Samsung reclaims top spot as iPhone sales plunge dramatically

After the largest decline in iPhone sales since the Covid-19 lockdowns, Samsung has reclaimed the top spot. Apple lost its… Continue reading Samsung reclaims top spot as iPhone sales plunge dramatically The post Samsung reclaims top spot as iPhone...

After the largest decline in iPhone sales since the Covid-19 lockdowns, Samsung has reclaimed the top spot. Apple lost its title as the leading global mobile phone seller due to a significant drop in sales compared to its South Korean competitor.

Until the end of 2023, Samsung held the title of the largest mobile phone seller for 12 years, but Apple’s iPhone models surpassed it in sales at that time. However, after just one quarter, it was pushed down to second place, thanks to impressive sales of the Galaxy S24 series, which launched in January earlier this year. Samsung reportedly shipped more than 60 million Galaxy S24 series phones during the period.

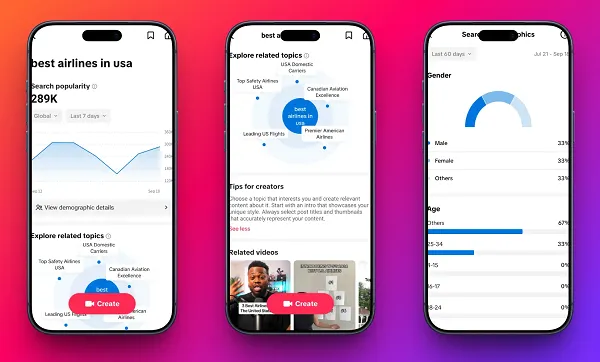

Global smartphone shipments increased to almost 8 per cent to 289.4 million units during January-March, with Samsung, at 20.8 per cent market share, clinching the top phone maker spot from Apple, according to research firm IDC. While Apple’s smartphone shipments dropped about 10 per cent in the first quarter of 2024.

During the first quarter, Xiaomi, a leading smartphone maker from China, held the third position with a market share of 14.1 per cent. Apple’s smartphone shipments in China shrank more than two per cent in the final quarter of 2023 from a year earlier.

Is Apple struggling to maintain its position?

The decline highlights the difficulties the U.S. company faces in its third largest market, where some Chinese firms and government bodies restrict employees’ use of Apple devices. This action reflects measures similar to those the U.S. government takes against Chinese apps on security grounds.

Ryan Reith, group vice president at IDC, responsible for Worldwide Mobility and Consumer Device Trackers, stated: “While IDC expects these two companies to maintain their hold on the high end of the market, the resurgence of Huawei in China, as well as notable gains from Xiaomi, Transsion, OPPO/OnePlus, and vivo will likely have both OEMs (original equipment manufacturers) looking for areas to expand and diversify.

“As the recovery progresses, we’re likely to see the top companies gain share as the smaller brands struggle for positioning,” he added.

In November, the tech giant said revenues dipped one per cent to $89.5 billion in the three months to September 30 compared to the same period last year. Similarly, in January, an Apple analyst anticipated a considerable decrease in iPhone shipments this year.

Featured image: Canva

JimMin

JimMin