Envest Global & CAPA Release Airline Sustainability Ratings

The second effort in the ongoing partnership covers 100 airlines, using 2021 data. The report places each carrier into a rating category based on 11 key metrics. The rating also accounts for how readily each carrier discloses its own...

Envest Global and the CAPA Centre for Aviation have introduced an airline sustainability rating system as part of the partners’ most recent airline sustainability report. The groups released the report, which now evaluates 100 airlines, up from 52 last year, on Nov. 21.

The Envest Global research team worked with publicly available emissions and airline operations data to create its sustainability metrics and compile the report, including in quarterly earnings reports, bi-annual and annual investor reports or sustainability reports published by individual carriers.

The Ratings

• PLATINUM (8) – Ranked in top 10 of 100 across a number of key metrics; full and transparent emissions data disclosure; mature offset and SAF programs

• GOLD (9) – Ranked in the top quartile across a number of key metrics; high level of emissions data disclosure; some SAF use and offsets

• SILVER (38) – Ranked outside the top quartile across a number of key metrics; variable emissions data disclosure; limited reported SAF use and offsets

• BRONZE (29) – Variable emissions disclosure; Covid-19 restriction challenges evident in recommencing operations; gov’t policy significantly impacting load factors and operational efficiencies; aircraft/network efficiencies compromised by decisions made regarding fleet during Covid

• BLUE (16) – Insufficient public disclosure and/or no reporting of emissions data or other sustainability data

The carriers were contacted to confirm the data in the cases where it was fully disclosed. In other cases, they were asked to fill in any missing data or asked to provide the fundamental data if the carrier did not disclose such information. Some carriers were prepared and willing to provide it when contacted. Many were not ready, according to Envest Global co-founder Johnny Thorsen, who is leading the effort to distribute the report to the corporate travel community.

“Only 12 airlines out of the 107 we reached out to actually provide a full disclosure of their sustainability efforts,” according to Thorsen.

“That was a big surprise because we thought more airlines would be sharing what they are doing,” he said. “Even when we reached out and asked if they wanted to give us the information that was missing, most of them said no.”

Thorsen speculated that these airlines likely did not have the data well documented or in a format they felt was credible to contribute, but one of the challenges he set forth for corporate buyers whose companies care about travel emissions is to begin pressing their preferred airlines to provide foundational sustainability data to help move the corporate travel industry forward when it comes to driving sustainability-based decision-making.

Having that data in a more public forum should lay the groundwork for a greener travel industry, according to Thorsen.

The Metrics

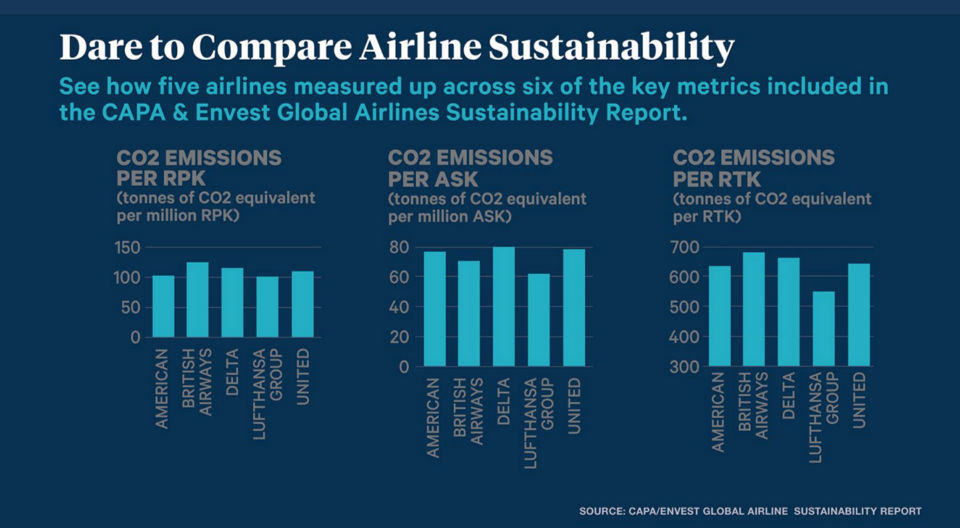

The researchers evaluated each carrier by 11 key performance indicators to create the ratings and sort the airlines accordingly. In addition to emissions data disclosure itself, which weighed heavily in the ratings, the report also covered passenger CO2 per revenue passenger kilometer, passenger CO2 per available seat kilometer, total CO2 per revenue tonne kilometer, net passenger CO2 per RPK, net passenger CO2 per ASK, net CO2 per RTK, along with load factor, fleet age, the use of sustainable aviation fuel—not investment in SAF, but actual usage—and purchased carbon offsets.

Each of the “net” metrics accounts for emissions reductions credited to SAF usage and carbon offsets.

Not every KPI was weighted equally in the final ratings formula, however. Data disclosure was key, as it spoke to the carrier’s credibility and commitment, said Thorsen. “Without the disclosure, the airline could not make it into the Platinum group,” he said. But other metrics were more malleable as Envest worked to find the right formula, and may also change in future reports as conditions and opportunities change for carriers.

“We originally thought load factor would be a critical one because the higher the load factor, the better this airline would be at getting people moved for a given amount of fuel,” said Thorsen. “But the reality of 2021 is that some airlines had limited control of load factors based on where in the world they were located and limitations or restrictions placed on their operations [due to Covid-19]. So load factor was demoted a bit.”

Another interesting factor was SAF usage. Only 20 airlines reported any SAF usage—and it was infinitesimal compared to traditional fuel. SAF usage was weighted neither under nor over average in the ratings calculations. But carbon offsets, which already pose a challenge due to the impossibility of evaluating the quality of the offsets, will get more complicated as time passes, said Thorsen.

“One airline has announced it will stop using carbon offsets entirely, after being one of the most aggressive offsetters,” said Thorsen, noting that offsetting is a strategy largely considered to kick the can down the road in that the carbon is emitted now, but the offsetting is delivered often over time—and is unlikely to catch up to current airlines emissions intensity. For that reason, some companies are moving away from them. “It doesn’t make sense for them to drop out of a top category because they are moving away from offsetting, so we already have some interesting dynamics coming out of this work.”

One of the big notes coming out of the report was the future sustainability outlook for airlines with older fleets and/or a large percentage of long-haul flights that traditionally fly with reduced load factors—both were major contributors to more intensive carbon emissions and could portend both metal investment and route or network strategies.

Different Strokes for Different Folks

Ultimately, said Thorsen, the Envest Global and CAPA team wants to build a procurement tool for travel buyers that will account for their own KPI priorities, potentially allowing them to weight the metrics for their own programs. That’s a few steps down the line—perhaps in a year’s time.

“We want to create a digital version of the index, but that obviously will require a very clean presentation of what is currently a pretty complex Excel file,” said Thorsen. “We’ll also need to account for the program in which the company flies on two airlines 50 percent of the time and the rest is spread across 40 airlines. What impact should that have?”

For now, Envest Global and CAPA are offering a pre-set ratings system that travel buyers can use as a starting place for emissions-based decision-making. “I’ve spoken to a few buyers and they were really positive about saying this was a tool they really needed,” said Thorsen.

He admits that most corporate travel buyers aren’t really at the point of making emissions-based decisions. “They come to conferences and talk about it, but when they get back to their offices, they may not be able to spend even five minutes on sustainability each week,” he said, but pointed out these may be the buyers who need the report the most. “They need simple tools and information presented clearly just to get started.”

ValVades

ValVades

.jpg)