CBRE Again Raises U.S. Hotel Rate, RevPAR Forecast

CBRE Hotels Research this week again increased its projection for 2022 U.S. hotel performance expectations, another in streak of forecasts from the firm that paints a powerful pricing picture for the coming months.

The breakneck speed of recovery is slowing, but strong group demand, inbound international and business transient will keep prices rising.

CBRE Hotels Research this week again increased its projection for 2022 U.S. hotel performance expectations, another in streak of forecasts from the firm that paints a powerful pricing picture for the coming months.

The research firm projects revenue per available room will close 2022 up 14.7 percent year over year, higher than the 13.1 percent CBRE projected in May. The newly revised forecast factors in a 3.5 percent increase in expected average daily rate and 2.2 percentage point reduction in demand.

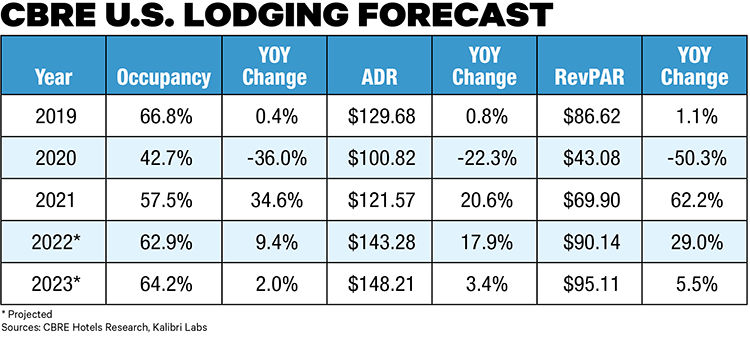

CBRE now projects 2022 U.S. occupancy to reach 62.9 percent, a 9.4 percent year-over-year increase. ADR is forecast to reach $143.28, according to the firm, and is expected to rise slightly further next year. The firm projects RevPAR to increase from $90.14 in 2022 to $95.11 in 2023.

[Report continues below chart.]

Q2 Outperformed Expectations

Second-quarter hotel performance was stronger than CBRE expected. RevPAR rose 38 percent over 2021, reaching an all-time quarterly high at 106 percent of 2019 levels. That growth was driven by a 25.5 percent year-over-year increase in ADR, bolstered by inflation, and an occupancy increase of nearly 10 percent, “demonstrating travelers’ limited price sensitivity in many peak demand markets,” according to the report.

That price imperviousness likely was buoyed by consistent improvements in group business and increasing inbound international travel, according to CBRE, both of which will continue to support pricing power, with “a modest uptick in transient business [travel]” underneath the top drivers.

CBRE does not see growth continuing at a breakneck pace. Signs of slowing already are on the horizon.

“As we progress through the third quarter, it is worth noting that the brisk pace of demand recovery has begun to slow. We are seeing a pullback in ADRs in select record-setting markets,” said CBRE head of hotel research and data analytics Rachael Rothman in a statement.

MikeTyes

MikeTyes