The State of Consumer Trends in 2023 [New Data]

From the rise of AI to the growing popularity of shopping on social media, heightened data privacy concerns, and consumers tightening budgets due to recession fears, times are changing fast.

![The State of Consumer Trends in 2023 [New Data]](https://blog.hubspot.com/hubfs/consumer%20trends%202023-1.png#keepProtocol)

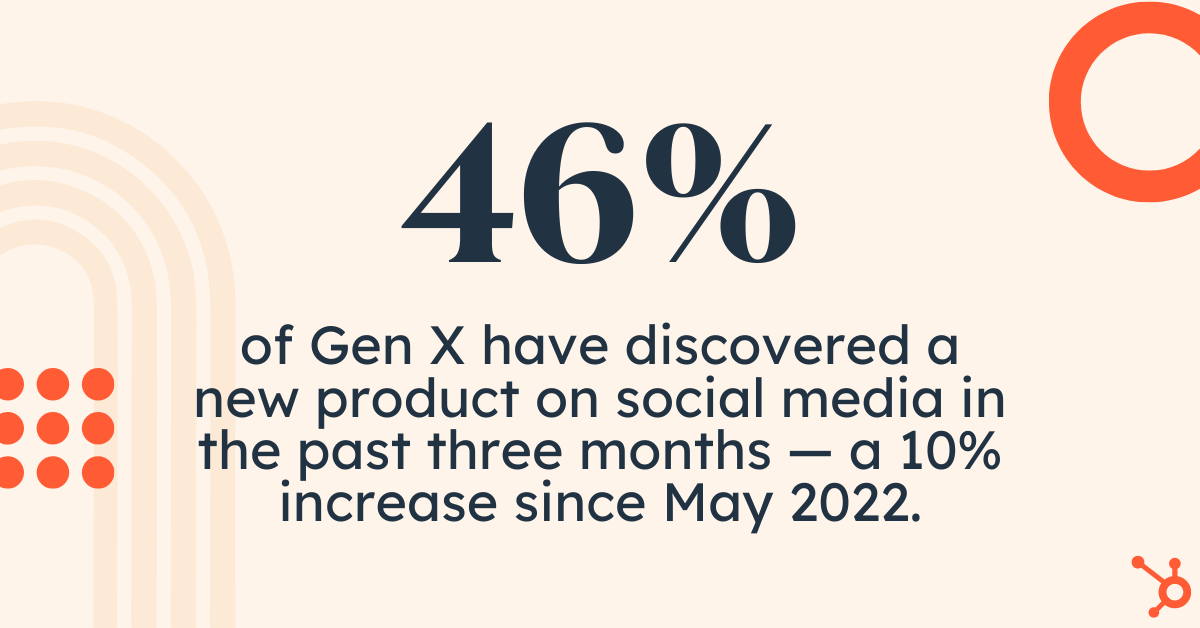

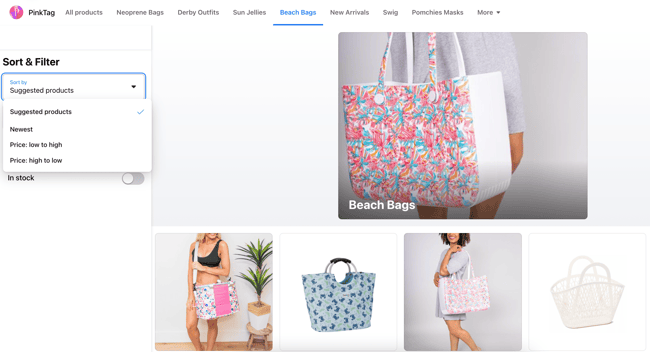

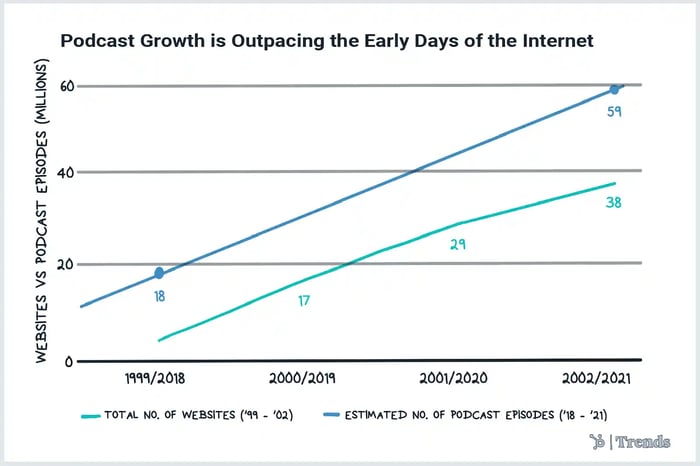

From the rise of AI to the growing popularity of shopping on social media, heightened data privacy concerns, and consumers tightening budgets due to recession fears, times are changing fast. To help marketers keep up and stay ahead of the curve, we've run biannual Consumer Trends Survey of 600+ US adults, to keep a pulse on: AI is hands down the top trend of 2023, with one in three consumers already using chatbots and platforms like ChatGPT. But here's the plot twist – only 26% of consumers actually trust content created with AI. As businesses leverage AI, building trust and maintaining transparency are key to fostering consumer confidence in AI-driven experiences. Regardless, 40% of full-time employees use AI at work, and 75% of them say it's effective. The top use cases for AI chatbots at work revolve around assisting people in their work rather than doing their job for them — helping with tasks like getting ideas or inspiration, summarizing text, and learning new things. These are also among the most effective uses for AI in the workplace, with workers saying AI is most effective for analyzing and reporting data, learning new things, creating images/videos, getting ideas and inspiration, and conducting research. Lastly, we asked consumers which AI they plan on using in the future. Despite ChatGPT’s head start, over half of consumers see themselves primarily using Google Bard once it's publicly available — followed by ChatGPT — with Bing in third place. Social media is quickly becoming the future of e-commerce, with social shopping growing in popularity across all age groups. Influencers are impacting more purchase decisions, while customers increasingly sliding into DMs for customer service. Just in the past three months, 41% of consumers have discovered a product on social media. In fact, Gen Z, Millennials, and Gen X prefer finding products on social media over any other channel. When it comes to actually purchasing these products. 17% of social media users have bought something directly on a social media platform in the past three months, rising to 22% of Gen Z and 27% of Millennials since our January update. On top of that, 24% of social media users have bought a product based on an influencer’s recommendation in the past three months, a 33% increase from when we ran this survey last year. For Gen Z, 40% have bought a product thanks to an influencer in the past three months, and (similarly to our January update) they say recommendations from influencers are more impactful to their purchase decisions than recommendations from their friends or family. 19% of social media users have also sent DMs to get customer service in the past 3 months, up 45% from last year. Not only that, but 1 in 5 Gen Z, Millennials, and Gen X say DMs is how they prefer to get customer service from a company. In past Consumer Trends pulse surveys, we continued to see that consumers don’t fully trust social shopping. Today, they seem to be coming around. While just 47% of social media users feel comfortable buying through social apps and only 42% trust social media platforms with their card information, both of these are improvements over last year's numbers. Despite being the most used social media platforms, Facebook, YouTube, and Instagram saw the least growth in users in our survey group year-over-year. Facebook usage remained flat, Instagram usage dropped by 5%, and YouTube usage dropped by 2%. Meanwhile, BeReal grew 333%, Twitch grew (43%), and TikTok grew (21%). (Note: We ran this survey just before Threads launched and expect it to be a big discussion point in our next bi-annual survey.) Still, Facebook is the most popular social media app, used by 68% of consumers, followed by YouTube (61%), Instagram (40%), TikTok (34%), and Twitter (30%). Although LinkedIn is towards the bottom of the list, B2B marketers shouldn't panic or count it out. Although it saw a slight decrease in users year over year, the usage on this platform can vary (and even might be seasonal in response to how workplaces hire or promote). For example, in our January 2023 update, we saw that LinkedIn had 20% more consumers who reported active usage. Overall, this data aligns pretty closely with data we’ve seen from App Stores, platform analytics firms, and reports directly from the respective platforms. While there’s no denying search engines are still