Fibo Group Review 2024 with Rankings By Dumb Little Man

Fibo Group Review Forex brokers play a pivotal role in enabling individuals and businesses to trade in the foreign exchange market. They act as intermediaries between traders and the vast global financial market. Fibo Group, established in 1998, stands out as...

| |

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like: User Experience Profit Potential Reliability Broker Expertise Cost-effectivenessBy integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies Fibo Group as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

Fibo Group Review

Forex brokers play a pivotal role in enabling individuals and businesses to trade in the foreign exchange market. They act as intermediaries between traders and the vast global financial market. Fibo Group, established in 1998, stands out as a veteran in this arena, marking its presence as one of the first brokers to facilitate Forex trading.

This review is dedicated to giving you a comprehensive overview of Fibo Group, an international financial holding company renowned for its long-standing operation in the Forex market. Through an exhaustive evaluation, we aim to highlight the broker’s unique selling propositions as well as any potential drawbacks.

What is Fibo Group?

Fibo Group is recognized as a notable player in the global financial sector, functioning as an international financial holding company. Since its inception in 1998, the company has carved out a niche for itself as one of the trailblazers in the Forex market. This early entry into the market has positioned Fibo Group as a trusted name among traders and investors alike.

The company distinguishes itself by offering a comprehensive suite of services tailored for trading and investing. Fibo Group caters to a wide audience, from novice traders to seasoned investors, providing them with tools and resources to navigate the complex world of Forex trading. This broad range of services underscores the company’s commitment to meeting the diverse needs of its clientele.

Recognition and accolades have followed Fibo Group‘s commitment to excellence and innovation. The company was honored with the “Best ECN Broker” award at the Forex EXPO in 2014, highlighting its outstanding electronic communications network services. Furthermore, Fibo Group earned the title of “The Most Trusted Forex Broker 2014” at the International Investment and Finance Exhibition of China, cementing its reputation as a reliable and esteemed brokerage firm in the international financial community.

Safety and Security of Fibo Group

After thorough research conducted by Dumb Little Man, it’s clear that Fibo Group prioritizes the safety and security of its clients’ funds and personal information. The broker operates under the strict oversight of the British Virgin Islands Financial Services Commission (BVI FSC). This regulation by an internationally recognized authority signifies Fibo Group‘s commitment to upholding high standards of transparency and reliability.

One of the key safety measures implemented by Fibo Group is the use of segregated accounts, as mandated by regulatory requirements. This practice ensures that clients’ funds are kept separate from the company’s operational funds, providing an additional layer of security. The BVI FSC, known for its rigorous regulatory framework, sets forth strict guidelines for its licensees, thereby safeguarding traders’ investments.

Moreover, Fibo Group offers negative balance protection to its clients, a crucial feature that prevents traders from losing more money than they have deposited. In the event of disputes, the company also facilitates the settlement through an independent arbitrator. This approach to conflict resolution underscores Fibo Group‘s dedication to fair and transparent practices, ensuring that any issues are resolved impartially and efficiently.

Pros and Cons of Fibo Group

Pros

Extensive array of trading platforms, mobile versions included 24/7 technical support Over 60 currency pairs available for tradingCons

Early withdrawal fees from PAMM accounts Limited bonuses and promotional offers High minimum deposits, challenging for beginnersSign-Up Bonus of Fibo Group

As of the current time, Fibo Group does not offer a sign-up bonus for new clients. This information reflects the company’s approach towards promotions and special offers, which aligns with their fairly modest program in this area.

Minimum Deposit of Fibo Group

Fibo Group sets a notably accessible entry point for potential traders, with a minimum deposit amount starting from $1. This low threshold makes it easier for individuals of varying financial backgrounds to start trading. Despite the firm’s reputation for high minimum deposits in certain account types, this basic entry-level requirement demonstrates Fibo Group‘s commitment to inclusivity in the Forex market. Newcomers and experienced traders alike can take advantage of this minimal initial investment to explore the vast array of trading opportunities offered by Fibo Group.

