These Are the Best Credit Cards for People With Bad Credit

If you’ve made missteps with your credit in the past, all isn’t lost. Though you typically won’t be able to receive approval for credit cards that offer the most rewards and the best benefits, you can still start taking...

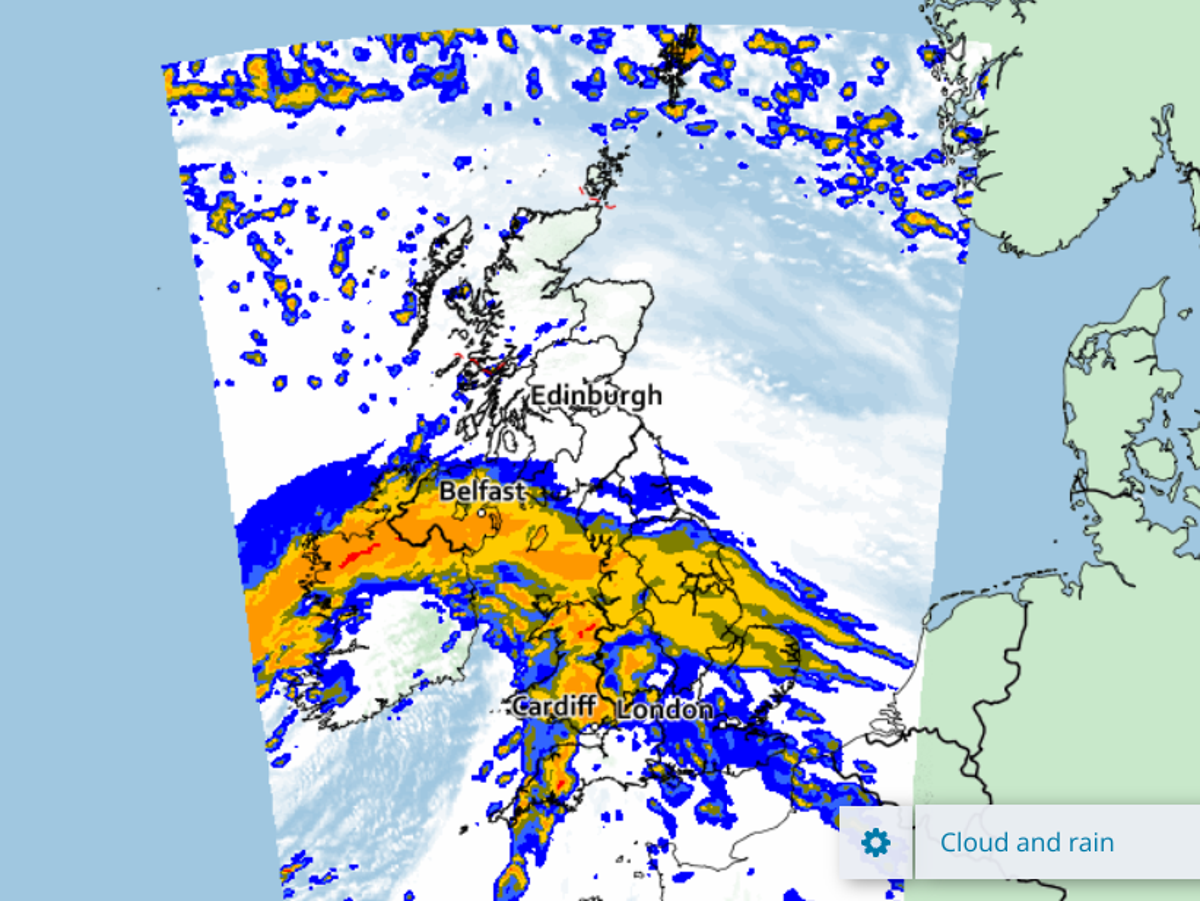

Photo: Ivan Kruk (Shutterstock)

If you’ve made missteps with your credit in the past, all isn’t lost. Though you typically won’t be able to receive approval for credit cards that offer the most rewards and the best benefits, you can still start taking steps toward re-building your credit by applying for a credit card geared toward people with bad credit or no credit history.

As a general rule, you have two options if you have bad credit: secured cards and unsecured cards. A secured card will give you slightly better terms, but you’ll have to put down a deposit that is equal to your credit line to get started. If you later decide to close your account and it’s in good standing or you graduate to an unsecured card, your deposit will be returned to you. If you don’t want to put down a deposit, there are unsecured cards for people with bad credit, but these cards typically have higher interest rates and often charge other fees.

Due to these higher fees and generally less favorable terms, we typically recommend a secured card if you have bad credit, but we’ll list a couple of the best unsecured options available, too.

The best secured credit cards for people with bad credit

Discover it Secured Card

The Discover it Secured Card is one of our top picks for those with bad credit because in addition to not charging an annual fee, it offers rewards on all eligible purchases and a sign-up bonus in the form of a Cashback Match (Discover will match all of the cash back earned during your first year as a cardholder at the end of that first year). Discover will regularly review your account to see if you qualify to graduate to an unsecured account and have your deposit returned.

G/O Media may get a commission

30-Day Free Trial

Homer Learn & Grow Program

Stimulate your kids' minds

Your little ones are glued to the screen, and that's a reality we have to accept. But what if they could learn and grow while watching videos and playing games? Create a foundation for learning with this free trial.

OpenSky Secured Visa Card

The OpenSky Secured Visa Card doesn’t require a credit check to apply, so it may be a good option if you have a history of credit mistakes. However, this card does not offer rewards and charges a $35 annual fee.

Navy FCU nRewards Secured Visa Card

You’ll have to be eligible to join Navy Federal Credit Union to be eligible to apply for the Navy FCU nRewards Secured Visa Card, but if you can, it’s a good option to consider. It does not charge an annual fee and offers rewards on all purchases. Additionally, those who pay their cell phone bill with this card can benefit from cell phone insurance.

The best unsecured credit cards for people with bad credit

Petal 1 “No Annual Fee” Visa Card

The Petal 1 “No Annual Fee” Visa Card is one of only a few unsecured cards available to those with bad or no credit. However, those with bankruptcy or a history of past missed payments may not be eligible for this card. It offers 2% to 10% back in rewards at select merchants, does not offer a welcome bonus, and does not charge an annual fee.

Tomo Credit Card

Those without a credit history in the U.S. may be able to benefit most from the Tomo Credit Card, as it doesn’t require a U.S. credit history to be eligible for the card. Those interested in applying will need to provide Tomo with their salary information, and Tomo may take other financial considerations into account, as well. This card offers cash back on all purchases and does not charge an annual fee.

JaneWalter

JaneWalter