U.S. oil on pace for worst day in two years after Israel spares Iran crude facilities

Oil prices lost ground on Monday after Iranian energy facilities were not damaged during an Israeli attack over the weekend.

View of Iran's oil industry installations in Mahshahr, Khuzestan province, southern Iran.

Kaveh Kazemi | Getty Images

U.S. crude oil sold off steeply Monday, putting the benchmark on pace for its worst day in more than two years after Iranian energy facilities were not damaged during an Israeli attack over the weekend.

Futures for global crude benchmark Brent slid 5.94% to $71.53 per barrel at 9:26 am ET, while U.S. West Texas Intermediate futures dropped 6.26% to $67.29 per barrel. U.S. crude oil is on pace for its worst day since July 12, 2022, when prices fell 7.93%.

Israel on Saturday attacked Iran's military installations in three provinces in response to Tehran launching ballistic missiles against Israel on Oct. 1.

Iranian news agency Tasnim reported that the attack, which the state-owned Islamic Republic News Agency said killed four soldiers, had inflicted "limited" damage. The strike steered clear of oil, nuclear, and civilian infrastructure locations. Iranian oil news network Shana said that Iran's oil industry operation is "underway normally" with no disruptions.

For weeks, markets had braced themselves for an Israeli retaliation following the direct Iranian offensive against the Jewish state earlier this month. Broader Middle East tensions have continued to rise following the attack on Israel by Iran-backed Hamas on Oct. 7 last year.

Oil markets' key consideration had been a direct engagement between both parties, with concerns of an attack on Iranian oil facilities rising in recent weeks. Iran accounts for up to 4% of global oil supplies, according to the U.S. Energy Information Administration.

Oil prices will remain under pressure for the rest of this year, it may be difficult to see Brent crude oil prices reaching $80 in the foreseeable future.

Andy Lipow

president at Lipow Oil Associates

"The recent Israel military action is unlikely to be seen by the market as leading to an escalation that impacts oil supply," Citi analysts wrote in a note on Monday, cutting the bank's Brent oil forecast by $4 to $70 per barrel over the next three months.

Oil markets are also staring at a global oversupply.

"With Israel deliberately, and perhaps with some American encouragement, avoiding the targeting of crude oil facilities, the oil market is back to looking at an oversupplied market," said Andy Lipow, president of Lipow Oil Associates.

Oil production has been increasing not just in key countries such as U.S., Canada and Brazil, but even among smaller players, such as Argentina and Senegal, he added.

"Oil prices will remain under pressure for the rest of this year, it may be difficult to see Brent crude oil prices reaching $80 in the foreseeable future," Lipow told CNBC over email.

The risk premium has come off a few dollars per barrel, as the more limited nature of the strikes, including avoiding oil infrastructure, have raised hopes for a de-escalatory pathway, said Saul Kavonic, an energy analyst at MST Marquee.

