M’sian startups who struggle with funding need to know these 8 things before trying again

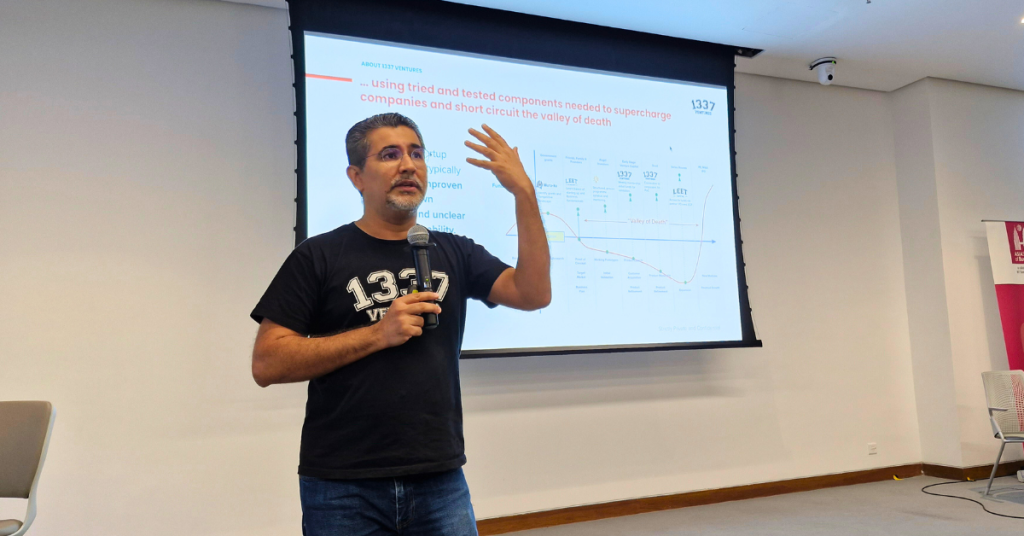

Here is some helpful funding advice for startups and entrepreneurs in Malaysia, as told by VC firm 1337 Ventures' Bikesh Lakhmichand.

As a startup, it’s like a rite of passage to look for funding in order to grow your business.

But it’s easier said than done as funding requires a lot of steps. One of them being that you need to approach investors and convince them to give you a large sum of money.

So we’ve compiled a list of 8 realistic funding advice from Bikesh Lakhmichand, one of the founding partners of 1337 Ventures (a Malaysian early-stage venture capitalist (VC) firm), shared during an event at Startup Week Malaysia 2023.

1. Never raise money when you need money

We’ve heard this from both investors and entrepreneurs alike. When you’re thinking about funding, the first question you should ask yourself is how much money do you need and how fast do you need it?

If the answer is that you need the money now, then Bikesh believes it’s kind of the end of the road for you.

Image Credit: Pexels

Image Credit: Pexels Because realistically, you don’t know how long it will take to raise the funds. At the same time, the more you don’t need the money, the easier it will be to negotiate with investors because you’re not desperate.

In his experience, investors can typically feel when you need the funds and might take this as a red flag. To them, it will seem like your company is a sinking ship, so they may not want to be associated with you.

So the key here is to raise money when you actually don’t need it. This way, it’ll give you a headstart on getting funds before a crisis happens and leaves more flexibility for a financial agreement.

Business tip: Bikesh shared that in a practical sense, startups should generally fundraise every 12 to 18 months.

2. It is your job to be visible to investors

If you didn’t know, every investment firm will usually have an investment analyst whose main role is to find deals. Which basically means that they’re the ones looking at and bringing deals to the table for consideration.

Hence, your responsibility is to put your business on their radars.

“If analysts can’t find you and don’t know you exist then it’s your problem,” Bikesh shared. “Your role is to be discoverable to these analysts.”

Most of these analysts can be found on LinkedIn through their job descriptions. So don’t be shy and hope that they will somehow stumble upon your brand. Instead, take the initiative to add them, message them, and tell them more about what you do.

“Whether you get funded or not is a different story, but if they don’t know that you exist then that’s your problem. You need to fix this. Stop trying to work in stealth mode.”

3. Fundraising is a full-time job on top of running your business

This may seem like a no-brainer to some but in case you didn’t know, fundraising is also a full-time job. It requires a lot of time, energy, and resources, especially in the beginning.

In other words, it’s not something that you can just leave aside and get back to whenever you’re free.

