FTSE 100, DAX 40, and S&P 500 Show Strength Before FOMC Decision

FTSE 100 Sees Slight Pullback After Recent Highs The FTSE 100 experienced a slight pause in its upward trajectory after reaching a ten-month high of 7,786 last week. The index dipped to a low of 7,694 on Tuesday but...

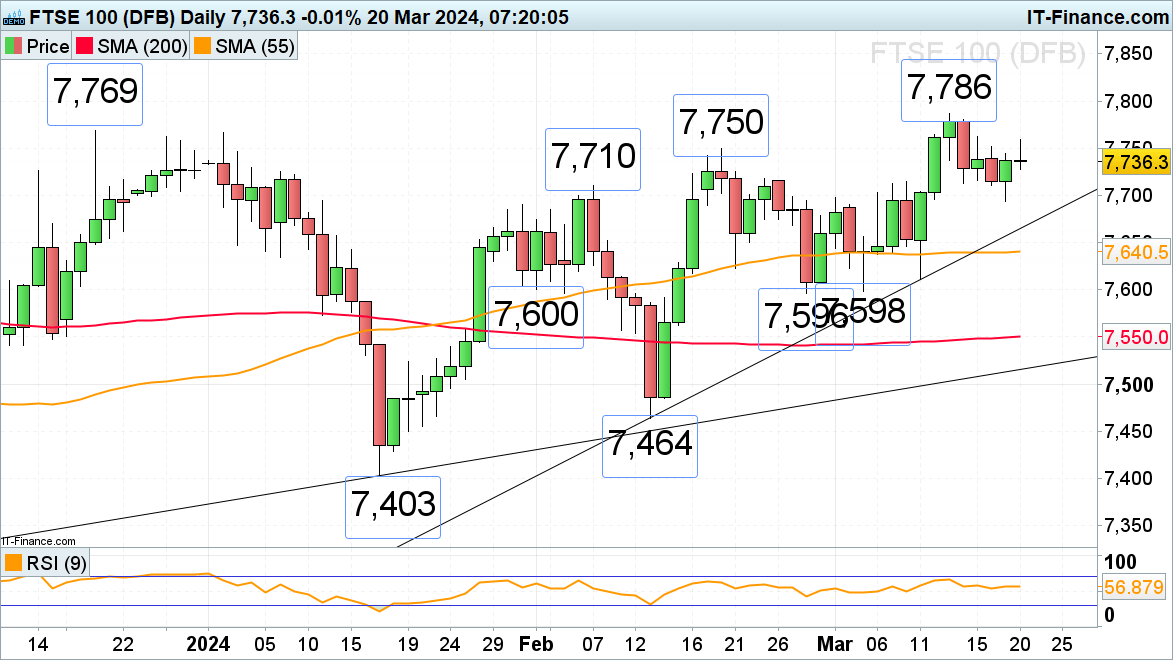

FTSE 100 Sees Slight Pullback After Recent Highs

The FTSE 100 experienced a slight pause in its upward trajectory after reaching a ten-month high of 7,786 last week. The index dipped to a low of 7,694 on Tuesday but soon found support from the energy sector, propelled by rising oil prices. This boost comes as investors await the Bank of England’s monetary policy announcement on Thursday.

A resistance zone is evident between 7,747 and 7,769, corresponding to the highs from September to December, just below the recent peak at 7,786. Support levels are identifiable above the 7,694 mark, specifically at last week’s low of 7,713 and the highs from October and early February, ranging between 7,710 and 7,702.