dominant, social search is growing in popularity, especially among Gen Z, Millennials, and Gen X. Not only do 31% of consumers turn to social media to search for answers to their questions, but one-fourth of 18 to 54-year-olds prefer to search on social media over search engines. Another thing going for social search is the fact that 54% of consumers use their phones over any other device when looking something up on a search engine — jumping to 80% for Gen Z since our last survey. But between search engines, social search, and AI, consumers still say search engines are the most effective way to get their questions answered. Ultimately, while social search and generative AI becoming more popular, traditional search isn’t going anywhere just yet. The past few years have seen dramatic shifts in how we work, with hybrid and remote work becoming more common while being in the office full-time fell out of favor. Just 32% of full-time employees surveyed are in the office all week, down from 40% a year ago. Meanwhile, both fully remote work and hybrid work became more common, with 34% of workers saying they’re hybrid and another 34% saying they work remotely. Not only that, but hybrid is the most popular work model (preferred by 41% of employees), followed by remote (32%), with in-person coming last (27%). What's more, remote and hybrid employees aren’t interested in returning to the office full-time, with 47% saying they’d consider leaving if they had to come in five times a week. But, they’re more open to coming back than they were last year, when 54% said they’d rather quit. The good news? Offering flexibility could result in great employee or team retention. The top reason people we surveyed want to stay in their job is to maintain their flexible work schedule, beating out competitive pay. Not only do consumers need to see flexibility to stay loyal to employers, but they also need to see efforts made to build a positive and healthy company culture. A whopping 67% of employees say it's important that the company they work for has a diverse and inclusive culture, up 20% from last year. And it makes sense. As more people are asked to go back to the office — even part-time, they’re more heavily putting their work experiences into perspective. After all, why would you want to return to an office associated with negativity, unnecessary stress, uninclusive siloes, or psychological safety? If poor culture, flexible work, or other negative things like overwork, lack of upward motion, or poor recognition of good performance aren’t handled, teams may run into a trend some leaders fear — quiet quitting. At this point, one-third of employees surveyed are actively doing it — still on par with our research from the past year. 64% of consumers think the US is currently in a recession and 63% are tightening their budgets in response. About half (49%) of US adults have taken steps to plan or prepare for a recession. Additionally, with 42% of consumers expect the recession to for over a year. Although many companies will save thousands, or even millions, on reducing office space and facilities costs with hybrid and remote work, half of consumers are still rightly concerned about being laid off from their current job. For marketers, earlier research from this year showed that their departments were already working with less resourcing, headcount, and budget than past years. As some industries are still seeing the brunt of economic trends, this has likely continued. Many also worry that AI — the very tool that streamlines their busy work — could take over their work entirely. At HubSpot, we think AI should be used as a tool to help employees cut out busy work and drive results, not as a means to save money by cutting staff. And, heads of other AI platforms, like Jasper.AI, agree. Still, it’s understandable to worry how the combination of AI and economic could do to job security. After all, most employees we’ve surveyed compare AI to a modern-day Industrial Revolution. If you’re concerned about your role, zone in on skills AI can’t replace -- like critical thinking. Meanwhile, use AI to give you and your team more time to earn a high-performance track record. This way, if your role does shift or dissolve, you’ll be able to pivot and adapt to change. A whopping 84% of consumers say data privacy is a human right. Not only are 81% of consumers worry how companies use their personal data, but 72% say they’re more likely to buy from companies they trust with it. So, how should marketers (or any other area of business) build that trust? We asked what would make consumers more comfortable sharing data with companies, and it comes down to transparency, security, and ownership. Consumers want to be given a choice in whether or not to share their personal data and be told exactly how their data will be used. Another