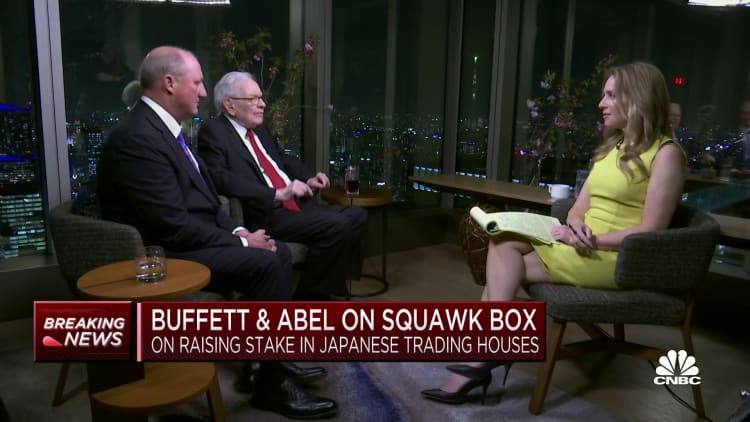

Warren Buffett's trip to Tokyo is seen as a 'stamp of approval' for investing in Japan

Buffett recently revealed that he raised his stakes in the country's top trading houses, saying he was "confounded" by the opportunity.

Warren Buffett, chairman and chief executive officer of Berkshire Hathaway Inc., in Fukushima Prefecture, Japan, on Monday, Nov. 21, 2011.

Bloomberg | Bloomberg | Getty Images

Berkshire Hathaway's Warren Buffett is in Japan and recently revealed that he raised his stakes in the country's top trading houses, saying he was "confounded" by the opportunity to buy them two years ago.

The five companies — Mitsubishi Corp., Mitsui & Co., Itochu Corp, Marubeni Corp., Sumitomo Corp. saw two consecutive days of gains as Buffett confirmed he added roughly another percentage point to his holdings. Berkshire Hathaway's stakes in all five trading houses is now 7.4%.

On Thursday, the shares continued to trade mostly higher for a third day, paring earlier losses after Federal Reserve minutes showed expectations for a recession in the U.S. in the fallout of the regional banking crisis. Sumitomo shares fell 0.5%.

Buffett's trip is a "stamp of approval" — especially for domestic investors in Japan, according to Monex Group's Jesper Koll.

"For Japanese institutional investors, this really is now the stamp of approval that Japan can deliver superior returns," Koll told CNBC's "Street Signs Asia."

He emphasized Buffett's trip has the potential to boost confidence among Japanese investors as the nation continues to grapple with low consumption.

"The real focus is confidence for Japanese investors, and that's where Warren Buffett's visit was very, very important," Koll said. "He's got the track record globally, but now he's got a very positive track record in investing in Japan."

Stock picks and investing trends from CNBC Pro:

Household spending in Japan marginally increased by 1.6% in February, the latest government data showed.

That also marked the first growth in consumption that the economy has seen in fourth months, with spending outside of seasonal factors led by recreation, leisure and travel.

Private consumption is a key indicator for Japan, accounting for more than half of the nation's gross domestic product.

'Unique antenna'

Monex's Koll added that Buffett will benefit from the upper hand the trading houses hold.

The trading companies, also referred to as sogo shosha, are conglomerates that import everything from energy and metals to food and textiles into Japan. They also provide services to manufacturers. The trading houses have helped grow the Japanese economy and contributed to the globalization of its business.

"Any new venture, any new enterprise that is being formed, the Japanese trading houses will have superior intelligence and superior access to the deal, and that's something that Berkshire Hathaway is going to be able to leverage in a unique antenna into the future view in Japan as well as the Asia-Pacific," Koll said.

Earlier this week, the Bank of Japan's new governor Kazuo Ueda reiterated that he intends to maintain the central bank's accommodative monetary policy, which provides further support for the Japanese equity market and retail investors.

Ueda emphasized that the central bank's yield curve control and negative interest rate policies will likely be sustained until the economy reaches its target of 2% in inflation.

Konoly

Konoly