Cannabis brand building—here's what marketers should know

As more states legalize recreational marijuana, industry leaders weigh in on what it takes to go to market.

Every year, 4/20 seems to mark another milestone for the cannabis industry. States continue to roll out legalization: currently a total of 37 states allow medical use and 18 have legalized adult recreational use with major markets like New Jersey allowing sales this week. Plus, federal legislation is currently under debate in Congress. But new markets and a growing consumer base don’t necessarily mean bud and roses for brands.

Similar to adult industries like alcohol or gambling, cannabis marketing has an extensive set of restrictions; however, the difference is that without a centralized set of regulations, those rules can be vastly different from state to state. Jeff Finnerty, senior VP of marketing at multi-state weed retailer Ayr Wellness, illustrated this hardship through the brand’s Wicked Sour Gummies product, which originally launched in Massachusetts.

“You would think that it would be easy for us to take that brand and move it to all the rest of our states,” explained Finnerty. “Unfortunately, that wasn't the case once we went to the state of Florida, where you can make a gummy. The process of making that, the ingredients—all approved by the state. But the state thought that the term ‘wicked’ and the word ‘sour’ appealed to children. So, while ‘wicked’ is a nod to the phrase ‘wicked good,’ something that is a positive thing in Massachusetts, and ‘sour’ is literally the descriptor of what the product tastes like, we had to create a different brand in the state of Florida.”

Restrictions like this, as well as similar stories from leaders across the industry, highlight the issues for building brand identity and consumer loyalty across state lines and can impede brands’ attempts to normalize broader conversation about cannabis socially and politically.

To point out the limitations of these restrictions, Weedmaps launched a campaign earlier this year timed for the Super Bowl. The spot, which features a broccoli lamenting the burden of being the emoji representation of weed, makes the plea, “Cannabis is here. Let’s talk about it.” The spot was part of a larger stunt in which the brand inquired into advertising at the Big Game alongside beer and betting ads, but was denied.

Brand building

With so many obstacles between a cannabis brand and new consumers, building an identity can seem like an insurmountable task. Grabbing screentime with new consumers can be much more difficult, THC seltzer brand Cann Co-Founder Luke Anderson told Ad Age, especially as weed becomes a more socially acceptable substance and draws in new audiences.

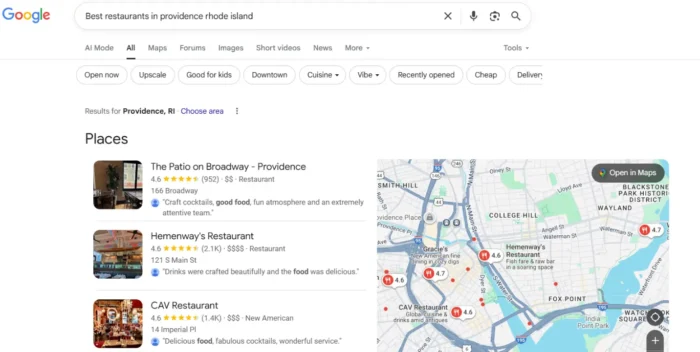

“We are experimenting with paid ads that are compliant that don't show the product, but talk about its feeling and then go to a landing page,” said Anderson. “If you can figure out how to walk that narrow path of not tripping any compliance wires for a digital platform, you can actually capture new consumers’ interest. But there are different rules on TikTok than Meta than Google and Snapchat. So, we have to learn the rulebook and then form relationships at the top level with each of these digital marketing platforms.”

Last year, Cann launched a holiday campaign on its owned social channels featuring celebrities Baron Davis, Darren Criss and Kate Hudson. Anderson previously told Ad Age that the casting choice was intentional as a way to enter the political conversation and put recognizable faces in front of voters who need the push of seeing America’s sweetheart getting high to begin understanding cannabis outside of stoner culture.

“If you're able to, as a cannabis brand, have a story and go toe-to-toe with a big CPG company the same way that a Procter & Gamble or Unilever would execute the campaign, then there's very few people doing that,” said Anderson.

But as the economy surges in the cannabis industry, it’s also important to make sure an endorser or celebrity entrepreneur aligns their wallet with purpose. “I get a lot of phone calls from celebrities who want to build a cannabis brand,” said Troy Datcher, CEO of the Parent Company, which owns the Jay-Z-backed weed brand Monogram.