important factor is knowing their data is stored securely and that it won’t wind up in the hands of third parties. Lastly, consumers want to maintain ownership of their data with the ability to remove it from your database if they so choose. Companies have a lot of work to do to build that trust, with over half (52%) of U.S. adults saying they usually decline to have their personal data tracked. Just 19% usually allow their data to be tracked, while 29% say it depends on the company. Ultimately, embracing today's privacy-first world will be positive for your brand perception -- and most importantly -- customer trust and safety. In a recent post, our CMO, Kipp Bodnar, explains why data privacy is far from just a passing fad. Companies taking a stance on social issues has grown more important and influential on consumers’ purchasing decisions, with 49% of U.S. adults saying brands should do more regarding social advocacy. Affordable healthcare, income inequality, climate change, and racial justice are the most important issues respondents want to see companies take a stance on. For Gen Z specifically, racial justice, LGBTQ+ rights, and climate change are the most important issues. On top of that, 20% of Gen Z say a brand's commitment to diversity and inclusion is one of top five factors in their purchase decision. Compared to last summer’s Consumer Trends results, respondents increasingly support brands committed to diversity and inclusion, as well as small businesses. 42% of consumers say they’re more likely to buy a product based on the brand’s commitment to diversity and inclusion, up 17% from last year. Additionally, 37% chose a product based on the brand’s commitment to diversity and inclusion in the past three months, up 23% from last May. 52% of consumers say a product being made by a small business makes them more likely to purchase, while 46% have chosen to buy a product because it was made by a small business (both up 18% from last year). While the list above reflects data from our most recent consumer pulse checks in mid-2023, below you'll find highlights (which still could impact marketers) from an earlier survey six months prior. Despite the waning hype around the metaverse, attitudes haven't changed much over the past six months. Both May and January's surveys found only 8% of U.S. adults have ever visited a metaverse. Public opinion on the metaverse has improved slightly over the past nine months. 36% of consumers now say the metaverse is the future of technology — up 6% since May. And 33% say the metaverse is an extension of reality, up 18% since May. However, investments in virtual currencies have seen a decline. In fact, among those who've ever visited a metaverse, only 50% reported buying cryptocurrency in January — which is a 35% decrease since May. Additionally, 60% of metaverse visitors reported buying NFTs in January 2023 ... 13% lower than May's respondents. The decrease in purchasing virtual currencies might have to do with today's economic landscape. If people are generally more conservative with their spending, this could trickle into the virtual atmosphere, as well. However, it's important to take note of the decrease as a potential signifier that virtual currency isn't as popular as it was in 2022. In January, we found that 46% of Gen X and 24% of Boomers had discovered a new product on social media in the past three months — that's a 10% and 41% increase since May 2022, respectively. All of which is to say: continuing to invest in social media marketing as an opportunity for product discovery is a good idea as we near 2024. One of the most fascinating things to dig into when looking at survey results were the vast differences between Gen Z and other age groups -- including their closest predecessor, Millennials. When taking a deeper dive into our generation-by-generation data, we found that Gen Z: The findings above weren't the only interesting points to call out. Our lead researcher and analyst, Maxwell Iskiev explores the differences between how all age groups shop and discover products with this follow-up guide: While some consumers, especially those in younger generations like Gen Z and millennials, are ready to throw their whole wallet into the metaverse and cryptocurrency, most are still getting their first taste of the Web3 world. In fact, 51% of our survey participants from the May 2022 survey say they don't even understand what Web3 even is yet. While Web3 experts believe this technology will continue to grow in the coming years, businesses don't need to pivot their whole strategy to get ahead of it right this second. However, as the technology gets more prominent and accessible, it's still helpful to learn about the potential opportunities and risks of the Web3 space. That's why Caroline Forsey interviewed a handful of Web3 experts to learn more about how