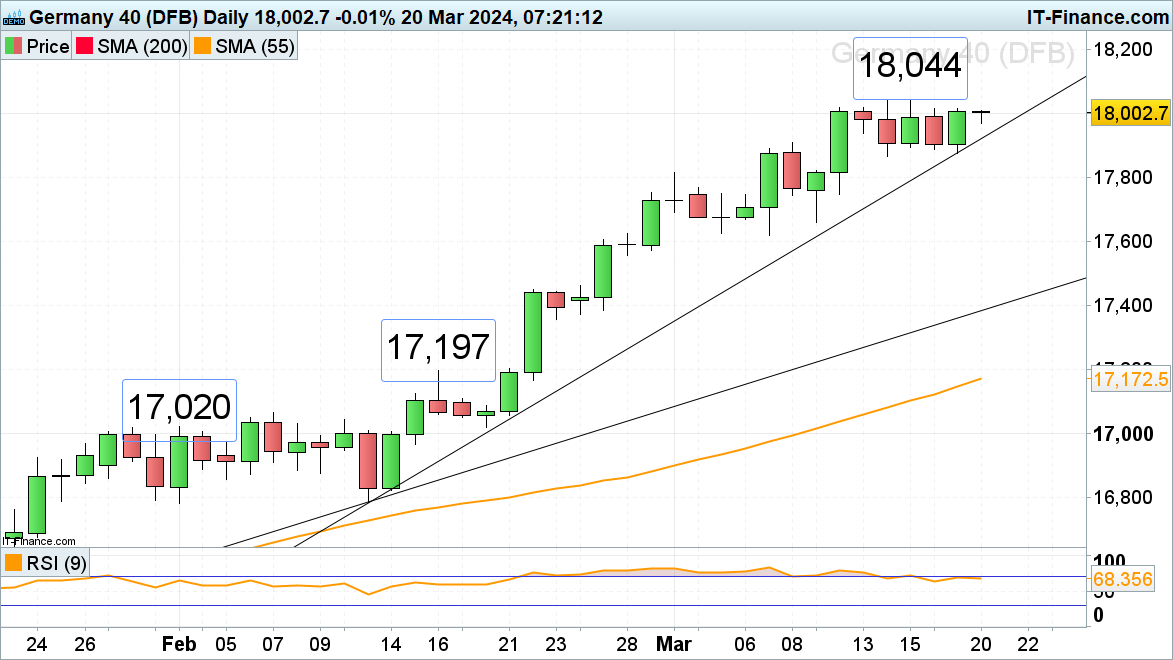

DAX 40 Eyes New Record Highs

The DAX 40 is poised to reach new record heights, targeting the 18,050 point mark in anticipation of the Federal Open Market Committee (FOMC) meeting on Wednesday. This optimism is driven by the investment in undervalued German firms, amid hopes for the nation’s economic recovery.

The next significant milestone lies around the 18,200 point area, while the uptrend from February to March, marked at 17,920, provides a strong foundation. This is further supported by the recent low at 17,865.

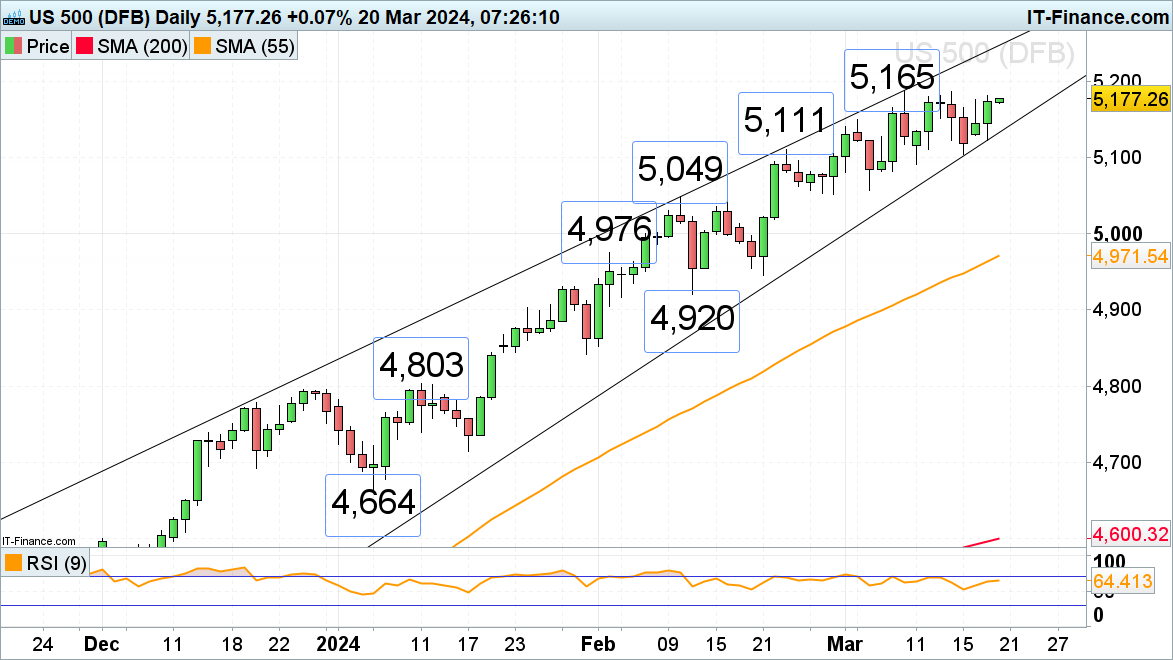

S&P 500 Targets Record Highs Once More

The S&P 500 remains in the vicinity of 5,150 points, aiming to surpass record levels once again before the FOMC meeting on Wednesday. The market is closely watching the 5,200 point level as a key psychological target.

Support for the index is reinforced by the uptrend line stretching from October to March, situated at 5,132 points.

MikeTyes

MikeTyes