Nikkei and Taiex lead gains in Asia, as tech stocks rally on renewed AI enthusiasm

Asia-Pacific markets jumped higher on Thursday, tracking gains on Wall Street fueled by a tech rally.

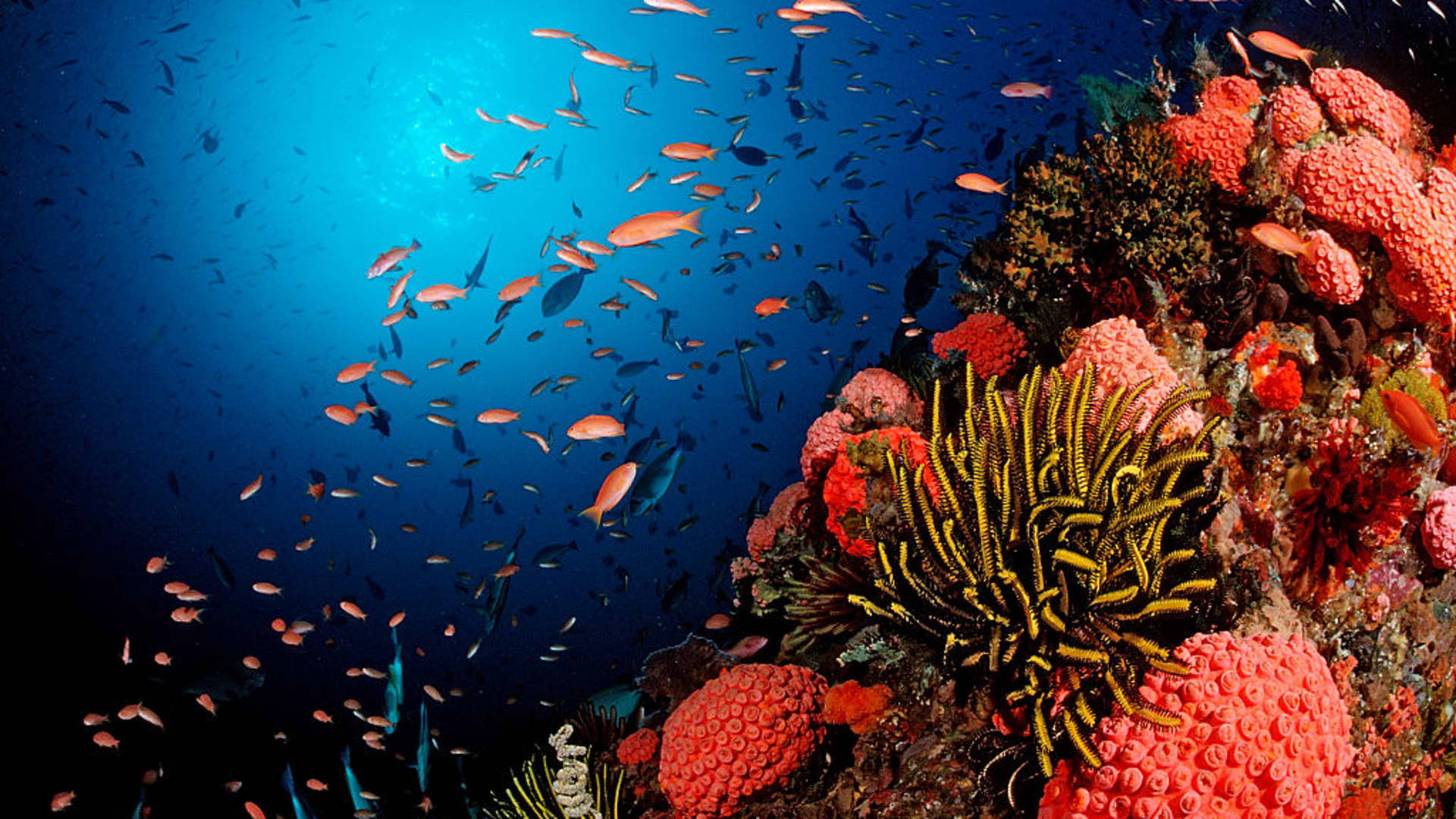

TSMC offices in San Jose, California, US, on Thursday, April 18, 2024.

David Paul Morris | Bloomberg | Getty Images

Asia-Pacific markets rose Thursday, tracking gains on Wall Street fueled by a tech rally.

Japan's Nikkei 225 jumped 3.41% to close at 36,833.27 and The Taiwan Weighted Index advanced 2.96% to finish at 21,653.25.

During the trading session, chipmakers and related companies extended the global chip rally, as the bullish investor sentiment spilled over to Asia.

Tokyo Electron rose 4.8%, Advantest was up 9% and Renesas Electronics was 3.47% higher. SoftBank Group, which owns a stake in chip designer Arm, jumped 8.4%.

In South Korea, the Kospi was 1.67% higher and the small cap Kosdaq gained 3%. SK Hynix and Samsung Electronics soared over 8% and 1.85%, respectively.

Taiwan Semiconductor Manufacturing Company closed 4.79% higher and Hon Hai Precision Industry — known internationally as Foxconn — up 4.72%.

Asian chipmaking heavyweights rallied after Nvidia CEO Jensen Huang made a compelling case for the future demand for AI chips.

Separately, shares of Seven & i jumped as much as 7.3% after Bloomberg reported that Alimentation Couche-Tard is weighing increasing its bid for the Japanese retail group. The report noted, however, Couche-Tard would need to come up with a much more attractive proposal than the initial $39 billion buyout approach.

Couche-Tard is still debating next steps and there's no certainty it will submit another proposal, Bloomberg report said, citing people with knowledge of the matter.

On the economic front, Japan's producer price index rose 2.5% year-on-year in August, less than the expected 2.8% and the 3% reported in the previous month. The data is among the key indicators closely watched by the Bank of Japan. The central bank has signaled it intends to further raise interest rates in coming months.

Investors will also look toward the release of Hong Kong's producer price index for the second quarter this afternoon.

India is also poised to release its August consumer price index late Thursday. Economists polled by Reuters expect it to rise 3.5% year-on-year, compared to 3.54% in July.

Chinese home appliance maker Midea Group plans to price its shares at the top of the range in a deal that would raise at least $3.46 billion in a Hong Kong listing, Reuters reported Wednesday, citing people with direct knowledge of the matter.

The listing is set to be the largest offering in Hong Kong since May 2021.

Australia's S&P/ASX 200 advanced 1.1% higher to close at 8,075.7. Hong Kong's Hang Seng index was up 1% as of its final hour of trading, while mainland China's CSI 300 slipped 0.43% to end at 3,172.9.

Overnight in the U.S., the broad-based S&P 500 advanced 1.07%, while the Nasdaq Composite rallied 2.17%. The Dow Jones Industrial Index inched up 0.31%.

The major benchmarks rebounded from intraday lows as core CPI rose slightly more than expected and investors changed their bets for a quarter-percentage-point-cut by the Fed next week.

Investors on Wall Street will look toward the release of the August producer price index on Thursday, which is expected to show a rise of 0.2% in the headline as well as core inflation readings, according to economists polled by Reuters, compared to 0.1% and 0.0% previously.

—CNBC's Pia Singh and Lisa Kailai Han contributed to this report.

Troov

Troov