TAM, SAM & SOM: What Do They Mean & How Do You Calculate Them?

As a marketer, I often find myself sitting down at my desk with a calculator to do some basic math. And most of the time, I’m in a kerfuffle with three acronyms: TAM SAM SOM.

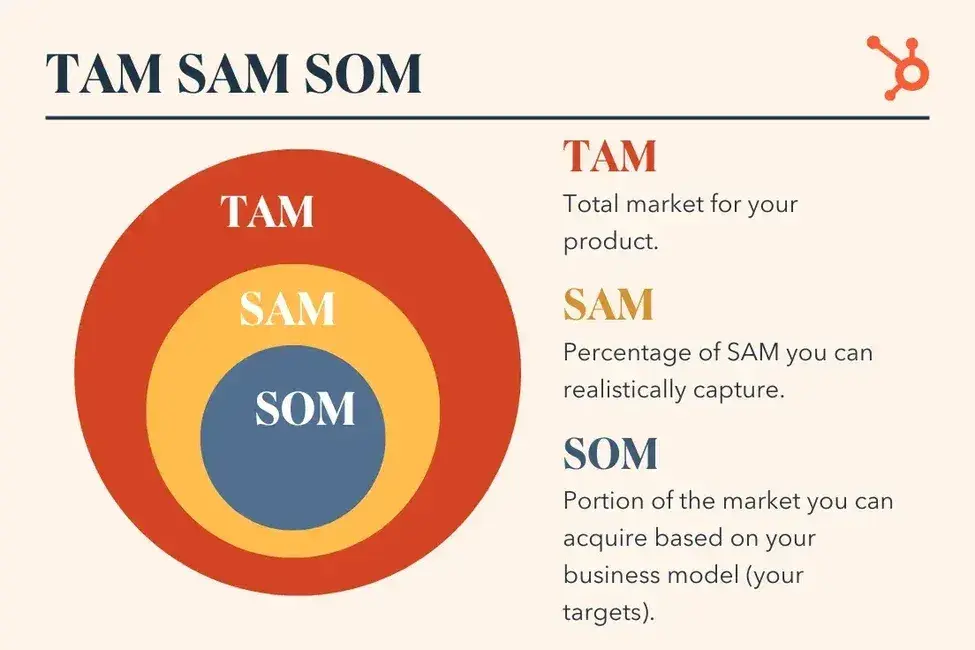

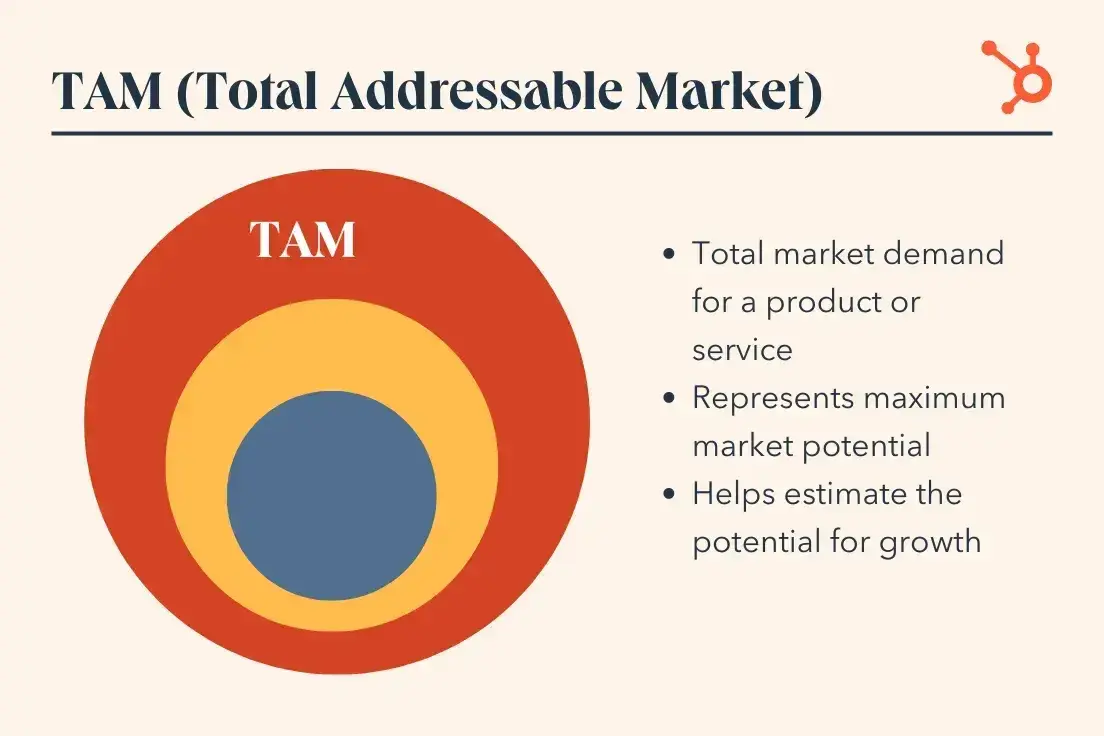

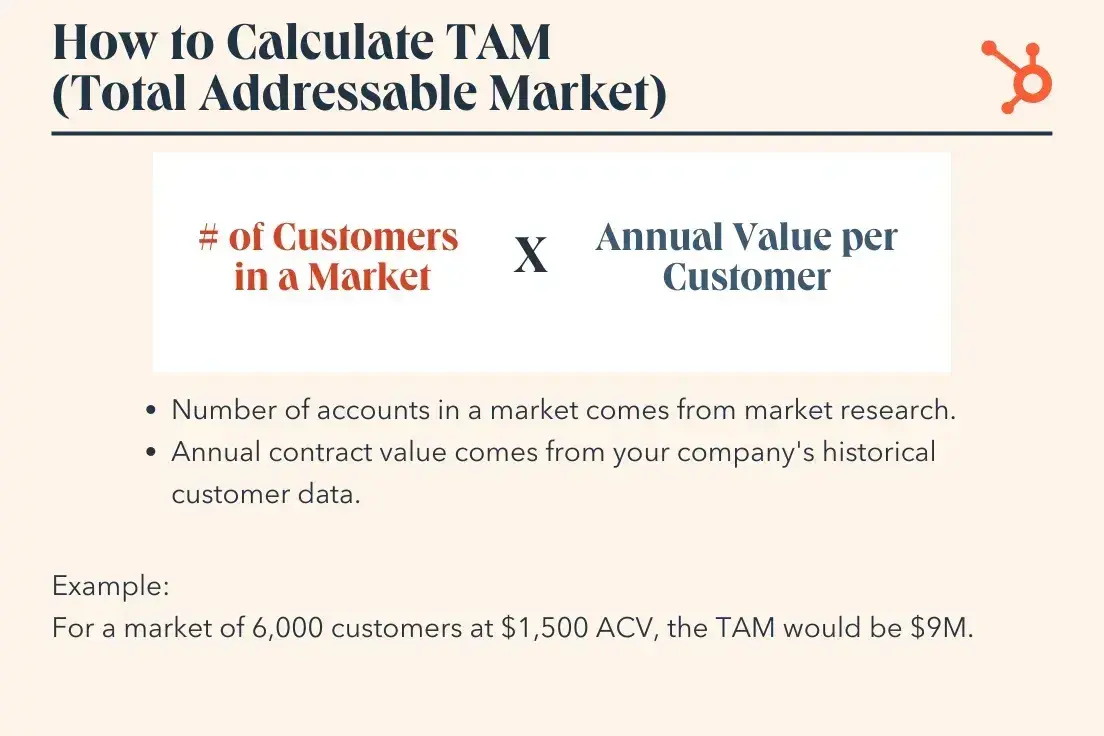

As a marketer, I often find myself sitting down at my desk with a calculator to do some basic math. And most of the time, I’m in a kerfuffle with three acronyms: TAM SAM SOM. Calculating your total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM) can be helpful beyond the realm of just marketing. Business owners can use these calculations to determine the viability of a business. Product teams can validate new product offerings. But that’s just the tip of the iceberg when it comes to the potential of the TAM, SAM and SOM trio. Ignoring these numbers can be detrimental. You could enter a market that doesn’t have a large enough market size to convince investors to back you, or you could set an unrealistic revenue goal for your business and burn your employees out. To help you avoid these issues, I’ve put together a guide that’ll teach you exactly how to calculate your industry’s total addressable market, serviceable addressable market, and share of market. Table of Contents TAM, SAM, and SOM are acronyms for three metrics to describe the market your organization operates in — Total Addressable Market, Serviceable Addressable Market, and Serviceable Obtainable Market. These metrics are key components of a business plan, particularly as you craft your marketing and sales strategy, set realistic revenue goals, and choose to enter the markets that are worth your time and resources. Before I break down how to use these in your business, let’s get clear on what TAM, SAM, and SOM are and their relationship with one another. If you’re new to TAM SAM SOM, it’s easy to feel like you took a wrong turn somewhere and landed in alphabet soup. But, I want you to know that TAM, SAM, and SOM are simply overlapping metrics that make it easier to fine-tune your business plan, identify achievable goals, and understand the potential revenue and operational impacts of certain business decisions. So let’s break them down. TAM Definition: The maximum potential demand of a specific market. I know it can seem like finding this information can feel like a big task, so I’ll show you how to calculate TAM below. In the meantime, to simplify it further, total addressable market or TAM refers to the total market size — more specifically, the demand for a product or service. It’s the maximum amount of revenue a business can generate by