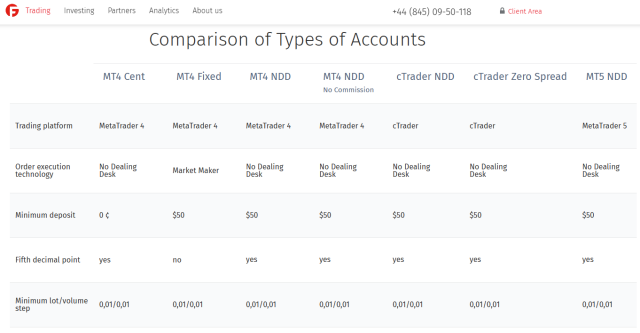

Fibo Group Account Types

Our team of experts at Dumb Little Man has conducted thorough research to provide a detailed list of account types offered by Fibo Group. Each account is designed to cater to the specific needs of different trader profiles, from beginners to seasoned professionals. Here’s what we found:

MT4 Cent: A cent account with no minimum deposit requirements, offering a maximum leverage of 1:1000 and spreads starting from 0.6 pips. This account is an excellent choice for beginners or those testing their trading systems. MT4 Fixed: Tailored for experienced traders who prefer classic trading conditions. This account features spreads from 2 pips, a minimum deposit of $50, and operates without commission. MT4 NDD: Designed for traders seeking direct interaction with liquidity providers, making it ideal for scalping. It comes with spreads starting from 0 pips, a minimum deposit of $50, and a commission of 0.003% of the transaction amount. MT4 NDD No Commission: Another excellent option for scalpers, distinguished by its lack of commission fees. Spreads begin at 0.8 pips with a minimum deposit requirement of $50. cTrader NDD: Specially intended for users of the cTrader platform and suitable for intraday trading. This account type offers spreads from 0 pips, a $50 minimum deposit, and a commission rate of 0.003% of the transaction amount. MT5 NDD: Best suited for professional traders who utilize scalping strategies, automated advisors, or trading signals. This account demands a minimum deposit of $1,000, features spreads from 0 pips, and a commission of 0.006% of the transaction amount.Each account type has been tested and verified by our experts, ensuring that traders can choose the option that best fits their trading style and goals.

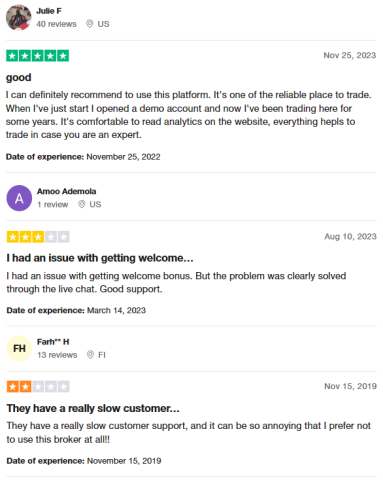

Fibo Group Customer Reviews

Customer feedback on Fibo Group reveals a mixed bag of experiences, with many praising the platform’s reliability and diverse trading options, while others highlight areas for improvement. Many users commend Fibo Group for its reliable trading platform, valuable analytics, and the inclusion of features like demo accounts and copy trading, which cater to both novices and experts. The availability of real stock trading is also noted as a significant advantage, offering investors the opportunity to buy and hold shares for the long term. On the support side, while some customers have had positive experiences resolving issues through live chat, others express frustration with slow customer support, to the point of preferring other brokers. This range of reviews underscores the importance of customer service in enhancing user satisfaction and trust in the trading platform.