it could impact how consumers use the world wide web in the future. Here is a quick, overarching summary of what Web3 could mean for future internet usage from Anna Seacat, VP of Marketing and Web3 Community at Proxy. While Web3 might be a new concept to many, expect to hear more about it as the technology becomes more accessible to consumers and businesses in the coming years. For more expert predictions around this, hear what our CMO Kipp Bodnar and Kieran Flanagan, our SVP of Marketing, have to say about it in this episode of Marketing Against the Grain. For more insights, check out these guides: By now, you know that video has played a powerful role in the lives of consumers. Not only do consumers stream more video than ever, but year-over-year, HubSpot researchers find that most brands consider it to be their most effective type of marketing content. But, not just any video will result in a conversion, purchase, or view. While you don't need a huge budget to woo your audiences, you will need to create content they'll actually enjoy, keep their attention on, and be persuaded by. In fact, 69% of our January 2023 respondents say it is more important that a marketing video be authentic and relatable than polished with high-quality video/audio. This video interview and post from Wistia CEO, Chris Savage goes into great detail on his tips for leveraging video to humanize your brand. For more on how marketers are benefiting from video in 2023, also check out our 2023 Video Marketing Report. In January 2023, 69% of consumers preferred to purchase a product in-store, while 52% preferred to purchase through an online retailer selling a variety of brands (e.g. Amazon.com). Take Pink Tag Boutique for example. The Kentucky-based clothing and accessories business saw immense growth on the Facebook Shops. They attribute $44,448 in incremental sales from the tool, and have seen 66% greater average order value from social commerce buyers compared to those who bought directly from the company site. For more examples of brands that are already excelling in social commerce, check out this post. You can also find more shopping trend data in this follow-up report from Caroline Forsey: The Shopping Trends of 2023 & Beyond [State of Consumer Trends Data] When looking at our survey results for the question, "Would you consider yourself a creator?", we found that 30% of 18-24-year-olds and 40% of 25-34-year-olds call themselves content creators. What's great for brands here? Your very own audiences might jump at the chance to create content for you, which could in turn help them build online influence. But, what exactly IS a "creator"? Check out this deep dive by Caroline Forsey to learn more: If Everyone's a Content Creator, Is Anyone? Now that you've read through the biggest findings of our Consumer Trends Report, you might also be asking, "What trends and themes could come in the next six months -- or beyond?" To give you a taste of just a few trends to keep on your radar, we reached out to Julia Janks of Trends.co to learn what she and her team of trend analysts will be focusing on. Here are three of the nine trends they're keeping on their radar. Forget loyalty points — gifting is the new customer retention strategy. As remote everything continues to rise, keeping connected to clients and loved ones will be key. Source: &Open Gifting powerhouse 1-800-FLOWERS had a record-breaking year in 2020, and venture capital is flowing into startups like &Open ($7.2m last May) and Gracia (~$14m since its 2017 launch). Companies will also use gifting to target employees, since worker retention is at an all-time low, and the average cost of replacing an employee is about seven months of their salary. The world of podcasts is growing faster than the entire internet did back in the early 2000s. Spotify alone now hosts 3m+ shows (that’s ~43x the number of titles on Netflix, Disney+, and Apple TV+, combined). Pop-up shops in the metaverse are a thing now. And, brands like Hogan are already testing them out. We could see the metaverse shopping industry continue to grow with consumer interest, as 30% of consumers HubSpot surveyed think more brands should consider virtual stores. For the Julia's full list of trends to watch, check out 9 Things Trends.co Analysts Will be Watching in The Next 6 Months & Beyond -- and don't forget to check out Trends.co for more business news, innovative ideas, and industry trend coverage. In the post above, we gave just a few highlights of our State of Consumer Trends Survey, as well as our predictions for what's to come. To learn more interesting themes, check out these follow-up posts: Want to see how data's changed since 2022? Click below to download the full findings of that survey in our State of Consumer Trends Report Consumer Trends Post AuthorsTop Consumer Trends of 2023 [Summer Update]

