“More than a woman’s issue”: Experts weigh in on challenges faced by S’pore’s female founders

From the valley of death to gender issues, we spoke to experts to learn more about unique challenges faced by female founders in Singapore.

Earlier in July, we did a deep dive into the startup scene in Singapore, where we interviewed four experts on whether the country lacks capable founders.

While we have determined this was not the case, one of our readers pointed out that only male voices were represented in the article. As such, we have reached out to two ladies active in the startup space in Singapore, either as venture capitalists or startup founders.

Well, it just so happened that our experts, Yuying Deng, CEO and founder of Esevel, and Anna Vanessa Haotanto, founder of Zora Health, have experience in both sectors; here are their insights.

“A capable founder is a generalist.”

Following the previous article, Yuying and Anna agree that beyond tangible metrics like revenue and user growth, being versatile in different areas and adapting to different approaches when needed are two key traits of “capable” founders.

Anna added that a capable founder must also create a strong company culture, build and lead a team, and sustain the company’s vision through difficult times. “To me, you need to always remember your values and vision and not waver when times get difficult.”

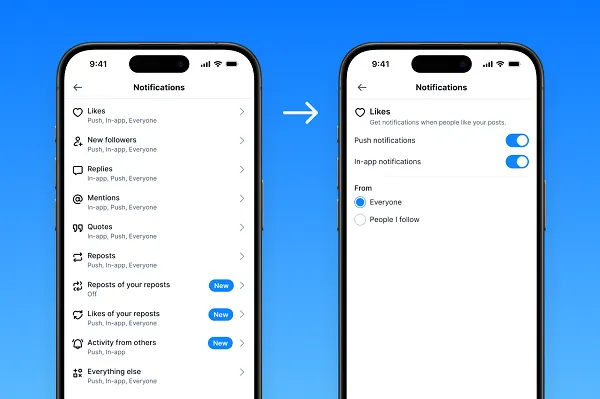

But one might wonder, what does it truly mean to be versatile? To Yuying, it is to master a paradox of qualities that “seem like opposites”.

Yuying’s examples on qualities that “seem like opposites”/ Graphic Credit: Vulcan Post

Yuying’s examples on qualities that “seem like opposites”/ Graphic Credit: Vulcan PostShe emphasised the need for entrepreneurs to listen, take feedback seriously, and take accountability for their mistakes. “The best entrepreneurs know they don’t have all the answers and are open to learning from others.”

Navigating the valley of death

Qualities aside, we need to acknowledge that the current economic environment has not made it easy for startups in Singapore to grow.

Due to inflation, many companies have become more conservative when managing their finances. Some choose to hire fewer employees, offshore operations to “less expensive” locations in the Southeast Asian region, or go fully remote.

Yuying highlighted that funding has “dried up” compared to the boom of 2021 and earlier years, inevitably increasing the pressure on startups to find their market fit in a shorter timeframe, which can be incredibly stressful.

“Companies that raised funds at high valuations in 2021 or before are now struggling to generate the revenue needed to justify those valuations. This puts them in a tough spot as they try to scale and grow in a more cautious market,” added Yuying.

On the other hand, Anna believes that while funding is available, the real challenge lies in securing “the right type” of capital.

She explained that investors have become increasingly cautious, which results in more stringent due diligence processes and higher expectations for startups to demonstrate traction and scalability.

“Finding and retaining top talent is a persistent challenge, especially in a competitive market like Singapore. Entrepreneurs often struggle to attract skilled professionals who are both affordable and aligned with the startup’s vision,” Anna elaborated.

Gender equality in the entrepreneurship scene

Aside from defining the characteristics of a capable founder, we are also curious whether gender plays a part in growing their business (spoiler alert: it does).

Thanks to social media, more women have come forward to “dismantle gender inequality and the structures that uphold it”. While women have been able to access opportunities with their male counterparts, there is still much more to be done.

Both experts agreed that there is a funding gap for women-run enterprises. According to Yuying, female founders receive less than 3 per cent of venture capital funding that male entrepreneurs typically secure.

She added that on top of the societal pressure for women to be business leaders and primary caregivers, many women internalise the same burden, leading to feeling burnt out—an experience that men might not have in the same vein.

In her previous interview with Vulcan Post, Anna shared that it took her 158 pitches to reach her target fundraising goal, where she brought up the occurrence of gender issues.