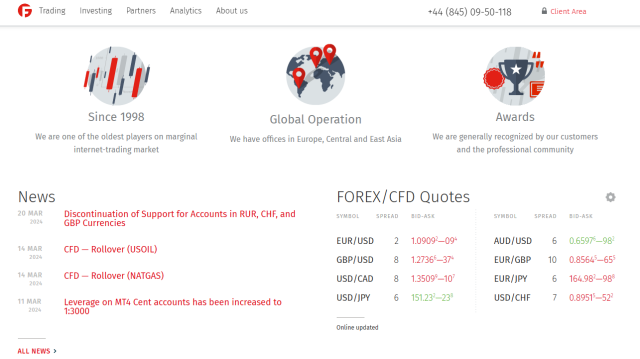

Fibo Group Fees, Spreads, and Commissions

In our comprehensive analysis of Fibo Group’s trading conditions, we focused on both explicit and potential hidden fees. It’s crucial to highlight that Fibo Group maintains transparency in its fee structure, with no hidden commissions identified. For traders considering account replenishment options, fees vary based on the chosen method. Using WebMoney incurs a 0.8% fee, while Skrill comes with a higher 3.9% charge. On a brighter note, deposits made through Connectum, RegularPay, Blockchain.com, BITPAY, Raidospare, and Neteller do not attract any commission fees, offering cost-effective alternatives.

Bank transfers for depositing funds into your trading account are subject to a commission that ranges from $35 to $50, depending on the bank initiating the transfer. Credit card deposits via YooMoney are charged at 2.35%. When it comes to withdrawing funds, traders can expect fees ranging from 0.8% to 4%, varying with the withdrawal method selected. Additionally, Fibo Group applies swaps, which are commissions charged for carrying an open trade to the next trading day. This comprehensive fee structure is vital for traders to consider when planning their trading strategy and financial management with Fibo Group.

Deposit and Withdrawal

A trading professional at Dumb Little Man tested the deposit and withdrawal processes of Fibo Group, providing crucial insights into their efficiency and flexibility. Fibo Group stands out for its ability to process withdrawals instantly upon receiving a client’s request, although the associated commission varies depending on the chosen method. Additionally, there are specific limits regarding the size and frequency of withdrawals, indicating structured financial management policies.

The company offers a wide array of 10 replenishment and withdrawal options, including bank transfer SWIFT, YooMoney, Connectum, RegularPay, Blockchain.com, BITPAY, Raidospare, WebMoney, Neteller, and Skrill. This diversity ensures that clients have the flexibility to choose the most convenient method for their transactions. When opting for electronic systems, funds are credited within minutes, providing an efficient means for traders to access their money. However, withdrawals through credit cards or SWIFT bank transfers may take up to 10 business days and 3-5 working days, respectively, to be processed.

Fibo Group supports transactions in multiple currencies, including USD, EUR, GBP, CHF, BTC, ETH, and RFC, catering to a global clientele with diverse financial preferences. Importantly, for withdrawals exceeding $1,000, the company mandates a verification procedure, ensuring security and compliance with financial regulations. This detailed examination of Fibo Group’s deposit and withdrawal processes underscores the broker’s commitment to providing a secure and user-friendly trading environment.

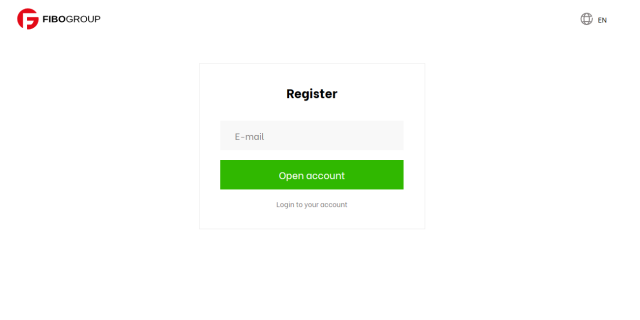

How to Open a Fibo Group Account

Visit the Fibo Group website. On the homepage, click the “Open Trading Account” button. Enter your phone number. Provide your last name and first name in English. Fill in your email address, which will serve as your login. Receive account access information via email. Go through the verification process recommended for new users. Log in to your personal account with the provided details. Before depositing, ensure you’ve completed all verification steps.Fibo Group Affiliate Program

The Fibo Group affiliate program offers a lucrative opportunity for traders and partners looking to diversify their income sources. Participants can earn a return from 1 pip, with commissions of up to 25% and 30% spread on each complete transaction. These earnings are contingent on the trading volume of the users they attract.