Digital and Online Trends

1. Consumers don’t trust AI, but one-third still use It.

2. Social media is the future of shopping.

3. Younger social platforms gain steam as legacy apps stall.

4. Social search and generative AI are disrupting traditional search engines.

Workplace & Budgeting Trends

5.. Flexible workplaces are more vital than ever for retention.

7. Company culture matters.

6. Consumers are tightening recession budgets.

7. Consumers continue to fear layoffs and recession impacts.

Privacy & Brand Perception Trends

8. Data privacy concerns are at an all-time high.

9. Consumers increasingly support brands committed to diversity and inclusion.

10. More consumers support small businesses.

Trends Discovered in January 2023

1. Consumers are investing less money into virtual worlds, items, and currencies.

2. Gen X and Boomers are warming up to social media product discovery.

3. Gen Z increasingly differentiates itself from others.

-min.jpg?width=1500&height=844&name=smt-2023%20(85)-min.jpg)

How Each Generation Shops in 2023 [New Data from Our State of Consumer Trends Report]

4. Some consumers are stepping into Web3, but most don't even know what it is.

How Businesses Could Shift in Web 3 [Executive Insights & Podcast]

Everything Brands Need to Know About the Metaverse

6. Consumers crave video, and effective brands are taking notice.

7. Stores and online retailers aren't going away, despite the growth of social commerce.

-min.jpg?width=1500&height=844&name=consumer-trends-article-updates%20(1)-min.jpg)

8. Many consumers consider themselves "creators."

What's Next for Consumers, According to Trend Analysts

1. Gifting strategies could catch the eyes of consumers.

2. Voice search and audio SEO opportunities will grow.

3. Consumers will visit pop-up shops -- in the metaverse.

Dive Deeper into Consumer Trends

JaneWalter

JaneWalter ![The State of U.S. Consumer Trends [Free Report]](https://no-cache.hubspot.com/cta/default/53/ebf9ec8e-a468-455a-943e-80aa4e6be694.png)