selling its product or service in a specific market. Total addressable market is most useful for businesses to objectively estimate a specific market’s potential for growth. This data also helps companies figure out product market fit. SAM Definition: The size of the TAM you can reasonably target as you build your audience. Due to the limitations of your business model, which might include your specialization or geographic limitations, among other variables, you’ll have a tough time servicing your total addressable market. SAM is a segment of TAM you can use to identify the addressable potential of a market segment, or the amount you can realistically market to, making it easier to estimate revenue and audience targets. Serviceable addressable market is most useful for businesses to objectively estimate the part of the market they can acquire to figure out their targets. SOM Definition: The size of the SAM you can potentially convert. Unless you're a monopoly, you most likely can’t capture 100% of your serviceable addressable market. Even if you only have one competitor, it would still be extremely difficult to convince an entire market to only buy your product or service. That’s why it’s crucial to measure your serviceable obtainable market to estimate how many customers would realistically benefit from buying your product or service. Serviceable obtainable market is most useful for businesses to determine short-term growth targets. It can also help with competitive awareness and strategizing. TAM, SAM, and SOM are essential to business strategy and growth planning. This is because these metrics show how much opportunity a particular market holds at every stage of business growth. TAM SAM SOM is also useful because it’s a simple and succinct way to present the value of an idea. This data gives teams an idea of the target audience and income opportunities for a market or niche. These metrics can also help businesses share key insights with investors if they are seeking funding. The process makes it easier to make decisions that impact growth. For example, say you don't have a clear picture of the right segment for your SAM. This could make your serviceable addressable market too big, which can then impact your SOM. “In my experience, these tools are extremely informative when determining how to niche. Take the time, and understand the opportunity or lack thereof with your new target,” says Lori Highby of Keystone Click. Highby says as her team niches further in their business, they use numbers from market research reports from firms like Gartner, Forrester, etc. as well as government and trade associations to calculate TAM, SAM, and SOM. They can then “find out which