Without national reserves, S’pore’s GST would have to be raised to 21% or more

If Singapore was run like any other country, the local GST rate would have to be set at 21% or more, to balance the budget.

The recently announced increase of Goods and Services Tax (GST) to 8% and 9% in the coming two years has led to largely negative reception by the Singaporean public. However, while nobody likes taxes to go up, it’s important to see things in a proper context.

Firstly, by global standards, the indirect tax on consumption in the city-state is among the lowest in the developed world. Compared to OECD countries (note: Singapore is not a member of the organisation), the city-state would rank third from the bottom — and this is only after the full GST increase.

Image Credit: OECD

Image Credit: OECDSome people like to argue that many of these countries have lower VAT rates on things like food, medicines, energy, books which helps reduce tax burden on ordinary people — and this is true (though in some of them, even reduced rates are higher than Singapore’s GST).

What is often forgotten in the debate is that the city-state employs GST relief tools as well, through a voucher/cash system that is helping the needy in a direct way. It’s a different approach and one that is, arguably, a lot more reasonable.

In a reduced-rate system, everybody pays lower VAT on certain goods, regardless of how wealthy they are. A millionaire family or a fancy restaurant pays the same low tax on food items than pensioners doing their shopping. In fact, every company or individual in the economy enjoys the reductions in the same way.

In Singapore, everybody pays the same tax on everything at the counter, but the needy receives GST relief to their utilities, top-ups to Medisave or cash, having a portion of the tax returned directly to their pockets. It’s much more targeted and less wasteful (after all, what’s the point of giving rebates on consumption to the richest?).

In other words, not only do all Singaporeans pay much less in GST than people in most developed countries pay in similar taxes on vast majority of products and services, but the poorest still receive direct help to reduce their bills.

This, however, does not yet explain the biggest achievement of the little city-state: why is the tax so low in the first place (particularly as both income taxes and corporate taxes are low as well)?

GST in Singapore should be at 21% – or over

You see, if Singapore was run like any other country, the GST would likely be in the range of 21% to perhaps 27%, broadly the same as VAT in Europe. This is how much would be needed to balance the budget.

The reason it is not necessary lies in nation’s reserves.

GST revenue in 2022 is projected to reach S$12.8 billion, at the prevailing rate of 7%. The government hopes to gain about S$3.5 billion every year after the GST is raised, to help pay for rapidly growing healthcare costs.

Meanwhile, the Net Investment Returns Contribution (NIRC) — the portion of profits from the investment of national reserves — is expected to exceed S$21.5 billion, up from about S$20 billion last year.

Evolution of NIRC over time. / Image Credit: The Straits Times

Evolution of NIRC over time. / Image Credit: The Straits TimesIn fact, NIRC accounts for over 20% of the national budget and is the single largest source of revenue. It is also unique in that virtually no other country in the world enjoys similar inflows.

Everybody else must make do with whatever they collect in taxes. Plus, they often have to pay hefty interest on debt, as governments run continuous deficits, spending more than they generate.

For each percentage point of GST, Singapore collects about S$1.75 billion.

Without NIRC, it would have to find another S$21.5 billion to cover its expenses. To finance it with GST, it would be forced to — at the very least — increase it by over 12 percentage points, from 9% to 21%, just to maintain the current level of revenue.

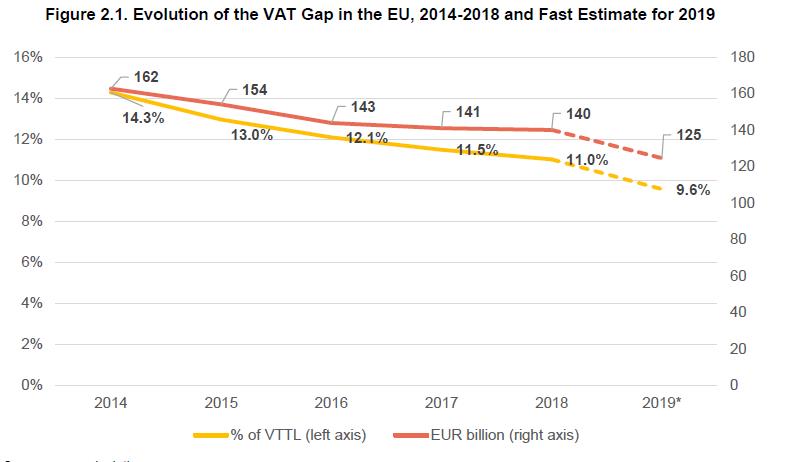

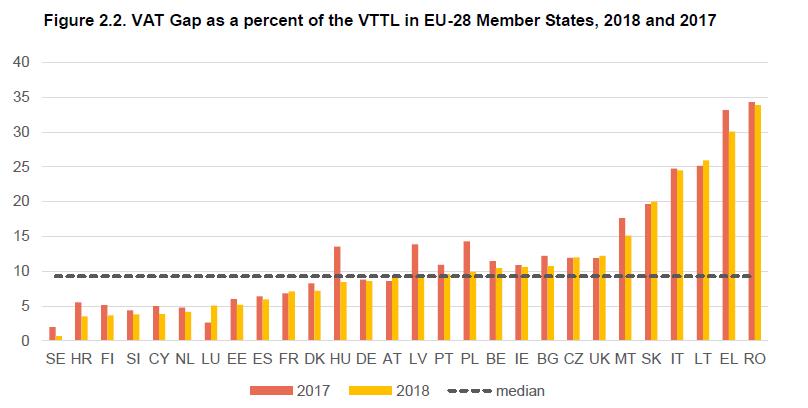

Higher taxes mean higher prices, so people spend less money, reducing consumption and thus, the tax base.With higher tax rates, the incentive to evade them grows. Consequently, so does the gap between theoretical maximum and what the IRAS would be able to collect.The latter is called the VAT/GST gap and, as you can see below, it has been on average a whopping 10% of projected tax revenues in the EU countries, with some failing to collect more than a third of what they would normally expect, due to tax dodging and lax enforcement.

(VTTL stands for VAT Total Tax Liability – the expected revenues from the tax)

Image Credit: European Commission

Image Credit: European Commission Image Credit: European Commission

Image Credit: European Commission As a result, the GST rate would likely increase by at least a few percentage points more to arrive at the missing amount. 23? 24? 25? All of these can be found in the EU.

Alternatively, the government could increase income taxes, but the latter would have to grow significantly for the lowest taxpayers, as already 80% of PIT is paid by just 10% of the wealthiest Singaporeans.

Increasing the rates on the richest could lead to capital flight and tax avoidance/evasion, destroying Singapore’s (relatively) low tax appeal.

Fortunately, these nightmare scenarios are just a cautionary tale of what could have been, but doesn’t have to and will not be.

Singapore has prudently saved and invested budgetary surpluses as well as foreign currency reserves for many decades, and today it can depend on them for a stable, high revenue filling the budget, preventing the government from having to make drastic spending cuts, raise taxes to European levels or, heaven forbid, actually borrowing to finance annual budgetary expenditures.

That’s why, while many are unhappy about the GST bump, the reality is that it’s nowhere near what it could – and in any other circumstances would be.

Join us in supporting the best homegrown brands. Shop now on VP Label:

Featured Image Credit: ASEAN Briefing

UsenB

UsenB