US Dollar Outlook Turns Bearish Amid EUR/USD, GBP/USD Setups

Fed’s Dovish Stance and Weak Job Data The US dollar, as measured by the DXY index, fell significantly over the last week, temporarily reaching its lowest level since April 10th. This decline was mostly due to lower US Treasury...

Fed’s Dovish Stance and Weak Job Data

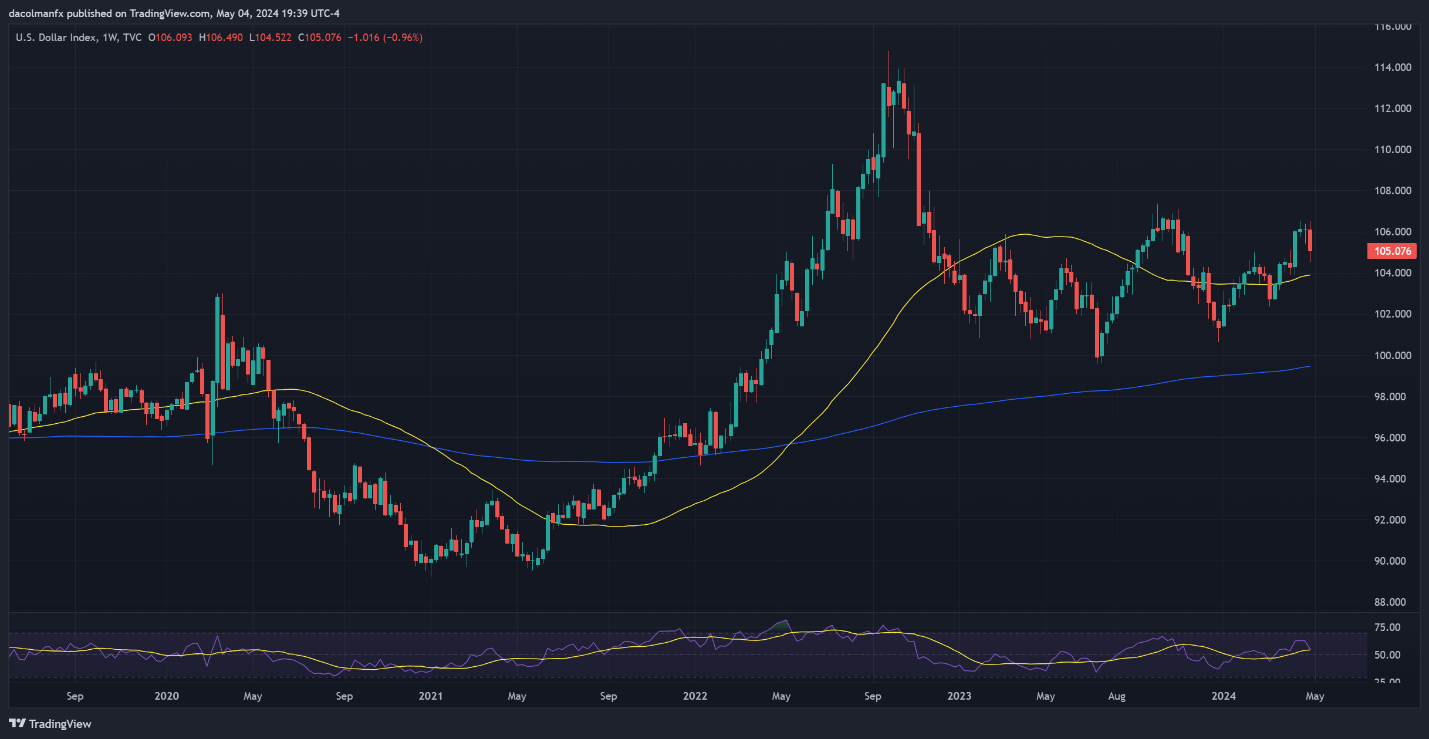

The US dollar, as measured by the DXY index, fell significantly over the last week, temporarily reaching its lowest level since April 10th.

This decline was mostly due to lower US Treasury yields following the Federal Reserve’s dovish policy decision and weaker-than-expected US job data.

Fed Chair Powell’s remarks, in particular, indicated prospective rate cuts despite inflationary threats, which weakened the dollar’s appeal.

Furthermore, the non-farm payrolls report showed a slowdown in job creation and weaker wage growth, supporting the pessimistic outlook. As a result, the DXY index fell roughly 1%, settling above 105.00.

Source: Chart by TradingView via DailyFX

Source: Chart by TradingView via DailyFXUpcoming Challenges

Looking ahead, the Federal Reserve’s relaxing prospects and growing signs of economic fragility may prevent bond yields from climbing, removing a significant bullish reason for the US currency.

This scenario predicts that the dollar may experience further decline in the immediate future. The relatively quiet US economic calendar in the coming week should allow recent market volatility to settle.

The mid-May Consumer Price Index (CPI) report will be critical, providing new insights into inflation trends and directing the Fed’s future policy moves.