niche is the most viable,” says Highby. I know that all this sounds great, but it can be tough to understand how to actually do TAM, SAM, and SOM calculations and use the data for your business. So, let’s break this down into some steps you can follow. Before you can do a TAM SAM SOM, you need to figure out what your market is, and what you’re marketing — a service, a specific product, or even a category of products. To calculate this, get as clear and specific as you can about your audience, factoring aspects like: Now, it’s market research time — dig in to find out how many potential customers are out there and the potential revenue value if everyone in that market purchases. For example, if I’m looking at women between the ages of 25 and 65, I’d want to find out how many women fit that definition. Then, I’d calculate the potential revenue if all those millions of women bought your product. In the example above, let’s say I work for a high-end luxury women’s professional clothing retailer looking at the U.S. market. So, I want to find how many women fit the demographic of ages 25 to 65 in the U.S. and then calculate the potential revenue. People living paycheck to paycheck aren’t likely to shop my brand, and women who don’t work in offices or don’t regularly attend professional functions are less likely to be my target market. Since my SOM calculation is about estimating the portion of the SAM I can realistically market to, I might find it by refining my market by income and/or employment. I can then refine it further by identifying the portion of that market I’m likely to capture, given the competitive landscape. Now that you have the calculation, it’s time to dig into the data and strategize. I’ll start by asking questions like: Then, when I’m armed with answers, I can think about strategies for standing out from the competition and leaning into my strengths to reach my market. Now that you know what each of these acronyms is and what they’re used for, let’s get into the nitty-gritty of how to calculate TAM, SOM, and SAM. Doing so requires advanced market research ahead of time, but here are the formulas once you're able to get those figures. The best way to calculate total addressable market is by running a bottom-up analysis of an industry: TAM is useful for: Using our sample high-end professional women’s apparel for this calculation, I learned that the global women’s apparel market was US$1.002 trillion in 2023 (IMARC group). Assuming growth of 3.3% each year, we can estimate that number to be $1.035 trillion in 2024. Pro tip: If you want to make your life easier when calculating TAM, use HubSpot’s TAM analysis template. It completely demystified the concept