TikTok Shares Data on IP Detection and Shopping Safety

TikTok's shared some new insights into its evolving shopping safety measures.

As it continues to expand its in-stream shopping push, TikTok is also looking to provide more assurance for brands that their IP is being protected in the app, while it’s also looking to implement responsible approaches to product listings, relevant to local laws in each region.

In line with this, TikTok has released its latest TikTok Shop Safety and Intellectual Property reports, which highlight its ongoing investment into measures to protect both consumers and sellers in the app.

Indeed, TikTok says that it’s spent nearly $1 billion on tools, people, and technology to solidify its in-app sales systems.

So where is that money going?

First off, TikTok says that it’s increased its IP staff, with 1,800 people now overseeing its intellectual property enforcement efforts.

That’s enabled it to take more action on counterfeit and deceptive goods, and between July and December last year:

More than 7.5M products were proactively rejected from being listed for IPR violations. More than 750K products were detected by TikTok Shop and taken down for IPR violations after being listed. TikTok Shop proactively stopped more than 125K livestreams and more than 550K short-form videos globally due to IPR infringement concerns. More than 16K creators had their permission to sell on TikTok Shop permanently revoked where IPR violations contributed to penalties.

In the second half of last year, TikTok also deactivated 900 stores for IPR violations, while it also removed 90,000 restricted and prohibited product listings.

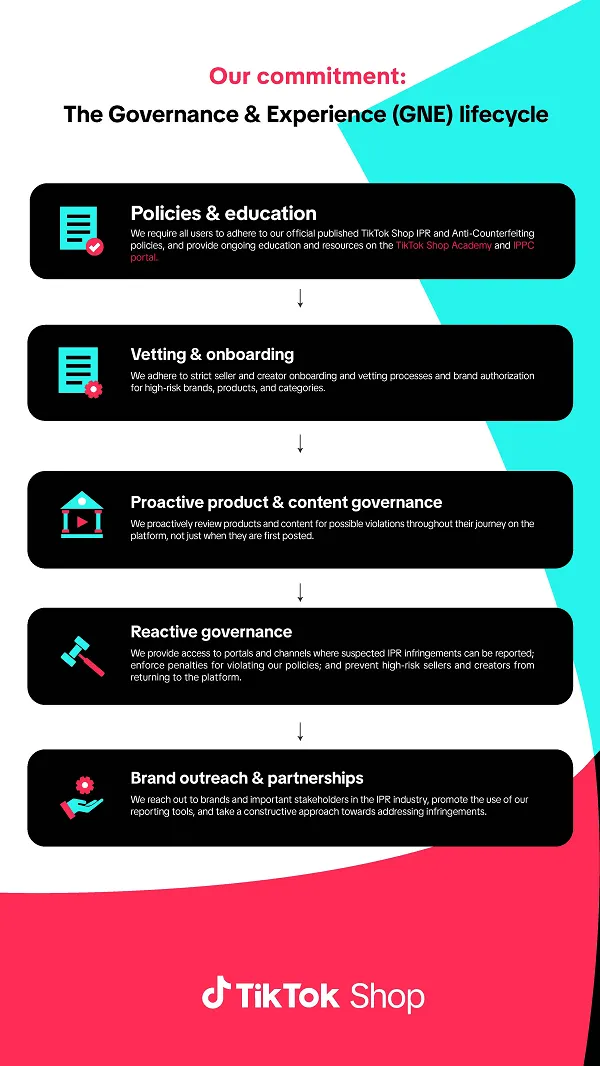

This is all in line with TikTok’s broader approach to shopping safety and enforcement, which it outlines in this overview:

By working with brands, and improving its systems, TikTok’s gearing itself up for a broader expansion of its shopping elements, which it hopes will become a bigger element of its app over time.

Though the impacts of the U.S./China trade was will be significant, as America is where it’s seen the biggest take-up of its in-app shopping options thus far. That’s why it’s now expanding its in-stream shopping push in Mexico, South America, Europe, and Asia, with a view to offsetting any potential losses as the trade dispute continues.

But losing the U.S. market will be hard to back-fill, and the longer the U.S. holds with its tariffs, the worse that will be for the app.

In some ways, it feels like TikTok is being forced to slow up its shopping push, just as it was gaining momentum, but maybe, through its expanding focus on other regions, it’ll be able to keep things moving in the right direction.

Troov

Troov

![Top Marketing Channels in 2025 — Here’s What Your Team Needs to Master [Data]](https://www.hubspot.com/hubfs/marketing%20channel.png)