EUR/USD Technical Analysis

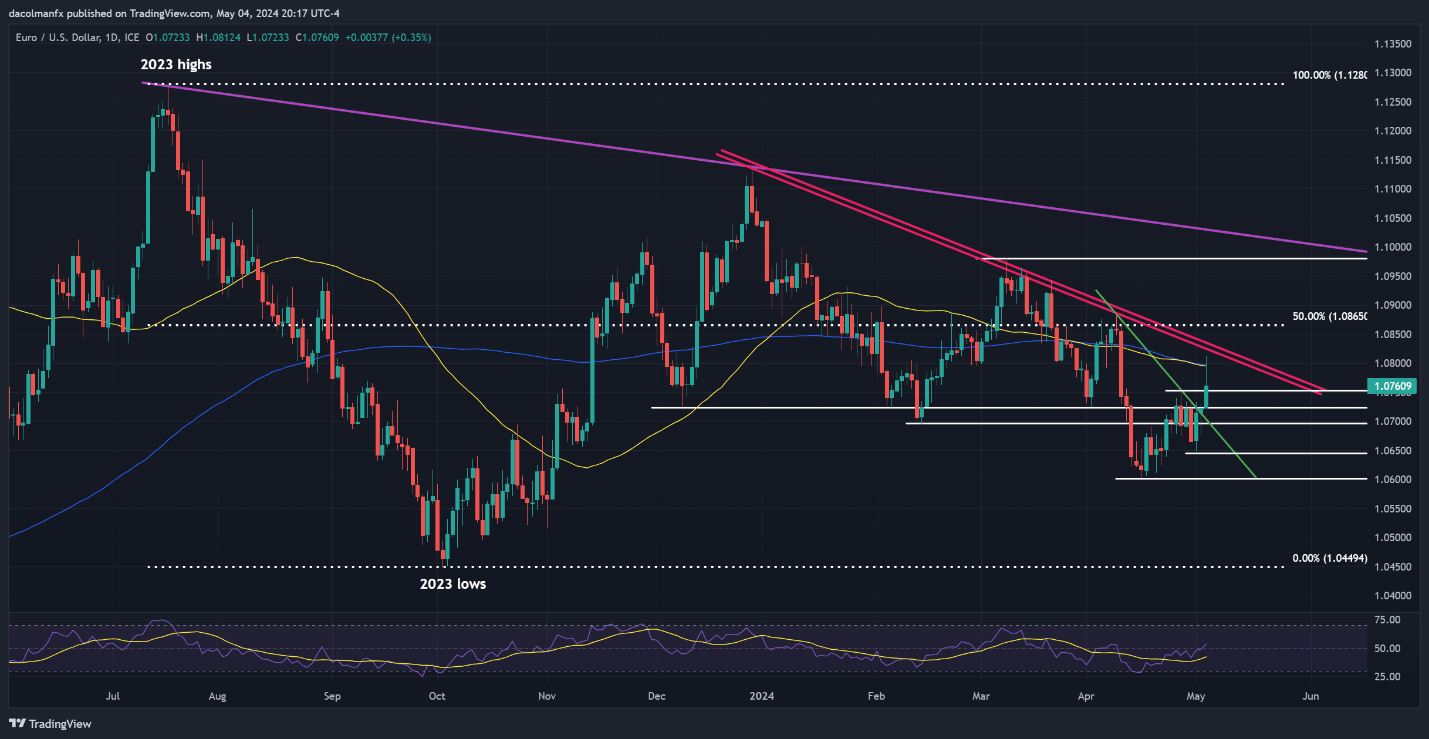

Last week, the EUR/USD pair rose, breaking numerous resistance zones and approaching the 50-day and 200-day Simple Moving Averages (SMAs). If the bullish momentum continues, the pair could test trendline resistance at 1.0830 and the Fibonacci barrier at 1.0865.

In a bearish reversal, support can be found at 1.0750, 1.0725, and 1.0695. Below these levels, the week’s low of 1.0645 and April’s bottom of 1.0600 will come into play.