for me and helped me understand not just tam, but also the ACV itself. To calculate your serviceable addressable market: SAM is useful for: To continue using our sample high-end women’s professional apparel brand, remember we were looking at women ages 25-65. Using data from the latest census, there are 86 million women in that range. Let’s say that each year, those 86 million women spend $2,000 on average every year on apparel. 86 million x $2,000 = $172 billion SAM And looking at the numbers, we’re not too far off. The U.S. women’s apparel market was estimated at $191.4 billion in 2024. To calculate your serviceable obtainable market: SOM is useful for: Now here’s where we get more hypothetical. Because the TAM and SAM speak to total markets available, and SOM speaks to more realistic market share, we’re going to make up some numbers. Our high-end women’s professional apparel brand has a higher price per item but most customers are likely to buy fewer pieces, and we’re likely to have fewer customers than, say, Walmart. For the sake of round numbers, let’s say: Note: I’m aware that these numbers represent unrealistic year-over-year market growth rates — I’m simply providing them for the purposes of showing you the calculations in action. $500 million / $172 billion 2023 SAM = 0.003% market share 0.003% * $191.4 billion 2024 SAM = $574.2 million That means, based on these completely fictional numbers that show drastically increasing demand, my fictional apparel company can reasonably expect 15% growth over last year. And if that’s accurate, it has significant repercussions for budgeting, operations, and production. But unless there’s something drastic happening in the big picture that reduced spending in 2023 and increased it in 2024, there’s a good chance these numbers are not realistic, so it’s important to go back to the numbers to make sure we’re factoring in things accurately. When I started my marketing, TAM, SAM, and SOM felt like abbreviation-heavy jargon. It was easier to just nod along and let the numbers go in one ear and out the other. However, today, I know these numbers matter. I even run the calculations myself! As you get started, keep in mind that these figures will largely be estimates to inform your strategy. The more market research you do and the more historical data you build up, the more precise your planning will be. Don't just figure out the opportunities in your market. Use your research to decide who you want to target and how you plan to engage them with your products. Then, use these templates to make your plans clear. Editor's note: This post was originally published in March 2019 and has been updated for comprehensiveness.TAM SAM SOM