“The first question I asked them is what's their connection to the industry, what's their connection to the plant or to the work that we find important as we are helping to shape the industry,” said Datcher. “And when someone leads with the fact that they want to make more money or start with, ‘It's a new revenue stream,’ that's a quick conversation. For me, when it's born in authenticity, it becomes a part of the cultural conversation.”

Mark Flores, director of brand engagement at weed-focused agency Receptor Brands, said the key to growing and maintaining brand loyalty with marijuana consumers is to “have a soul.”

“Have a brand identity that connects with people, not necessarily the pharmaceutical route, which is more transaction-based” said Flores, noting that mindset can be common in newly legalized states. “We see brands that really do care about their consumers and try to engage with them as often as they can. And when I say having a soul, I mean caring about the communities that you're serving goes a long way in differentiating yourself from brands that don't necessarily do that.”

Federal legalization

Many may jump to the idea that federal cannabis legalization is the final hurdle to solving these issues, especially as the Marijuana Opportunity Reinvestment and Expungement (MORE) Act was approved in the House of Representatives earlier this month and progresses to a vote in the Senate. Flores doesn’t think it’s that simple.

While federal legalization would have major implications allowing companies to localize the production process before shipping product across state lines, its effect on marketing and branding would resemble more of an umbrella effect, or have the potential to influence state regulations without necessarily unifying them.

“Bureaucracies are always going to get in the way, but there are organizations—and I'll give you an example: the National Cannabis Industry Association, where I sit on the state regulations committee. Harmonizing some of these laws is one of our goals in order to make federal legalization easier if and once it comes into fruition,” said Flores. “As you have more multi-state operators that are lobbying on [states’] behalf to make those laws a little bit more consistent, it's going to happen. It's just an uphill battle and it'll take time, but the industry is growing fast. The money behind some of those efforts to make laws consistent is there and we'll get there.”

When asked if he believes legalization hopefuls should get excited about the current round of legislation, Flores added, “We should be very excited because at the end of the day, it's getting us closer and closer to normalizing the conversation about cannabis because now it is making national headlines on a daily basis. And that is exciting.”

Subscribe to Ad Age now for the latest industry news and analysis.

Social accountability

Many political conversations around cannabis legalization center around racial justice. For example, New York’s licensing process, which is considered one of the most progressive, inherently favors local operations, especially those previously affected by marijuana laws.

“We had the opportunity to see what other states did and how they succeeded or failed, and especially as they tried to implement what they call equity programs, which is really that effort to get licenses into the hands of those impacted by the disproportionate enforcement,” said Freeman Klopott, a representative from New York State’s Office of Cannabis Management. As the state begins licensing sellers, which it claims will be allowed to operate by the end of 2022, its emphasis is on serving largely communities of color that have been disproportionately oppressed by cannabis laws.

But as governments incorporate social equity into their legislation, not all brands are as eager to broach the topic. Flores’s advice as new states open their recreational markets is to join the conversation head-on. He said that brands outside of the cannabis industry have taken a large role in providing a financial avenue for “social equity applicants to get into the industry without having to be plant-touching. That's great for now, but that doesn't answer the social equity question of how cannabis as an industry should be giving back to the communities that cannabis has affected historically.”

Last year, Monogram posted a series of out-of-home ads pointing out the hypocrisy of cannabis laws in the U.S. “There’s a state in America where cannibalism is technically legal and cannabis isn’t” reads one. Another states, “The war on drugs worked, if systemic racism was the goal.”

“That was a really courageous place for a brand to start communicating as it’s trying to build awareness, but it's also at the center of who monogram is,” said Datcher. “It's reflective of the community we are serving and so, for us, that allows us to have conversations.”

A series of videos on Monogram’s YouTube channel is an example of the brand’s efforts to spark discussions around social equity. In “High Tales,” influencers and stars like Tinashe and 2 Chainz meet over joints to tell stories about their craziest smoking encounters and normalize conversations about being stoned in the way wider audiences bond over boozy mishaps.

Datcher’s final advice: “Start with authenticity. Start with that passion. Find the right partner that can be complementary to your mission and have fun at it because we're at the very beginning of something incredibly transformative for all the folks who are participating.”

JimMin

JimMin