Dogecoin Down 13% As Whales Distribute $181 Million In DOGE

On-chain data shows the Dogecoin whales have gone on a notable selling spree recently, potentially explaining the decline DOGE has seen since its $0.307 high. Dogecoin Whales Have Reduced Holdings By 680 Million Tokens In a new post on...

On-chain data shows the Dogecoin whales have gone on a notable selling spree recently, potentially explaining the decline DOGE has seen since its $0.307 high.

Dogecoin Whales Have Reduced Holdings By 680 Million Tokens

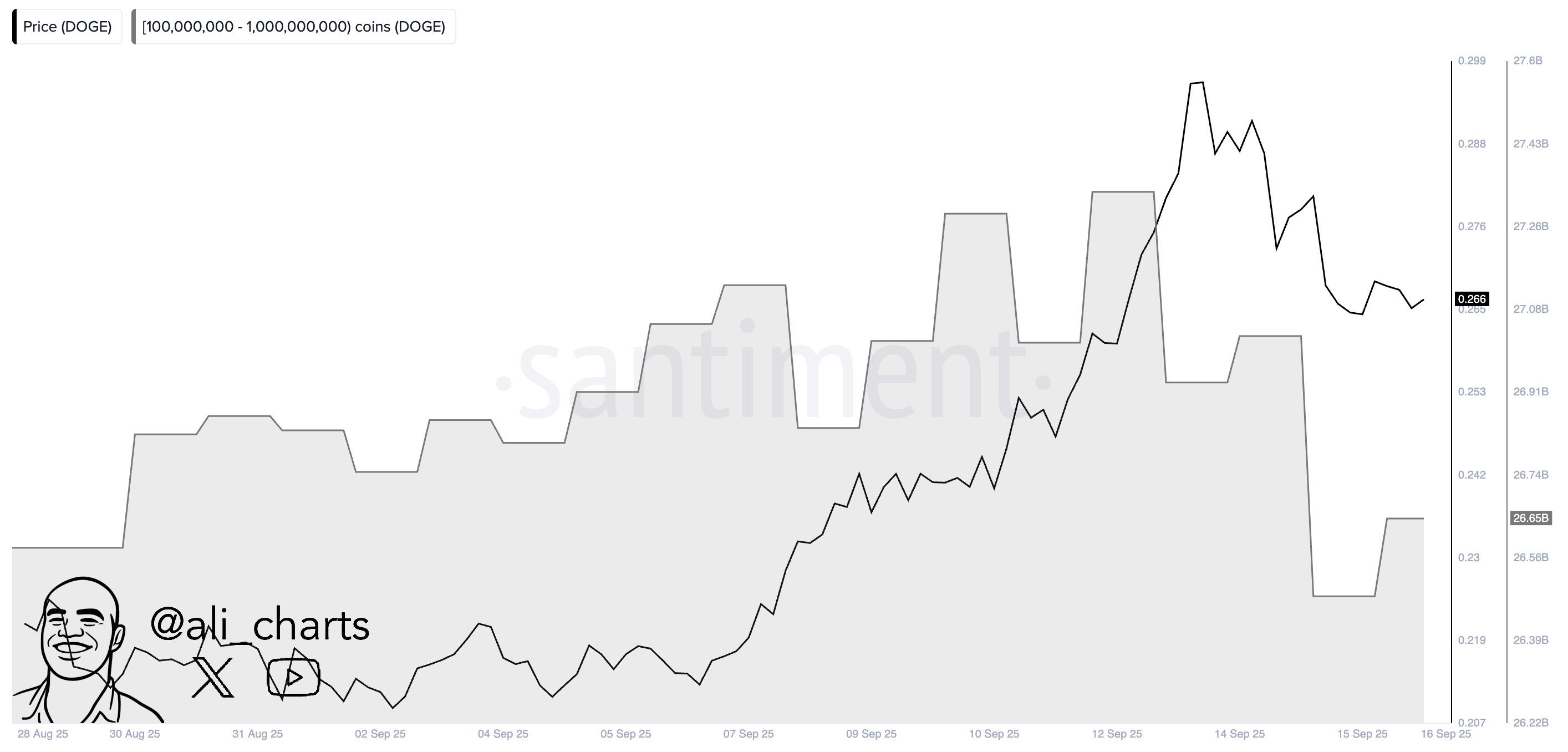

In a new post on X, analyst Ali Martinez has discussed about the latest trend in the Supply Distribution of the Dogecoin whales. The “Supply Distribution” here refers to an indicator from on-chain analytics firm Santiment that tells us about the total amount of the DOGE supply that a given wallet group is holding right now.

Investors or addresses are divided into these cohorts based on the number of coins that they are currently carrying. For example, a holder with 5 DOGE is put into the 1 to 10 tokens bracket.

In the context of the current topic, whales are the investors of interest. These entities are typically defined as those holding between 100 million to 1 billion DOGE. At the current exchange rate, the range’s lower end converts to $26.4 million, while the upper one to $264 million.

Thus, only the holders that have a substantial amount of capital invested into the memecoin would qualify for this group. As such, the behavior of the cohort in the form of its Supply Distribution trend can be worth keeping an eye on, as if nothing else, it can inform us about the sentiment among DOGE’s most influential investors.

Now, here is the chart shared by Martinez that shows how the Supply Distribution of the Dogecoin whales has changed over the last few weeks:

The value of the metric appears to have plunged in recent days | Source: @ali_charts on X

The value of the metric appears to have plunged in recent days | Source: @ali_charts on XAs displayed in the above graph, the Supply Distribution of this Dogecoin group has witnessed a sharp decline over the past few days, indicating that its members have participated in some net selling.

In total, the DOGE whales offloaded 680 million tokens (worth around $181 million) over a four-day span during this selloff. From the chart, it’s visible that the distribution began alongside DOGE’s recovery run to the $0.307 mark.

As whales have continued to sell, the memecoin’s price has plunged, currently sitting around 13% down compared to the earlier high. The trend in the indicator could now be to monitor in the coming days, as what these humongous investors do next could also have an impact on the cryptocurrency’s value.

Whales of Dogecoin aren’t the only ones that have participated in distribution recently. As the analyst has pointed out in another X post, XRP has also been facing selling pressure from its big-money investors.

The trend in the Supply Distribution of the XRP investors owning between 1 million and 10 million tokens | Source: @ali_charts on X

The trend in the Supply Distribution of the XRP investors owning between 1 million and 10 million tokens | Source: @ali_charts on XOver the last couple of weeks, XRP whales have shed 200 million tokens from their holdings, worth a total of $605.5 million at the current price.

DOGE Price

At the time of writing, Dogecoin is floating around $0.264, up 1.5% over the last 24 hours.

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Kass

Kass