TAM SAM SOM Definitions

TAM (Total Addressable Market)

SAM (Serviceable Addressable Market)

SOM (Serviceable Obtainable Market)

Why TAM SAM SOM Matters

How to Use a TAM, SAM, and SOM for Your Business

Step 1. Define your market.

Step 2. Use a TAM calculation to find the total market size.

Step 3. Use a SAM calculation to find the size of your potential market.

Step 4. Use a SOM calculation to find your potential market share.

Step 5. Identify opportunities and challenges.

TAM, SAM, and SOM Template

Total Addressable Market (TAM) Calculation

Example TAM Calculation

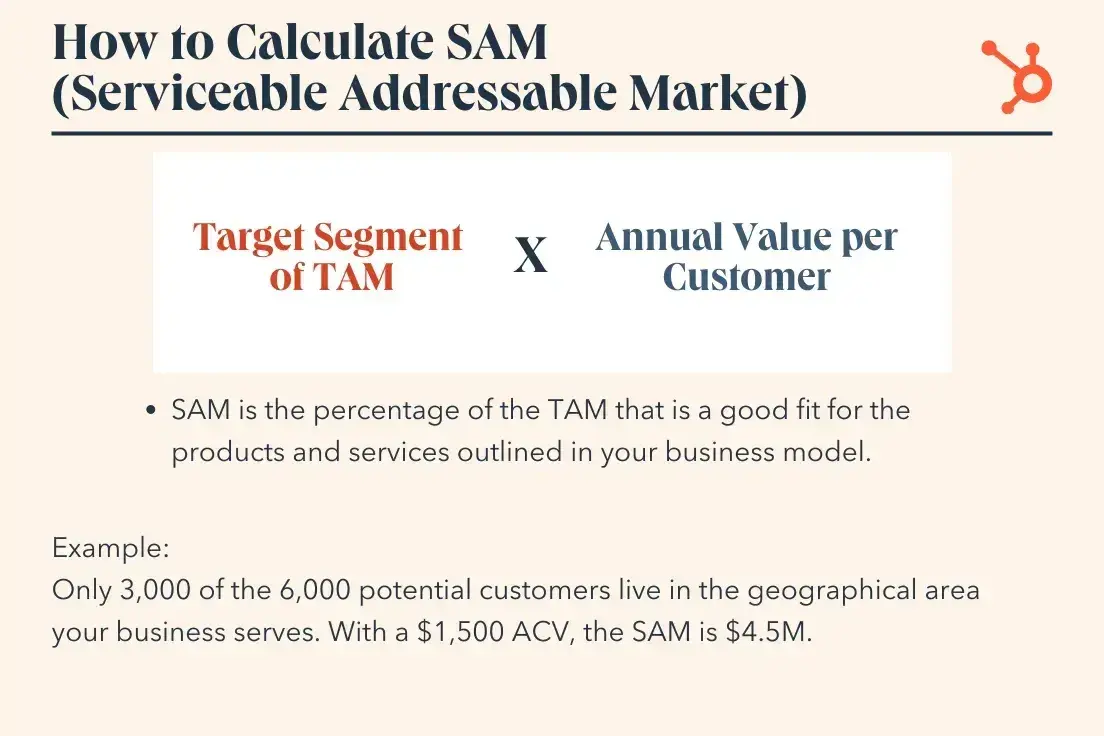

Serviceable Addressable Market (SAM) Calculation

Example SAM Calculation

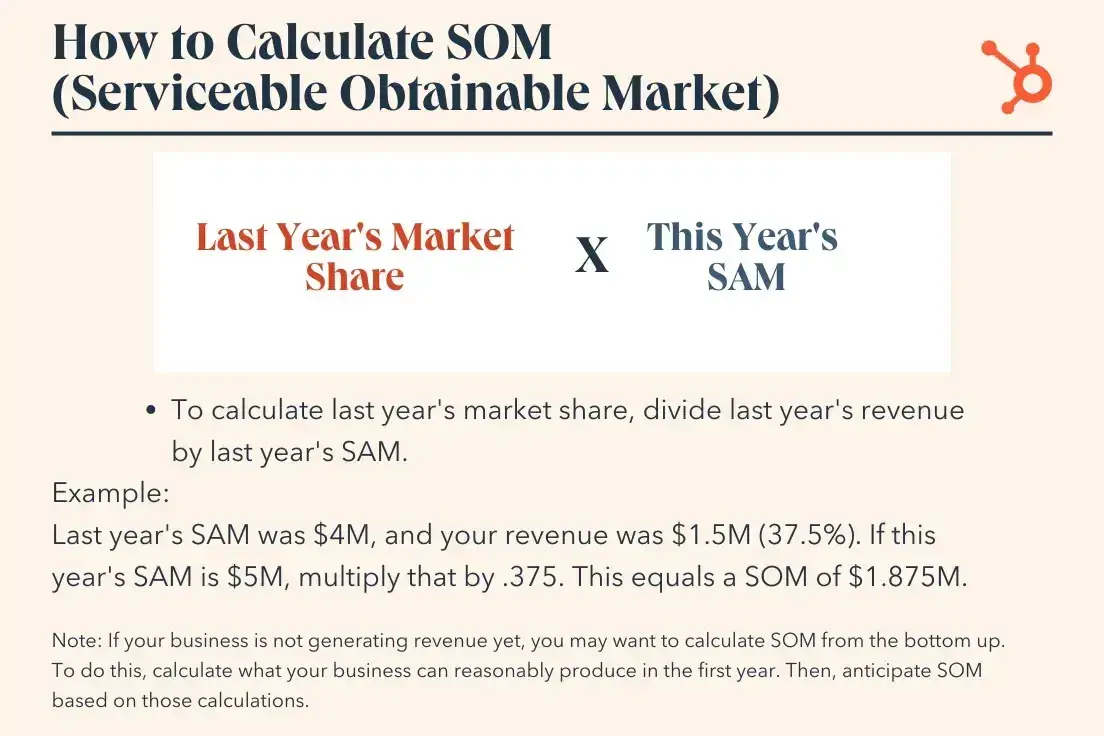

Serviceable Obtainable Market (SOM) Calculation

Example SOM Calculation

Right Size Your Market Opportunities with TAM, SAM, and SOM

FrankLin

FrankLin

![LinkedIn Shares Data on In-Demand Skills for Marketers [Infographic]](https://imgproxy.divecdn.com/zMbngFHDMAQdOuk7-FK5eSqQ-bYj9Kyqki-xmPgH4I8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9saW5rZWRpbl9mYWxsX2pvYnNfb3V0bG9vazIucG5n.webp)