SBF survey shares insight on S’pore’s job market in 2024: increased salary, but slower hiring

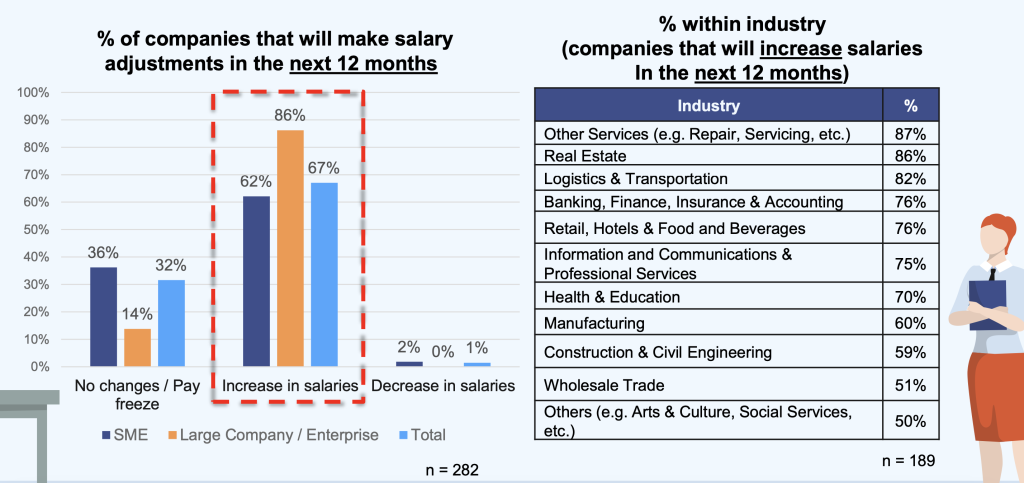

The SBF survey reveals an optimistic outlook, with 67 per cent of Singapore companies planning wage raises in 2024.

Despite expecting weakened economic conditions, a significant majority of companies are planning to increase the salaries of their employees in the next 12 months.

According to a survey by the Singapore Business Federation (SBF), as many as 67 per cent of companies are planning wage raises, with an average rise of six per cent. Only one per cent are considering pay cuts, with the rest (32 per cent) planning to keep salaries stagnant.

The survey, which analysed data from 282 businesses including SMEs and large corporations across major industries in Singapore, also revealed that 76 per cent of companies had already implemented wage hikes in the past 12 months.

Image Credit: Singapore Business Federation

Image Credit: Singapore Business FederationAnalysing the data according to company size, however, it’s worth highlighting that a significant 88 per cent of large corporations have already raised their salaries over the past 12 months, with an impressive 86 per cent planning to continue this trend in the coming year.

In the case of SMEs, 73 per cent reported salary increases in the previous year, and 62 per cent are optimistic about maintaining this upward trajectory in the year ahead.

Of the companies analysed in the survey, the majority of the companies that plan to hike the salaries of their employees were operating in the services industry (87 per cent), followed by the real estate industry (86 per cent), and the logistics and transportation industry (82 per cent).

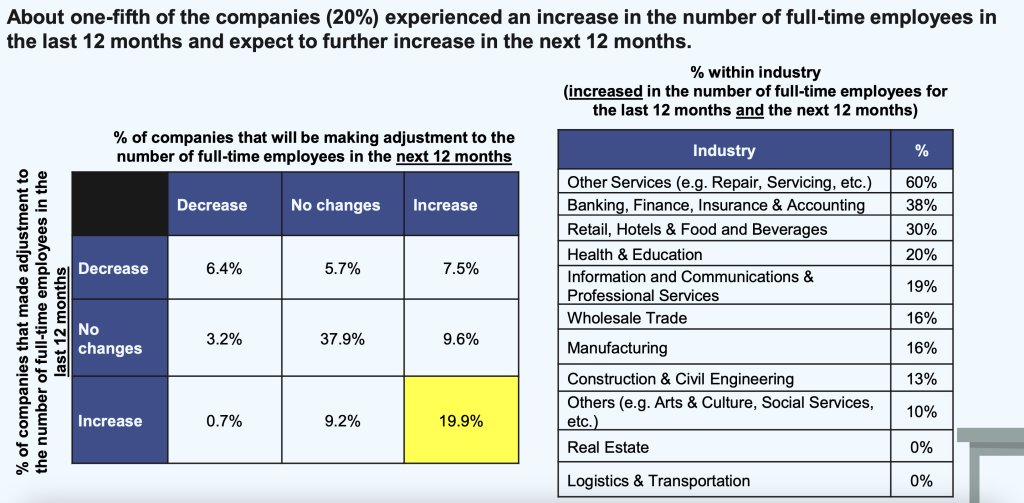

Only one-fifth of companies expected to further increase headcount

In terms of manpower, one in two companies (51 per cent) reported no changes to their full-time employee headcount in the last 12 months, and a similar number (53 per cent) do not expect a change in the next 12 months.

However, more companies (36 per cent) expect to increase their headcount in the next 12 months, as compared to the last 12 months, which stood at 29 per cent.

Correspondingly, while 19 per cent of companies reported a decrease in manpower in the last 12 months, the percentage of companies expecting a decrease in manpower in the next 12 months has declined to 10 per cent.

Image Credit: Singapore Business Federation

Image Credit: Singapore Business FederationIn the past 12 months, 20 per cent of companies have seen growth in their workforce and anticipate further expansion over the next year.

The top three sectors in this category are the banking, finance, insurance and accounting industry (38 per cent), retail, hotels and food and beverages industry (30 per cent), and the health and education industry (20 per cent).

