SEC slaps Citadel Securities LLC with $7 million fine to settle short selling regulations charges

Citadel Securities identified certain short sales as long sales, and vice versa, during a five-year period, the Securities and Exchange Commission said.

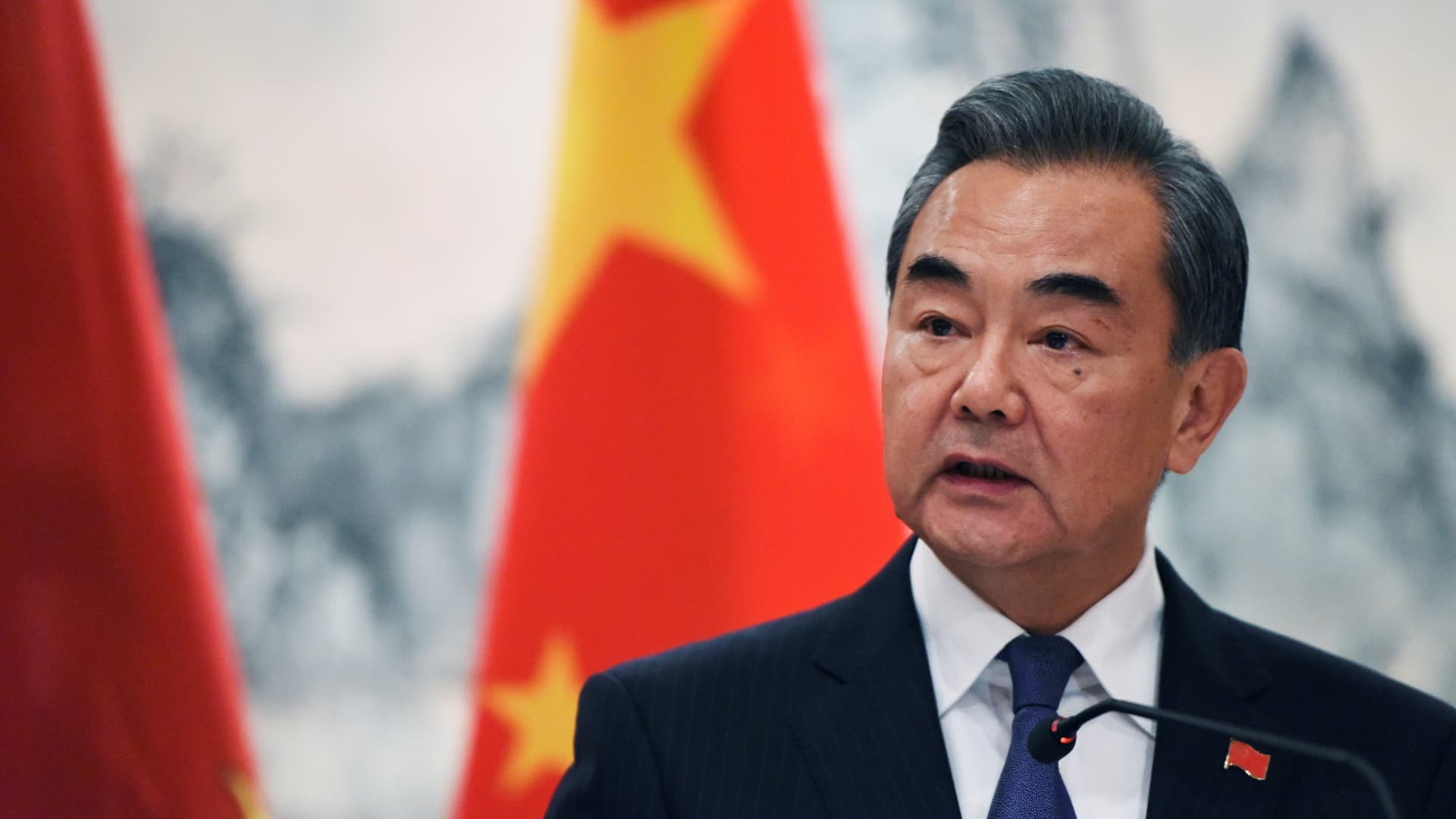

Citadel founder and CEO Kenneth Griffin.

Andrew Harrer | Bloomberg | Getty Images

WASHINGTON — The Securities and Exchange Commission fined Citadel Securities LLC $7 million in a settlement of charges that the big broker-dealer firm mismarked sales orders over a five-year span, the agency said Friday.

The SEC estimated that Miami-based Citadel Securities marked millions of certain short sale orders as long sales, and vice versa, from September 2015 to September 2020.

The inaccuracies were the result of a coding error in Citadel's automated trading system, the SEC found.

The SEC alleged Citadel Securities violated "a provision of Regulation SHO, the regulatory framework designed to address abusive short selling practices, which requires broker-dealers to mark sale orders as long, short, or short exempt."

A Citadel spokesperson told CNBC that the matter "had no impact on the quality of our client execution."

"While updating our systems to accommodate certain client requests, we made a coding change that inadvertently affected a de minimis percentage of our order markings," the spokesperson added.

"We detected the issue and promptly fixed it more than three years ago."

The SEC in its administrative order settling the case noted that "Citadel Securities is one of the largest broker-dealers in the U.S. equities markets."

"As of May 2023, Citadel Securities executed approximately 35% of all U.S.-listed retail volume and 22% of U.S. equities volume, across more than 11,000 U.S.-listed securities," the order noted.

In a short sale, an investor borrows stock shares and sells them, with the hope of buying the same amount of shares back at a lower price and returning them to the lender, pocketing the price difference as profit.

Mark Cave, associate director of the SEC's Division of Enforcement, said compliance with requirements that sales orders be properly marked "is a key component of regulatory efforts to curtail abusive market practices, including 'naked' short selling."

Failure to comply "can have negative downstream consequences on the accuracy of the firm's electronic records, including its electronic blue sheet reporting, depriving the Commission of important information about the markets it regulates," Cave added in a statement.

Also on Friday, the SEC fined Goldman Sachs $6 million for inaccurate "blue sheet" submissions containing identifying securities trading information.

BigThink

BigThink