For those interested in the PAMM agent role, there’s a chance to secure 15% of the manager’s remuneration, providing a significant incentive for building a network of clients. The program is designed to reward affiliates for driving and expanding their customer base, offering them a pathway to additional income.

Importantly, affiliate rewards are credited daily, ensuring a steady flow of earnings. There are no restrictions on the settlement and payment of these rewards, making the Fibo Group’s affiliate program an attractive option for traders seeking to enhance their financial gains.

Fibo Group Customer Support

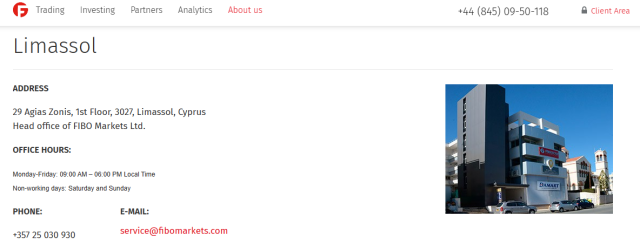

Based on the experience of Dumb Little Man with Fibo Group Customer Support, multiple channels are available for clients seeking assistance. Customers can reach out via phone numbers listed on the site, email, live chat on the broker’s website, or through a feedback form in their account. This variety ensures accessibility and convenience for users in need of support.

Customer support is accessible directly from the Fibo Group website as well as from within a user’s personal account, providing a seamless experience for addressing inquiries or issues. The team’s responsiveness and the availability of multiple contact methods underscore Fibo Group‘s commitment to delivering comprehensive support to its clients. This approach facilitates efficient communication and problem resolution, enhancing the overall user experience with Fibo Group Customer Support.

Advantages and Disadvantages of Fibo Group Customer Support

|

|

Fibo Group vs Other Brokers

#1. Fibo Group vs AvaTrade

Fibo Group and AvaTrade cater to different segments of the Forex and CFD trading market. AvaTrade stands out for its broad global reach, regulatory compliance across multiple jurisdictions, and a vast array of financial instruments. With over 300,000 registered customers and a strong emphasis on regulatory adherence, AvaTrade offers a robust trading platform, especially for traders who value a wide selection of instruments and global market access. Fibo Group, on the other hand, offers the advantage of low minimum deposits and a variety of account types catering to both beginners and experienced traders.

Verdict: AvaTrade might be better suited for traders looking for a globally recognized broker with a wide range of trading instruments. Its strong regulatory framework provides a secure trading environment. However, for those prioritizing low entry requirements and diverse account options, Fibo Group is an excellent choice.

#2. Fibo Group vs RoboForex

RoboForex shines with its extensive array of trading options, cutting-edge technology, and flexible trading conditions suitable for different trading styles and volumes. Its innovative approach, including contests on demo accounts and a wide selection of trading platforms, appeals to a tech-savvy audience. Fibo Group, with its straightforward trading conditions and emphasis on security and low minimum deposits, offers a contrasting approach that prioritizes ease of entry and a variety of trading experiences.

Verdict: For traders who value technology and a wide range of trading platforms, RoboForex stands out as the better choice. Its commitment to innovation and customizable trading conditions offers a dynamic trading experience. Fibo Group remains a strong contender for those seeking a user-friendly interface and lower financial barriers to entry.

#3. Fibo Group vs FXChoice

FXChoice focuses on serving experienced traders with a preference for active and passive trading strategies. Its commitment to quality services is evident in its selection of classic and professional ECN accounts, along with a licensing by the International Financial Services Commission of Belize (FSC). Fibo Group’s approach is more inclusive, offering low minimum deposits and a variety of account types to cater to a broader audience, including beginners.

