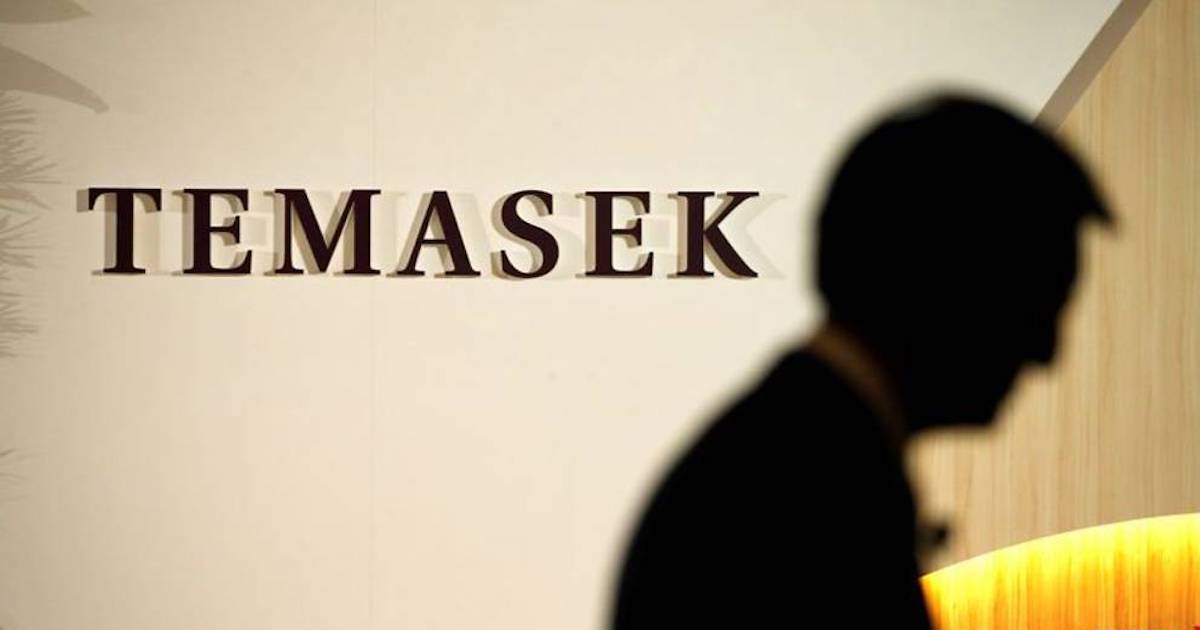

Temasek Holdings confirms that it has no direct exposure to the collapse of Silicon Valley Bank

In 2015, Temasek acquired SVB's speciality finance business focused on venture debt in India for about S$45 million.

Singapore’s Temasek Holdings has confirmed yesterday (March 12) that it does not have any direct exposure to Silicon Valley Bank (SVB), as reported by Bloomberg.

This comes after the fund reportedly checked with its portfolio companies to determine their level of exposure to the lender. Other funds such as Sequoia Capital China and Yunfeng Capital have done the same.

SVB has become the biggest US lender to fail since the 2008 banking crisis on Friday (March 10).

The bank’s collapse comes after it was forced to sell securities at a loss to realign its portfolio, due to the higher interest rates imposed by the Federal Reserve, while managing lower deposit levels from clients, many of which were in the venture capital arena and burning through cash.

Temasek bought SVB’s Indian venture debt arm in 2015

In 2015, Temasek acquired SVB’s speciality finance business focused on venture debt in India for about S$45 million.

The acquisition was carried out to add another layer to Temasek’s credit business in India, as well as expand its exposure to the early-stage investment space.

The fund signed a share purchase agreement to buy 100 per cent of the stake in SVB India Finance Private Limited, the subsidiary of SVB, as well as some of its other subsidiaries.

SVB India Finance, which was established in 2008 to provide debt capital to domestic venture-backed early and mid-stage businesses in India, was subsequently rebranded to InnoVen Capital India. It then rolled out its operations in Singapore in a bid to establish itself as a pan-Asian venture lender.

Currently, the business is co-owned by Temasek and United Overseas Bank.

Featured Image Credit: Edgar Su via Reuters

Tfoso

Tfoso