M’sia’s latest digital bank by YTL-Sea wants to stand out by having a ChatGPT-styled chatbot

Ryt Bank, a Malaysian digital bank by YTL Digital Capital Sdn Bhd and Sea Limited announces AI and ChatGPT-like features.

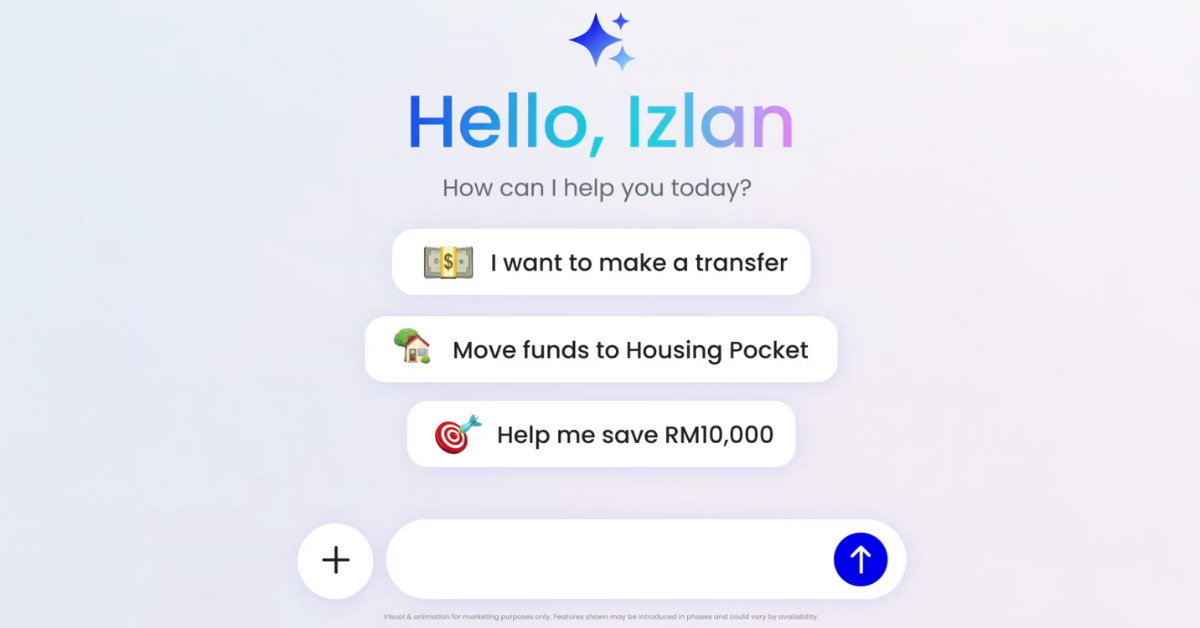

If you’ve ever wondered if banking could be as easy as sending a text, then you might be interested in Ryt Bank and its ChatGPT-like chatbot—Ryt AI.

A joint venture between YTL Digital Capital Sdn Bhd (YTL) and Sea Limited (Sea), Ryt Bank aims to redefine banking in Malaysia by incorporating artificial intelligence (AI) into its platform. It is the latest digital bank to secure a digital banking licence from The Ministry of Finance.

Based on the latest press release, Ryt AI is a personalised and AI-powered private banker designed to simplify banking services, deliver tailored financial insights, and manage advanced savings strategies.

Image Credit: Ryt Bank

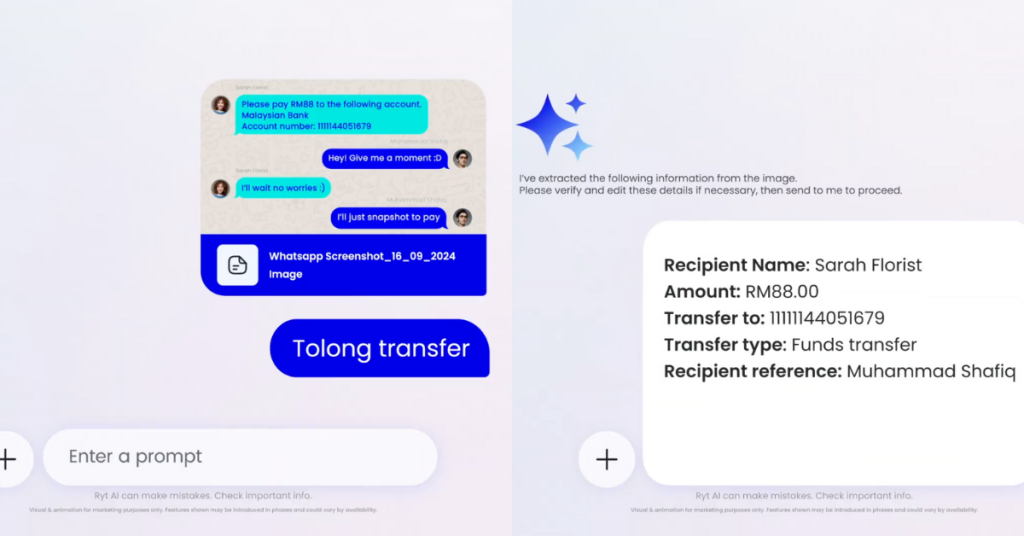

Image Credit: Ryt BankOne example of Ryt AI in action is its advanced fund transfer feature. Users can initiate and complete fund transfers by simply sending a prompt to Ryt AI, similar to how you would use ChatGPT.