Image Credit: Flickr

Image Credit: Flickr According to Bikesh, once you go down the route of funding with investors, you will always be fundraising in the future. This is because the first investors that invest in your company will want their money back, and so on and so forth.

So the question comes down to: Do you, as the founder, actually have the capacity for this? If not, then it might be best to look into other funding options for the time being.

Which brings us to the next point…

4. Take money from your mum and everyone else first

It’s a running joke in the local investor space, but Bikesh explained that one question investors typically ask is have you taken money from your mum?

“If you haven’t taken money from your mum then why are you coming to me?” he stated. Because to investors, it comes off as you not having enough faith in your business idea.

“You don’t trust that you’ll do well enough to give your mum back her money, but you want to take my money? Why would I trust you if you don’t even take your family and friends’ cash first?”

The idea here is to just bootstrap as much as possible. This way, you can build up the value of your business before going to the fundraising stage. It will give you a better chance at negotiation and possibly provide you with better funding rates.

5. Understand who you’re going to and for what reason

Aside from money, another reason that startups look for investors is because they provide mentorship and networking opportunities. For example, investors in the fintech industry would have corporate networks in the same field.

They also differ in which startup stages they fund, the cheque sizes they give out, and their active geographical location. Some investors only conduct business within a specific country or region.

So before you start knocking on the doors of investors, it’s best to research and understand their background and portfolio.

This way, you won’t waste time trying to seek Series A funds from an investor that only does Series B funds, or have a meeting with a fintech investor when you’re doing agritech.

6. You have to find an investor that’s willing to put in the work

Speaking candidly, Bikesh shared that most investors already know the kind of companies that they want to invest in. In fact, he says they have a “shopping list” of the fields they want to invest in.

At the same time, they also have a good gauge of the cheque size they’re willing to write. It’s possible that you have to club around with a few investors to get the total funding amount you’re looking for.

However, when it comes to a group of various investors, it’s more likely that they’ll ask you to find “the lead” that will put in the work first.

In his experience, Bikesh said that smaller VCs prefer to tag along and let the more established VCs manage the funding round. This is because someone has to conduct the due diligence process, such as checking the finances, the company’s structure, legal documents, key personnel, employment contracts, and clientele.

Since it takes a lot of effort, especially in sectors that are too new, it might be a good idea to look for investors that are willing to take bigger risks.

7. Keep the funding a secret until it’s confirmed

This advice is applicable to most business-related deals, but probably more so when it comes to funding as such news spreads fast.

While most investors wouldn’t typically waste theirs (or your) time, it’s not an impossible thing. Sometimes, investors might have a lengthy 10-month discussion with you only to decide later that they don’t want to invest in you.

It might sound a little ridiculous but Bikesh assured us that it’s happened to him quite often in the past.

“The first line in every investment sheet states, ‘This is not binding’. So even if they tell you they want to invest in you, you shouldn’t tell the world that you’re going to raise funds from so-and-so,” he advised.

Because the reality is that it may not happen. So it’s better to wait until the papers are signed before you announce it to the press.

8. Investors are trained to be sceptical, so come prepared

Generally, investors have a rather bad reputation of shutting down potential business ideas. But that’s only because they’re actually trained to be sceptics. After all, how else are they supposed to ensure that the invested funds will see good returns?

Image Credit: Vulcan Post

Image Credit: Vulcan PostSo before going to them, you should be prepared to answer these basic questions:

Is your business proven? Are your expansion plans feasible, and how expensive (or cheap) are they? How real is the problem your company is solving? Is there a base of people that actually need it, as opposed to wanting it? How much work have you done before this, particularly in terms of business planning and funding? For example, have you raised funds before or has it been bootstrapped so far? What are the unknown elements of the business? What are the things that VCs or analysts don’t understand about it?Bikesh further explained that the key to good pitches is when the people listening in (like the investors and analysts) actually learn something about the industry from you.

“When you pitch, you’ve got to teach us something about the things you know that the others don’t,” he said. If this doesn’t show when you’re pitching, it might leave them wondering what’s the point in funding you.

“We’re not there to demean you, but we’re just there to be sure [of the business].” So just like any other kind of interview, it’s best to anticipate a list of hard questions they’ll ask and prepare to be in the hot seat.

Read articles we’ve written about Malaysian startups here.Featured Image Credit: Vulcan Post

Kass

Kass