Source: Chart by TradingView via DailyFX

Source: Chart by TradingView via DailyFXGBP/USD Technical Analysis

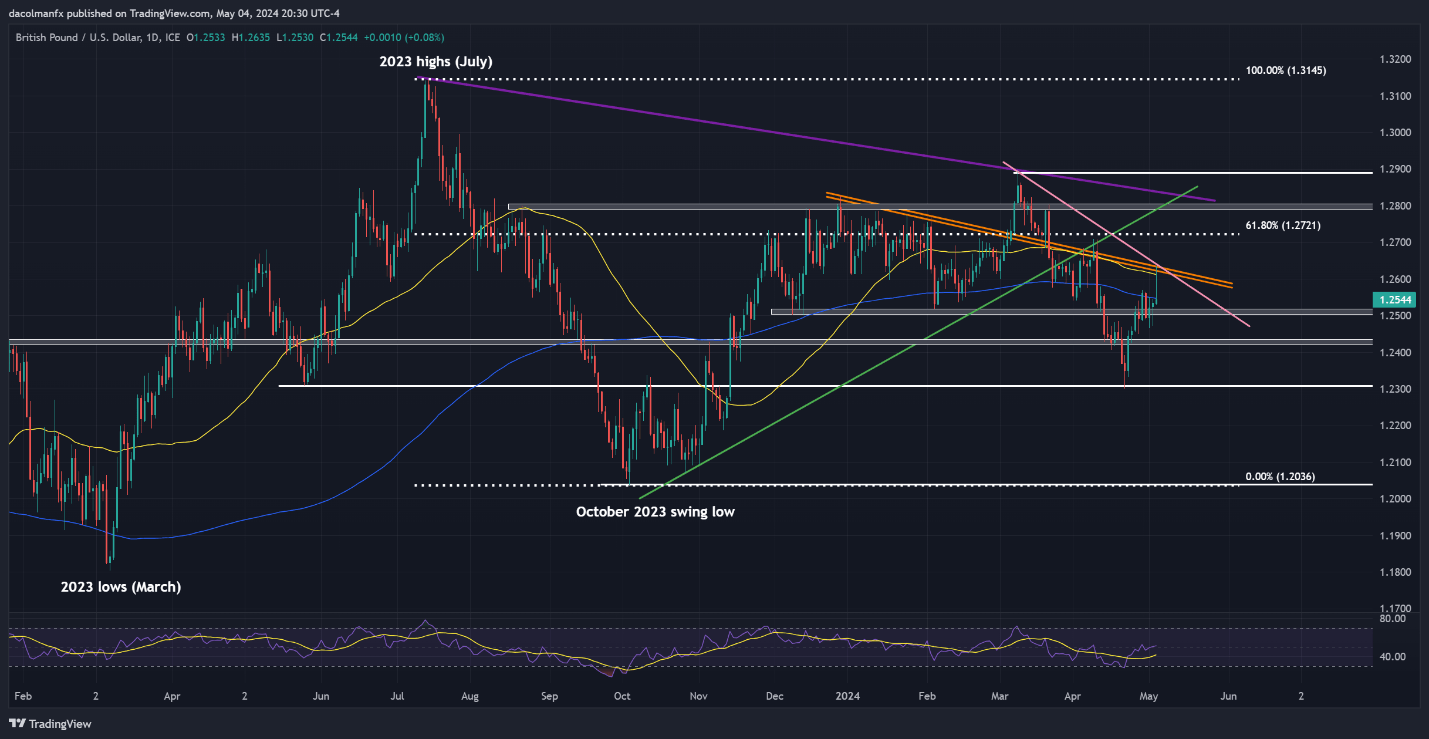

The GBP/USD pair also rose during the last week, although it failed to break the 200-day SMA. Traders should pay special attention to this signal, as a convincing breakthrough might lead to a challenge of confluence resistance near 1.0620.

If sellers resume and push the pair lower, support from 1.2515 to 1.2500 must hold to limit further downside danger to 1.2430. Further falls could target the 1.2300 level.

Source: Chart by TradingView via DailyFX

Source: Chart by TradingView via DailyFXGBP/USD Market Sentiment

Last week, the pound rose against the dollar due to Powell’s dovish comments and disappointing US economic statistics.

Although initial increases in labor costs in the United States boosted the dollar briefly, Powell’s confirmation of a forthcoming rate cut caused the dollar to lose its gains.

On Friday, poorer employment figures and a rising unemployment rate pointed to a slower labor market and lower inflationary pressures, alleviating fears about tightening monetary policy.

Source: ForexCrunch

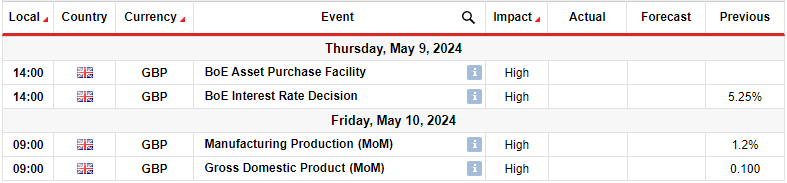

Source: ForexCrunchInvestors will focus next week on UK manufacturing and economic data, as well as the Bank of England’s interest rate announcement.

With evidence of economic recovery from a brief recession and the BoE closely following the Fed’s stance on delaying rate cuts, investor attention will be focused on the bank’s policy trajectory.

Final Thoughts

The US dollar’s bearish sentiment originates from a dovish Fed and recent economic weakness, indicating that traders should exercise caution. Technical setups in EUR/USD and GBP/USD indicate that these pairs may see further upside if critical resistance levels are breached.

Meanwhile, worse US data and dovish Fed comments will continue to influence market sentiment in the coming weeks.

Traders should pay close attention to economic data releases, particularly the mid-May CPI report and the BoE decision, as they will provide clearer direction for the dollar and its major equivalents.

Konoly

Konoly