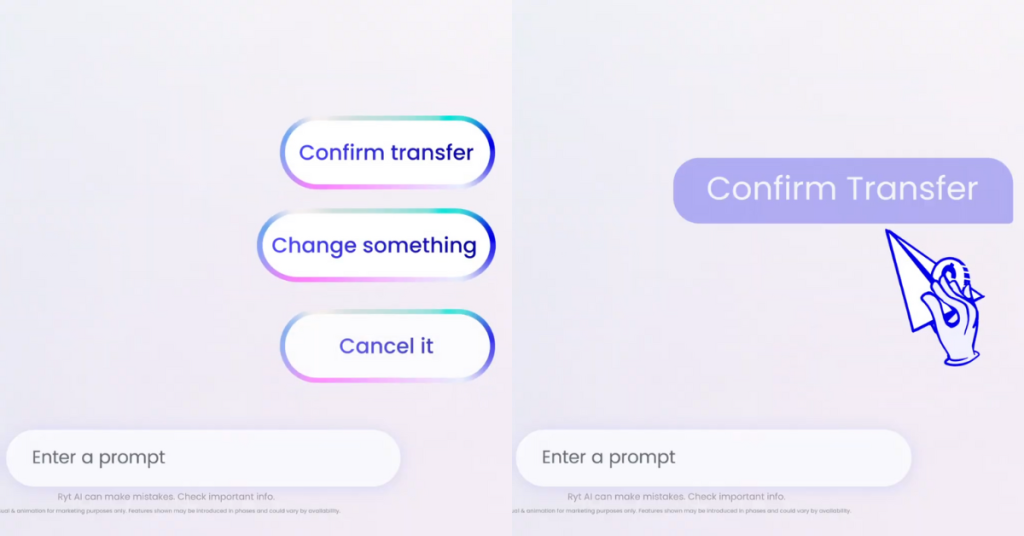

In a video shared with the press release, it’s shared that Ryt AI is able to extract key information from photos, such as screenshots. It will then send a text to double confirm the information before proceeding with the funds transfer. If there are any incorrect details, users are able to make amendments as well.

Image Credit: Ryt Bank

Image Credit: Ryt BankRyt Bank also teased other ways Ryt AI can be used in near future, including:

Creating a save “pocket” (which we deduce is a savings account) Managing transfer limits Setting monthly or annual savings goals (e.g. to save RM10,000 in a year) Scanning QR codes from albums and transfer Setting a recurring transfer Viewing spending insights A balance prediction for the end of the yearThe idea is that this would help save the time taken to log into your banking account and perform all these tasks. “This streamlined approach [also] ensures accessibility for a diverse range of users, supporting multiple languages to meet their needs,” stated Melvin Ooi, Ryt Bank’s CEO.

“By harnessing the power of artificial intelligence (AI) to provide an unequalled customer experience, we will deliver financial services that are meaningful and inclusive while helping customers achieve their financial goals.”

AI integration is cool, but is there anything we should be concerned about?

This question is one that we’re sure a good handful of Malaysians are asking. After all, banking is a private affair and adding artificial intelligence into the mix might scare some more sceptical users off, particularly if you like handling finances the traditional way.

To address the sceptics, Ryt Bank assures that it places security and transparency at its core.

The digital bank and its AI feature will come with advanced encryption, multi-layer security, biometric face-matching verification, real-time fraud monitoring, and PIDM protection up to RM250,000 for each depositor.

Image Credit: Ryt Bank

Image Credit: Ryt Bank“Ryt Bank’s services also come with no hidden fees, reflecting the bank’s commitment to honesty and trustworthiness,” the press release noted.

However, there is still the concern of how user data will be collected, stored, and used. What happens if there was a breach of sensitive information, what are the repercussions?

AI algorithms could also perpetuate biases if the training data isn’t large enough, which has the potential of leading to discrimination in other financial services such as loan approvals and credit scoring.

Lastly, there’s the argument that banking should have some form of human touch. As a user, I’m more inclined to trust an actual professional to perform financial services, especially if it’s dealing with large sums of money and other concerns.

While Ryt Bank has reassured that customers will be supported by 24/7 assistance, I’m curious as to how fast they’ll get back with more serious, time-sensitive issues.

-//-

Image Credit: Ryt Bank

Image Credit: Ryt BankAs one of five consortiums that got a digital banking licence from Bank Negara Malaysia, Ryt Bank plays a role in the country’s ambition of meeting the banking needs of the population. According to PwC, about 15% of the local adult population remained underserved and underbanked in 2023.

Ryt Bank received the Ministry of Finance’s approval to commence operations from December 20, 2024. To ensure a smooth rollout, the digital bank will be launched in phases to the public.

With YTL and Sea having global track records in their respective fields, Ryt Bank is set to become a Malaysian banking force.

For context, YTL has 70 years of corporate experience in industries like utilities, construction, and hospitality. On the other hand, Sea is a major global consumer internet company behind Garena, SeaMoney, and Shopee.

Learn more about Ryt Bank here. Read other articles on Malaysian startups here.Featured Image Credit: Ryt Bank

Fransebas

Fransebas