On the flip side, six per cent of companies experienced a decrease in headcount in the last 12 months and expect to further decrease in the next 12 months.

The top three sectors affected by this decline include the construction and civil engineering industry (10 per cent), the logistics and transportation industry (9 per cent), and the retail, hotels and food and beverages industry (9 per cent).

Increased business costs are a top concern

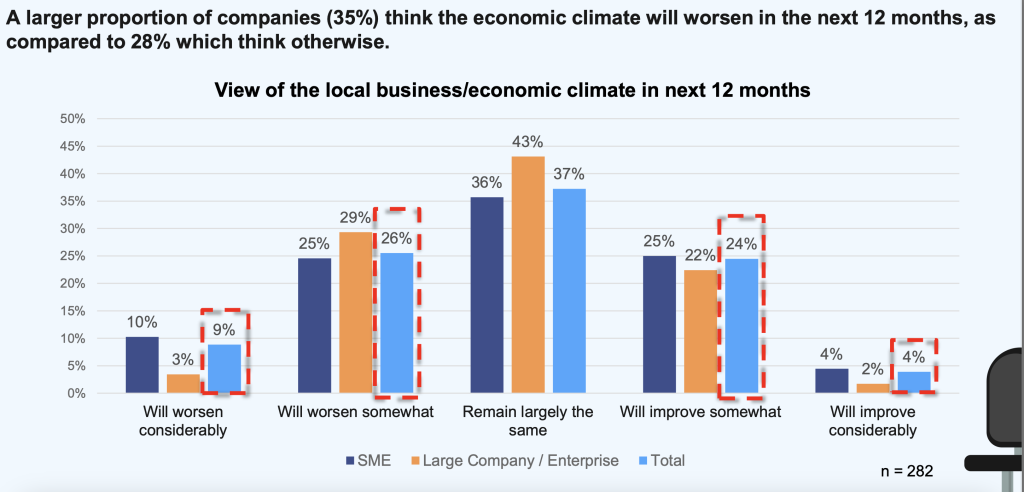

Despite the positive employment outlook in Singapore, a larger percentage of companies, specifically 35 per cent, anticipate a deterioration in business conditions over the next 12 months, as compared to the 28 per cent that expect improvement.

At the sectoral level, the information and communications and professional services industry leads with 50 per cent of companies expecting worse conditions, followed by the retail, hotels and food and beverages industry at 45 per cent, and wholesale trade at 44 per cent, all with a pessimistic outlook on the economy.

On the other hand, sectors like construction and civil engineering (59 per cent), real estate (57 per cent), logistics and transportation (55 per cent), and banking, finance, insurance and accounting (52 per cent) expect that business conditions will remain unchanged.

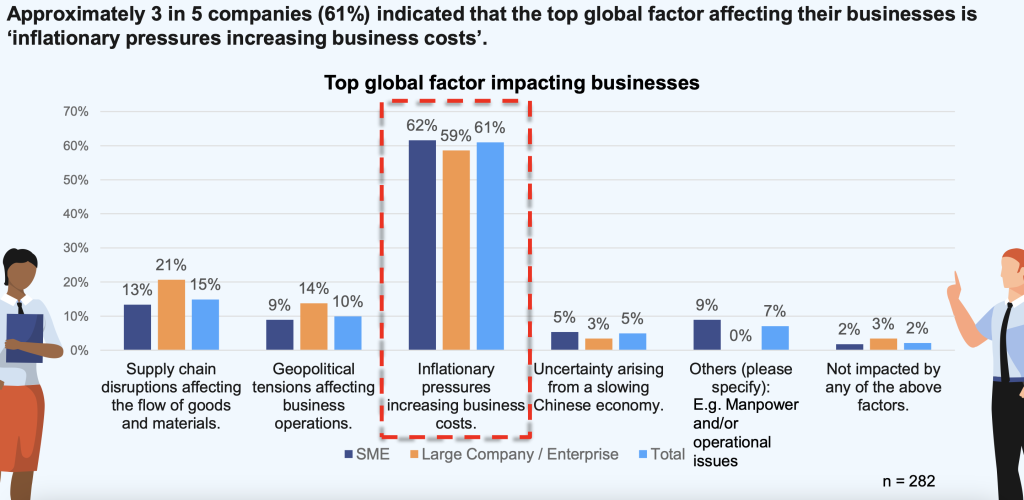

Three in five companies (61 per cent) have indicated that inflationary pressure, which has led to increased business costs, is the top factor impacting their businesses.

The three sectors most impacted by inflationary pressures are the real estate sector (100 per cent), health and education sector (80 per cent) and the information and communications and professional services sector (72 per cent).

As such, more companies (45 per cent) expect business revenue to decline in the next 12 months than improve (33 per cent). The majority of companies that expect revenue to decline operate in the wholesale trade industry (58 per cent), followed by the construction and civil engineering industry (49 per cent).

Meanwhile, those in the banking, finance, insurance and accounting industry (62 per cent) and information and communications and professional services (44 per cent) expect improving revenue.

The employment outlook in Singapore remains positive

On the whole, the survey results suggest that employment outlook across the city-state remains positive, although more businesses expect economic outlook to weaken. As such, there is a need for a moderation in the wage increases for the next 12 months.

“Businesses expect employment outlook to be positive even though business conditions have weakened. Nonetheless, there are sectors that expect to do well just as there are sectors that will continue to face headwinds. Hence, differentiated and sustainable wage growth that keeps with the underlying productivity growth of the sectors is important,” said Kok Ping Soon, CEO of SBF.

Featured Image Credit: Ministry of Manpower

JimMin

JimMin