Verdict: FXChoice is the preferred option for seasoned traders looking for advanced trading conditions and a focus on automated trading solutions. Its professional accounts and emphasis on tight market spreads cater to a more experienced clientele. Fibo Group, with its accessible entry points and diverse account options, is ideal for traders at different levels of experience, especially those just starting out.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you are looking to establish a successful career in forex trading and aim for substantial financial gains, Asia Forex Mentor is the ideal choice for the top forex, stock, and crypto trading course. Led by Ezekiel Chew, a visionary in the trading industry, Asia Forex Mentor stands out for its comprehensive educational program covering various markets. Ezekiel’s track record of achieving seven-figure trades distinguishes him as an exceptional educator.

Here are the compelling reasons why Asia Forex Mentor is our top recommendation:

Comprehensive Curriculum: The educational program offered by Asia Forex Mentor covers stock, crypto, and forex trading, providing aspiring traders with a well-rounded understanding of these markets. Proven Track Record: With a history of producing consistently profitable traders across different market sectors, Asia Forex Mentor demonstrates the effectiveness of its training methodologies. Expert Mentorship: Students benefit from the guidance of Ezekiel Chew, an experienced mentor renowned for his success in stock, crypto, and forex trading. His personalized support helps students navigate the complexities of trading with confidence. Supportive Community: Joining Asia Forex Mentor grants access to a supportive community of traders pursuing success in various markets. Collaboration and idea-sharing enhance the learning experience. Emphasis on Discipline and Psychology: Asia Forex Mentor emphasizes the importance of a strong mindset and disciplined approach to trading. Psychological training helps traders manage emotions and make rational decisions. Constant Updates and Resources: Continuous access to the latest trends, strategies, and market insights ensures that students stay ahead of the curve in dynamic financial markets. Success Stories: Asia Forex Mentor boasts numerous success stories where students have achieved financial independence through its comprehensive trading education.In conclusion, Asia Forex Mentor is the premier choice for those seeking the best forex, stock, and crypto trading course. With its comprehensive curriculum, expert mentorship, supportive community, and emphasis on discipline and psychology, Asia Forex Mentor equips aspiring traders with the tools and guidance needed to succeed across diverse financial markets.

Conclusion: Fibo Group Review

In conclusion, after a thorough review conducted by our team of trading experts at Dumb Little Man, Fibo Group emerges as a solid option for both beginner and experienced traders alike. The broker’s diverse range of account types and accessible minimum deposit requirements make it an attractive choice for those entering the world of Forex trading. However, it’s essential to note that while Fibo Group offers competitive features such as a wide range of trading platforms and multilingual support, it also has its drawbacks, including penalties for early withdrawals and limited promotional offerings. Traders should weigh these factors carefully before making their decision.

Despite its drawbacks, Fibo Group boasts several advantages, including a user-friendly interface, comprehensive educational resources, and a variety of trading instruments. The broker’s commitment to regulatory compliance and security also instills confidence in traders seeking a reliable brokerage service. Nevertheless, potential clients should be aware of Fibo Group’s limitations, such as its slower customer support response times and potential fees associated with certain withdrawal methods. Overall, while Fibo Group offers a range of benefits for traders, it’s crucial for individuals to conduct thorough research and consider their specific trading needs before committing to this broker.

>> Also Read: Admiral Markets Review 2024 with Rankings By Dumb Little Man

Fibo Group Review FAQs

Is Fibo Group suitable for beginners in Forex trading?

Yes, Fibo Group offers a variety of account types, including cent accounts with low minimum deposits, making it accessible for beginners. Additionally, the broker provides educational resources and demo accounts to help new traders learn the ropes before committing real funds.

How does Fibo Group ensure the security of traders’ funds?

Fibo Group prioritizes the safety of traders’ funds by employing stringent security measures. The broker is regulated by reputable authorities, and client funds are kept in segregated accounts to ensure they are separate from the company’s operational funds. This setup provides an extra layer of protection for traders’ investments.

What customer support options does Fibo Group offer?

Fibo Group provides multiple channels for customer support, including phone support, email, live chat on their website, and a feedback form within the personal account. Traders can reach out to the support team for assistance with account-related queries, technical issues, or general inquiries, enhancing the overall trading experience.

KickT

KickT