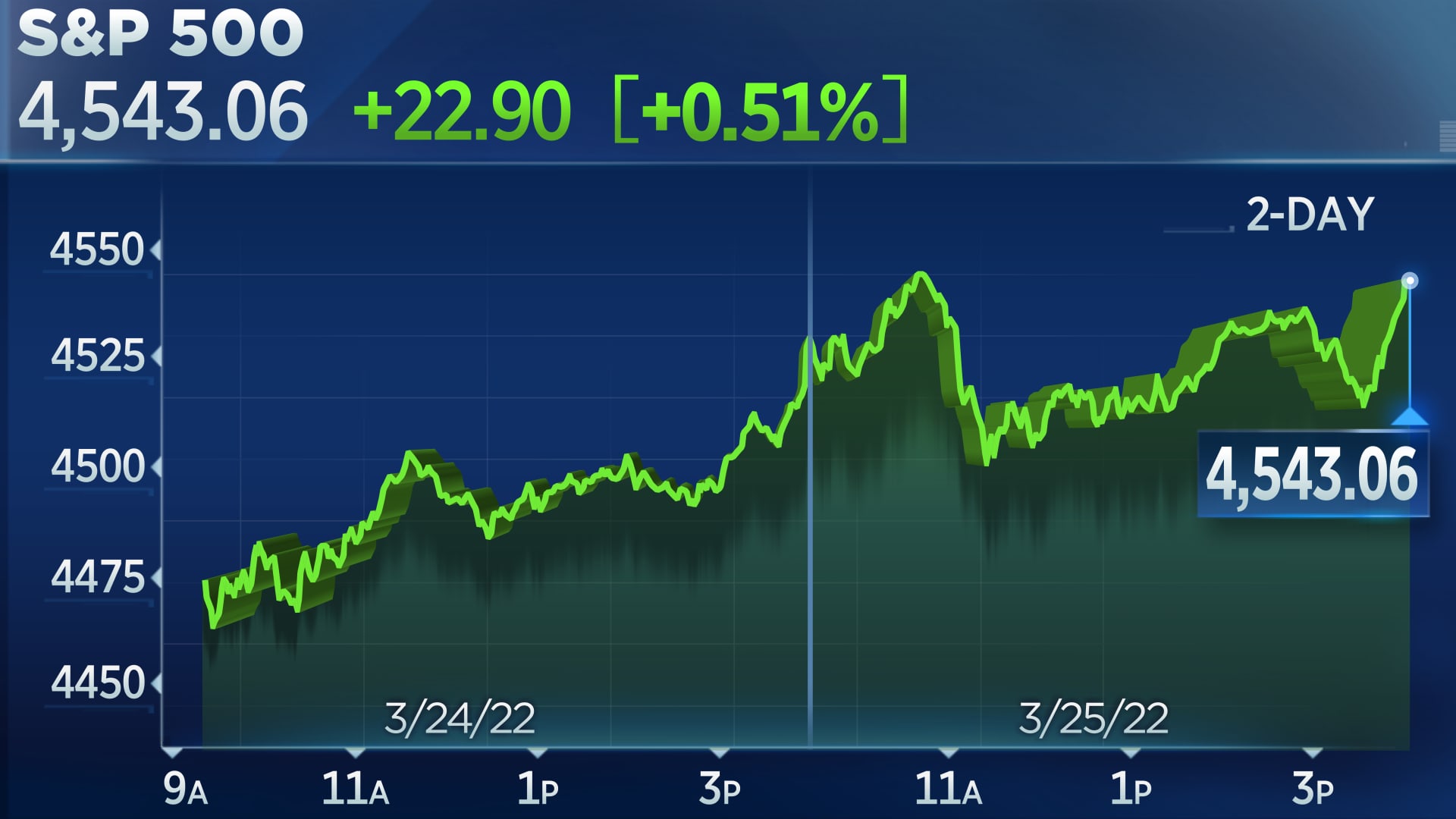

Oil prices year-to-date

The spotlight will now fall on whether Iran will counter the attack in the coming weeks, which would see risk premiums rise again, Kavonic told CNBC. He noted that the overall trend of the conflict still remains one of escalation, with a high scope for another round of attacks.

During a cabinet meeting on Sunday, Iranian President Masoud Pezeshkian emphasized Iran's right to react to Israel's attack.

"We do not seek war, but we will defend our country and the rights of our people. We will give a proportionate response to the aggression," he said.

Market attention will now turn to Hamas‑Israel and Israel‑Hezbollah cease-fire talks that resumed over the weekend, according to Vivek Dhar, director of mining and energy commodities research at Commonwealth Bank of Australia.

"Despite Israel's choice of a low‑aggression response to Iran, we have doubts that Israel and Iran's proxies (i.e. Hamas and Hezbollah) are on track for an enduring ceasefire," Dhar wrote in a note.

Although the selloff is a result of relief that Israel did not hit Iranian oil facilities, Rapidan Energy founder Bob McNally suggested that the markets are not out of the woods just yet.

"Direct Israel-Iran conflict will likely persist. Israel signaled it is able and willing to target energy and nuclear targets in future strikes," said McNally, who expects prices to remain volatile but rangebound.

Astrong

Astrong