Use This Calculator to See If You're Truly Middle Class

See how you stack up in the so-called American dream.

Credit: Bilanol / Shutterstock

The term "middle class" is thrown around all the time—especially during an election year—but what does it really mean? And more importantly, are you part of it? While definitions can vary, being middle class is closely tied to the idea of the "American dream," the notion that with hard work and sound financial management, you should be able to afford a home, raise a family, and eventually enjoy a comfortable retirement. Emphasis on the "dream."

In practical terms, pinning down exactly who qualifies as middle class is tricky. Location, family size, and local cost of living all play a role. About half of U.S. adults (52%) lived in middle-income households in 2022, according to a Pew Research Center analysis of the most recent available government data. And now, you can use Pew’s updated calculator to see how you stack up. Here's how it works.

How the income calculator works

Pew's analysis defines the middle class as households with incomes between two-thirds and double the national median household income, adjusted for family size. The calculator takes your location, household size, and pre-tax income to determine where you fall on the economic spectrum in your area.

The income is revised upward for households that are below average in size, and downward for those of above-average size. This way, each household’s income is made equivalent to the income of a three-person household. (Three is the whole number nearest to the average size of a U.S. household, which was 2.5 people in 2023.)

Pew Research Center says it does not store or share any of the information you enter, by the way—it's just for your own curiosity. And while this calculator provides a useful benchmark, it's important to note its limitations. It doesn't account for factors like debt, assets, or local cost of living beyond adjusting for household size. Your personal financial situation may be more complex than what this simple calculation can capture.

What this means for you

Outside of sheer curiosity, understanding where you fall on the economic spectrum can be valuable for several reasons. Knowing your economic status can help you set realistic financial goals and make informed decisions about saving, investing, and spending. Plus, many government policies and programs are aimed at the middle class. Understanding where you fall can help you anticipate how various policy proposals might affect you.

Zooming out, your position relative to others can provide context for broader economic trends and help you understand how changes in the economy might impact you personally. If you find you're not where you want to be economically, this information can inform decisions about career changes, additional education, or relocation.

Remember, being classified as middle class (or not) doesn't define your worth or success. It's simply a tool for understanding your economic position relative to others in your area. Many factors contribute to financial well-being and life satisfaction beyond income alone.

The bottom line

Understanding your economic status can be a valuable tool for financial planning and decision-making. However, remember that "middle class" is a broad category, and your specific financial needs and goals may differ from others in the same income bracket. Use this calculator as a starting point for understanding your economic position, but always consider your unique circumstances when making financial decisions.

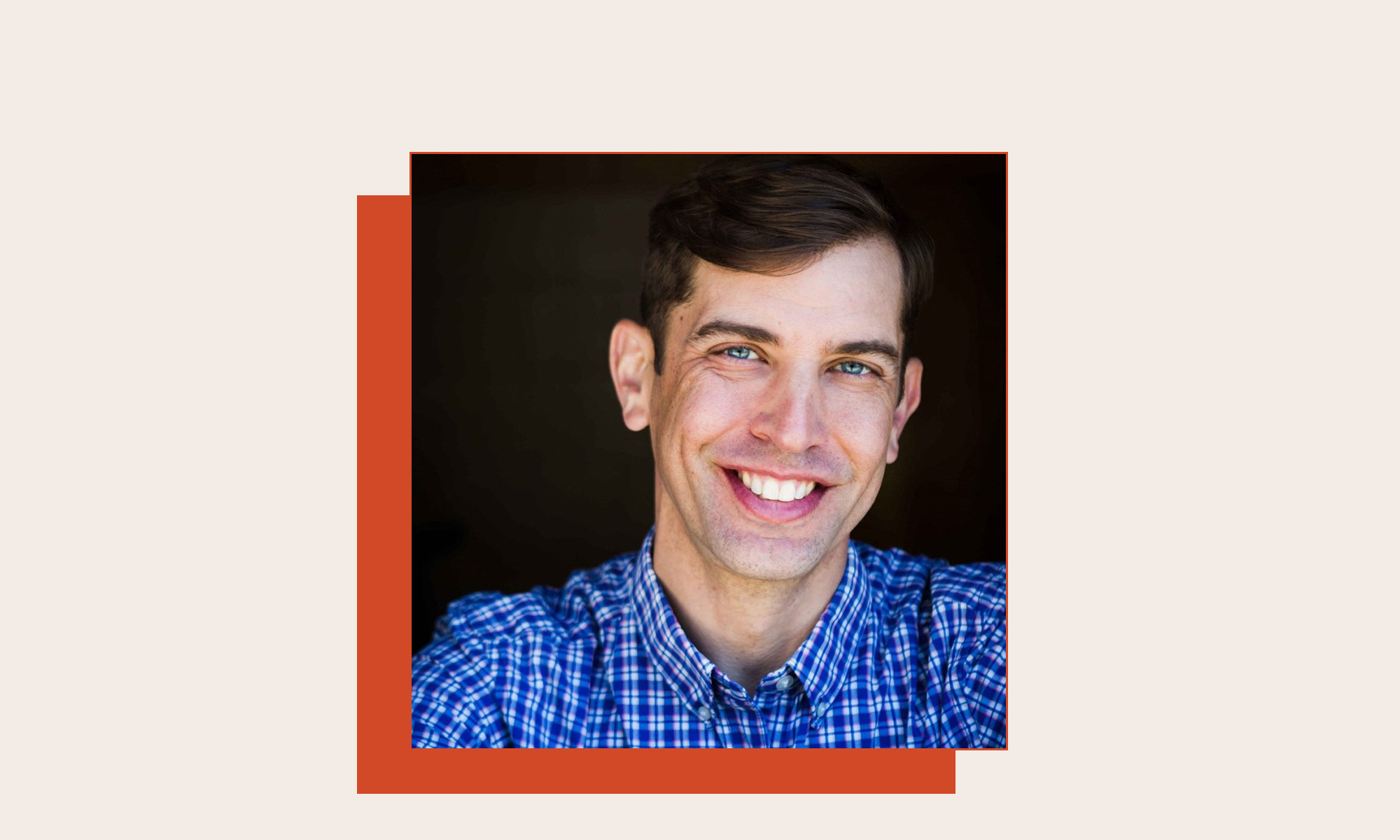

Meredith Dietz

Senior Finance Writer

Meredith Dietz is Lifehacker’s Senior Finance Writer. She earned her bachelor’s degree in English and Communications from Northeastern University, where she graduated as valedictorian of her college. She grew up waitressing in her family restaurant in Wilmington, DE and worked at Hasbro Games, where she wrote rules for new games. Previously, she worked in the non-profit space as a Leadership Resident with the Harpswell Foundation in Phnom Penh, Cambodia; later, she was a travel coordinator for a study abroad program that traced the rise of fascist propaganda across Western Europe.

Since then, Meredith has been driven to make personal finance accessible and address taboos of talking openly about money, including debt, investing, and saving for retirement. Outside of finance writing, Meredith is a marathon runner and stand-up comedian who has been a regular contributor to The Onion and Reductress. Meredith lives in Brooklyn, NY.

Tfoso

Tfoso