Greed Rising, Chainlink Stalling: Will LINK Smash Past $20 And Race To $36.5?

Chainlink’s token, LINK, has barely budged this month. It sits in 13th place by market cap after picking up just 3.8% since May 1. Its price hovers under $12 at times, though some reports put it near $16 when...

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Chainlink’s token, LINK, has barely budged this month. It sits in 13th place by market cap after picking up just 3.8% since May 1. Its price hovers under $12 at times, though some reports put it near $16 when markets last ticked. That mixed picture raises questions about whether LINK can keep its spot.

Cross-Chain Push Comes To Solana

According to published updates, Chainlink rolled out its Cross-Chain Interoperability Protocol on Solana on May 19, 2025. This feature aims to let developers tap into over $18 billion in assets across chains.

The upgrade is meant to help Solana’s DeFi world link up with Ethereum, Polygon, Avalanche and others. It shows Chainlink’s team isn’t waiting around for the price to climb.

⬡ Chainlink Adoption Update ⬡

There were 16 integrations of the Chainlink standard across 6 services and 16 different chains: Arbitrum, Avalanche, Base, Bitlayer, BNB Chain, Celo, Ethereum, opBNB, Optimism, Polygon, Ronin, Rootstock, Scroll, Solana, Sonic, and ZKsync.

New… pic.twitter.com/j3cnAnc3UC

— Chainlink (@chainlink) May 25, 2025

New Integrations Add Momentum

Based on reports from the Chainlink team, there have been 16 fresh integrations of its standards. Those span six service types and include support on Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Polygon, Solana and ZKsync.

Developer activity is on the rise. But that growth hasn’t sparked big moves in the LINK market yet. A $10.4 billion market cap still feels sturdy. Yet the token’s flat performance puts pressure on its ranking.

Resistance Zones Shape Outlook

Traders eye key hurdles on the LINK/USDT chart. First up is a wall at $20, a level where sellers have stepped in before. A push past that could send LINK toward a $25–$26 area. Beyond lies a mid-term target of $28–$30, matching late-2024 highs.

Volume spikes in April did trigger a 14% climb, pointing to possible repeat action. But bears still have a say. The MACD line sits under its trigger line, though the gap is narrow. Histogram bars are flat, hinting that selling force might be fading. A crossover could spark fresh buying.

$LINK‘s downtrend channel is about to break out.

This rise is likely to proceed smoothly to the $36.5 level, where there is a selling wall. pic.twitter.com/CaN2agtchk

— CW (@CW8900) May 26, 2025

Breakout Signs

Meanwhile, LINK is showing signs of breaking out of its downtrend channel, sparking bullish momentum among traders. Analysts note that a clean breakout could push LINK toward the $36.5 level, where a major selling wall sits.

The move follows increased developer activity and Chainlink’s CCIP launch on Solana. If buyers hold momentum, LINK may rally smoothly—but the $36.5 resistance could test the strength of this breakout.

LINK price forecast. Source: CoinCodex

LINK price forecast. Source: CoinCodexFlat Forecasts Keep Hopes Modest

Technical indicators are mixed. LINK’s one-month forecast shows a 0.61% gain by June 26, 2025, landing it around $15.64. That outlook comes with a “Neutral” reading on market sentiment.

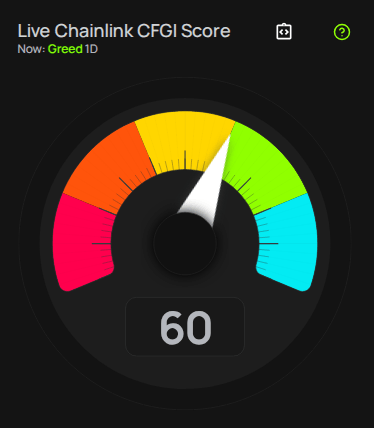

The Fear & Greed Index sits at 60, a sign of Greed. In the past 30 days, LINK had 12 green days out of 30 and saw 6.40% volatility. All that points to modest moves rather than wild swings.

What Comes Next For LINK

Chainlink’s core goal remains the same: power a decentralized oracle network that feeds real-world data into blockchains. Those efforts matter for projects that need price feeds, random numbers or cross-chain messages.

If a big DeFi protocol adopts CCIP or a major hack bounty gets paid out, LINK could see fresh demand. Until then, the token may drift. Watch the price near $11 and $20.

Featured image from Unsplash, chart from TradingView

Tekef

Tekef