GBTA: Travel Buyers Cite ’24 Growth, Optimism for ‘25

A Global Business Travel Association survey indicates global business travel growth in 2024, with further expansion expected in 2025; however, budget concerns, rising costs, and sustainability are key issues, with differences in regional outlooks and strategic priorities.

A Global Business Travel Association survey of 408 travel managers and 368 suppliers and intermediary representatives documented business travel growth in 2024 and projected additional spend and volume expansion going into 2025.

The survey, conducted in January, found that 48 percent of travel buyer respondents expected their organizations to travel more in 2025 than they did in 2024. And 57 percent expected to spend more on business travel in 2025, even if a slice of that percentage didn’t expect employees would take more trips. More than 70 percent of respondents said their companies traveled more in 2024 than they did in 2023.

Those sequential gains were prevalent across all geographies and all program sizes, according to the GBTA survey. In North America, Latin America and Asia-Pacific, three-quarters of respondents (and slightly higher in Latin America and Asia-Pac) said their travel volumes had increased in 2024. Only Europe lagged the trend, with 64 percent increasing trip volume in 2024 compared to 2023.

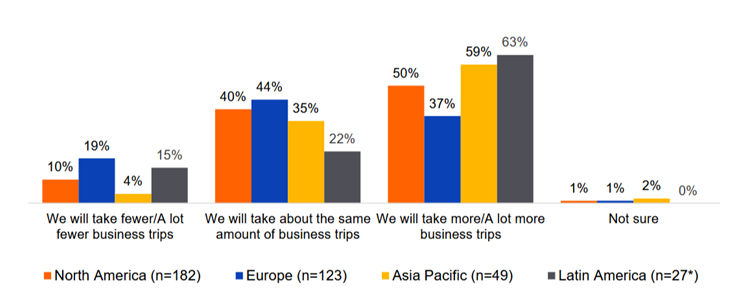

European was notable, again, for its outlook on 2025. Only 37 percent of European buyers said their companies would travel more this year compared to last. The region’s focus on carbon emissions may come into play for these expectations. Among North American travel managers, 59 percent said their organizations would “more” or “a lot more” trips in 2025. That was fewer than in Asia-Pacific and Latin America, where 59 percent and 63 percent of travel managers, respectively, expected company employees to take “more” or “a lot more” trips this year.

_____________________________________________________________________

How Travel Volume Will Change in 2025

(per region)

Credit: Global Business Travel Association, January 2025 Survey

Credit: Global Business Travel Association, January 2025 Survey_____________________________________________________________________

Revenue generating sales travel will lead in terms of trip purpose in 2025. That’s fairly closely followed, however, by travel associated with internal meetings, which survey respondents on average said would account for 21 percent of travel volume this year. External conferences and exhibitions followed at 14 percent, while training and supplier meetings fell lower companies’ priorities for travel.

Pricing and budget concerns top the list of issues faced by travel buyers and managers in 2025. Eighty-one percent of travel buyers listed the rising cost of travel as a significant issue for this year, and half of respondents expected their budgets may not handle the pricing pressure. Bigger picture economic concerns and geo-political friction were on the minds of 49 percent and 44 percent of buyers respectively. That topped the number of buyers who had heightened concerns about travel disruptions, which is notable. Just 37 percent of travel buyers listed that as a critical issue going into 2025. Only a third listed tech advancements and artificial intelligence as top-of-mind in their programs.

Buyer concerns in that sense were quite different from suppliers and travel management company reps who participated in the survey. Just over half of suppliers and TMC reps listed travel costs as a top concern. Suppliers were more concerned about the overall economic picture, with 55 percent noting uncertainty. Forty-seven percent had their minds on AI, showing suppliers much more engaged with tech changes than buyers this year.

That may be due to the idea that many buyers rely on their TMCs to outfit them with the proper technology to run a travel program. With that in mind, 30 percent of travel managers surveyed said they were going out to bid for a new TMC this year—and many of them reported the initiative was precipitated by deficient tech or lack of access to New Distribution Capability content or support. Seventeen percent of respondents said they were already implementing a new TMC partner. That makes 47 percent either implementing or evaluating a new TMC—that’s a huge shift.

Forty-one percent said they would be evaluating and possibly changing payment solutions (much of this was concentrated in Europe and Asia-Pacific). Thirty-one percent said they would be evaluating new booking tools, while 20 percent said they would be evaluating or changing their expense tool. Asia-Pacific-based buyers led the pack on several key initiatives, like willingness to integrate AI or other significant technology into travel management practices. Asia-Pac also led the way in plans to implement sustainability practices in 2025. North America was last on sustainability plans.

JaneWalter

JaneWalter

.jpg&h=630&w=1200&q=100&v=90ed771b68&c=1)