and groups for kids, and we put this into our homegrown transaction processing engine which has helped us keep kids safe while giving parents the peace of mind with over sight and controls.”

He pointed out that in Malaysia, minors can’t legally enter into contract. As such, the entire Vircle family banking is built with parent consent integrated through its spending controls and family account management.

Gokula at a presentation for The International School of Kuala Lumpur’s Young Investors Society / Image Credit: Gobi Partners

Gokula at a presentation for The International School of Kuala Lumpur’s Young Investors Society / Image Credit: Gobi Partners“We don’t risk our children’s future by making them sign up for their own e-wallet accounts without recorded and verified parent consent or oversight,” Gokula said.

He believes that this something that some e-wallet providers allow today, which ends up exposing young teens as young as 12 to danger such as financial scams. “Everything we do [is] to keep kids safe,” the Vircle CEO assured.

Bigger and bolder expansion goals ahead

In the bigger picture, Vircle’s mission is to bank one million Malaysian children and a three million children across Southeast Asia within the next five years.

“We have a lot of interest in two other Southeast Asian countries, both we are currently firming up our go-to-market,” Gokula said.

Other than that, Gokula mentioned wanting to go deeper into financial learning and education savings, as well as possibly incorporating a digital account opening for unbanked kids within Vircle app itself.

“It’s going to be an exciting 2024 for us,” Gokula said.

Learn more about Vircle here. Read other funding news we’ve written here.Featured Image Credit: KMP’s Yarham Yunus, Vircle founder & CEO Gokula Krishnan, and Gobi Co-founder Thomas G. Tsao

Astrong

Astrong