Norwegian Cruise Line Holdings reports ‘record’ second quarter revenue

Company claims 33% increase on same period in 2019

Norwegian Cruise Line Holdings (NCLH) has reported a “record” total revenue in its second quarter.

The company – which operates Norwegian Cruise Line, Oceania Cruises and Regent Seven Seas Cruises – said it achieved a total revenue of $2.2 billion for the three months to June 30 this year, representing a 33% increase on the same period in 2019.

It cited “solid revenue performance, lower costs and favourable fuel prices” as reasons for the success, adding revenue per passenger cruise day was up by 15% compared to 2019 levels.

More: Latin American singer to name new Norwegian Cruise Line ship

Cumulative booked position for the remainder of 2023 is at “record levels”, the company reported, saying its advance ticket sales balance is at a record $3.5 billion, approximately $167 million higher than the previous quarter and 56% higher than the second quarter of 2019.

Capacity will increase by 19% this year compared to 2019 due to the delivery of three news ships, meaning total 2023 occupancy is expected to reach 103.5% of 2019 levels. The company outperformed that in the second quarter, reaching approximately 105% occupancy, which it said reflects the completion of its phased ramp up.

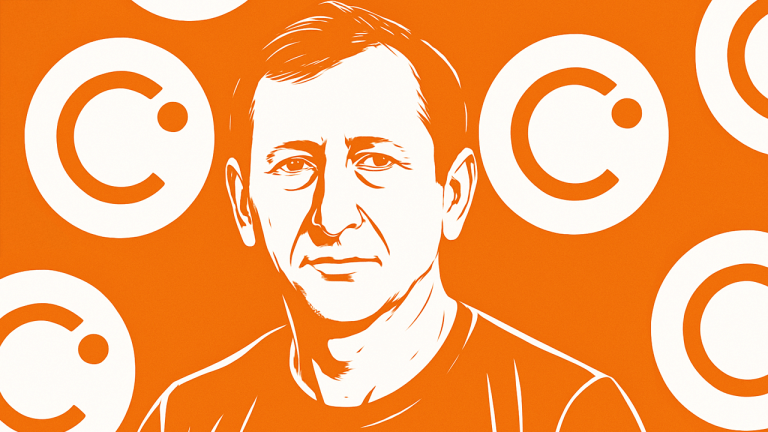

NCLH president and chief executive Harry Sommer (pictured) said: “The continued strength in the demand environment is evident not only in this quarter’s results, in which we generated a meaningful increase in pricing on 19% capacity growth compared to 2019, but also in our forward booked position which is within our optimal range and at higher pricing.

“As we look to the near future, we are focused on sustaining this momentum by capitalising on the robust demand environment, strategically enhancing our guest experience, rightsizing our cost base through our ongoing margin enhancement initiative, building excitement for the upcoming launches of Norwegian Viva and Regent’s Seven Seas Grandeur, and ultimately charting a path to reduce leverage and de-risk our balance sheet.”

Mark Kempa, executive vice-president and chief financial officer, said: “During the quarter, we achieved a second consecutive quarter of sequential operating cost improvement, demonstrating our commitment and relentless focus on improving efficiencies, reducing costs and restoring our margins in a strategic and data-driven manner while preserving the guest experience and superior service levels our brands are known for.”

ValVades

ValVades