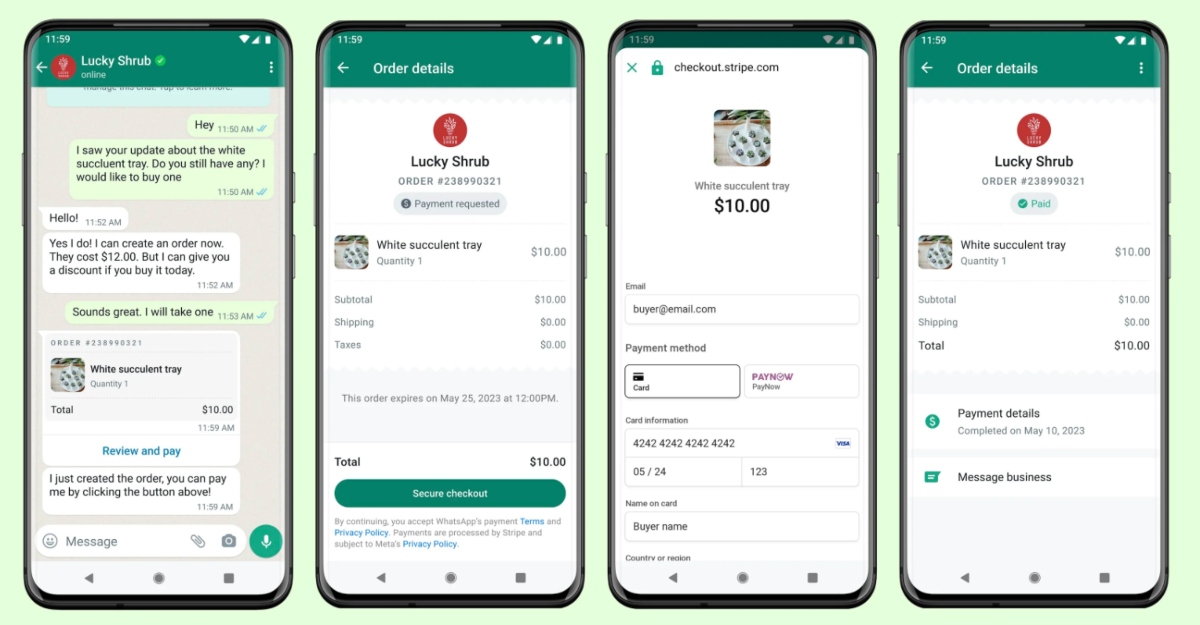

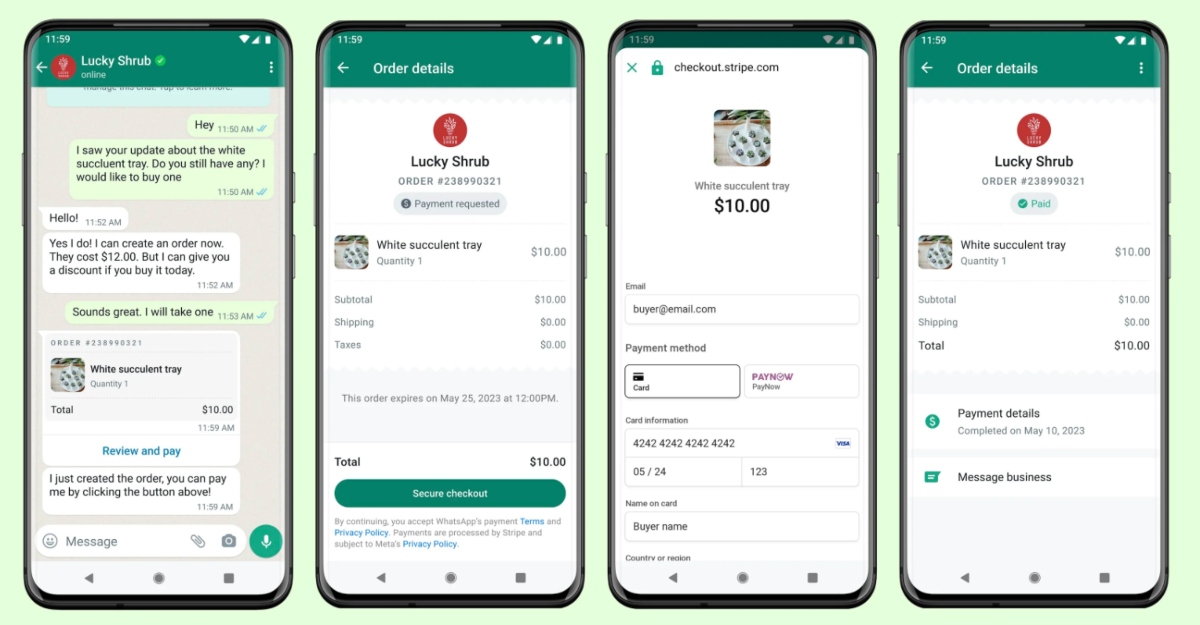

WhatsApp launches in-chat payment feature in S’pore – there are no transaction limits or fees

Singaporeans can now make purchases and pay local businesses directly on WhatsApp using credit and debit cards, or PayNow.

WhatsApp launched today (May 9) a new payment feature that allows users and businesses in Singapore to buy and sell directly via the messaging platform.

The in-chat payment feature will initially be rolled out to selected businesses using the WhatsApp Business Platform in the city-state, with more set to gain access in the coming months. Currently, it is already available in Brazil and India.

The service is supported by payments service provider Stripe and enables Singapore residents with a locally registered WhatsApp number to make purchases using Visa, MasterCard and American Express credit and debit cards or PayNow.

Most people I know in Singapore use WhatsApp to chat with each other.

Now, they can pay local businesses using the app as well. The speed and convenience of payments through WhatsApp will help businesses expand their revenue streams with new channels and access a wider customer base.

– Sarita Singh, regional head and managing director for Southeast Asia at Stripe.WhatsApp said that it will not impose transaction limits or charge additional fees for utilising the in-chat payments feature.

To ensure confidentiality and data privacy for its users, the messaging platform said that it works with trusted payment partners who are required to comply with payment card industry data security standards.

In addition, its policies require users to provide their legal name and identity for verification before being eligible to use the payments feature. Customer information is also transmitted directly to the payment partner, without being processed or viewed by WhatsApp.

Starting today, people in Singapore can pay their local merchants on WhatsApp in just a few taps. This seamless and secure experience will transform the way people and businesses in Singapore connect on WhatsApp.

– Stephane Kasriel, head of fintech at MetaFeatured Image Credit: Stripe

UsenB

UsenB