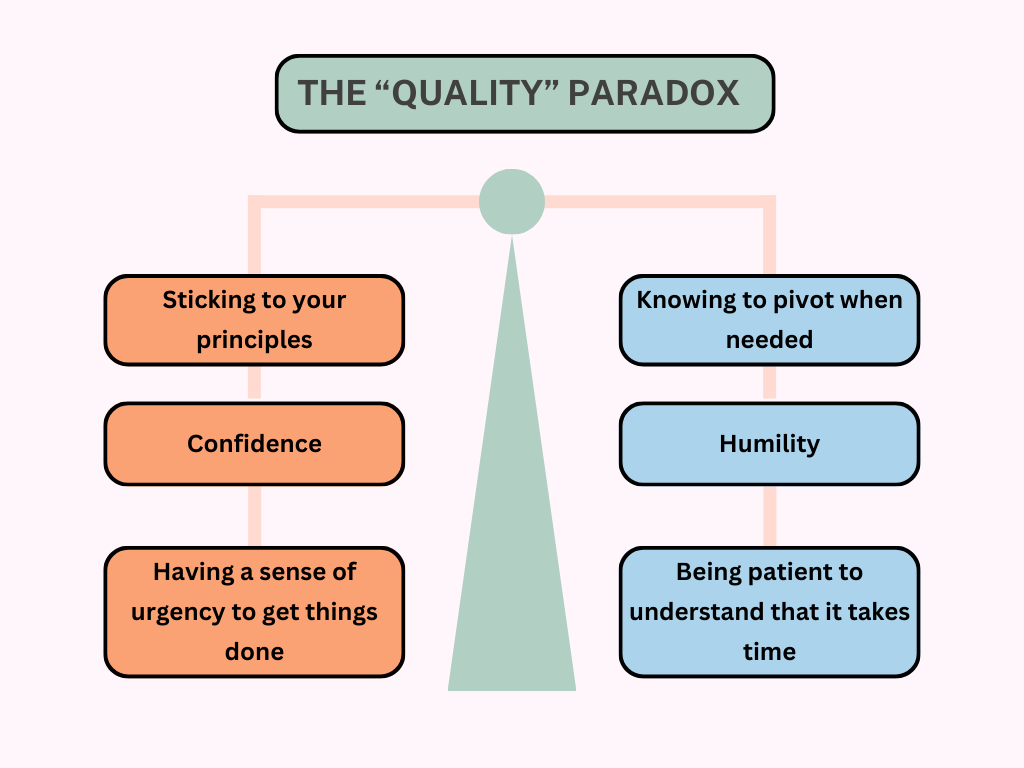

According to a study conducted by Harvard Business Review, women are more frequently asked defensive questions during pitches, interviews, and public forums, while men are asked more winning questions.

Examples of defensive and winning questions / Graphic credit: Vulcan Post

Examples of defensive and winning questions / Graphic credit: Vulcan PostIn essence, defensive questions implicitly assume their business is more vulnerable and require them to justify or defend their strategy and choices while winning questions assume the business will be successful and encourage the founder to highlight their vision and ambition.

The study also showed that the type of questions asked also has an impact on the amount of funding raised, with those being asked defensive questions only being able to raise an average of US$2.3 million in aggregate funds—seven times less than the US$16.8 million average raised by those asked winning questions.

This disparity means that women must work harder to shift the narrative from a defensive stance and pivot the responses to emphasise strengths and opportunities.

I think many women reach a point where they realise they have to be five times as good to get the same recognition as their male counterparts. But the good news is that most women are ten times as good, if not better.

So rather than getting stuck on the inequalities, I’ve found it more empowering to keep pushing forward, staying focused on what I can change, and proving what I’m capable of.

Yuying Deng, CEO and co-founder of EssevelThat said, Anna quickly clarified that the challenges she encountered during the fundraising process were not gender-focused. Instead, there was a lack of understanding and education about the specific issues her company aimed to address: women’s health.

[Fertility and women’s health] are not easy or common topics, which sometimes led to misunderstandings or underestimations of the market opportunity. The key was to educate potential investors about the importance and impact of women’s health, particularly in areas like fertility, where the need is significant but often overlooked.

I believe that increasing awareness and understanding of these critical issues is essential for driving not only investment but also broader support and recognition of the value that companies like Zora Health bring to the market.

Anna Vanessa Haotanto, co-founder of Zora HealthGranting more access to resources

While there has been an increase in funding for female entrepreneurs, both Yuying and Anna believe that there’s room for improvement.

Yuying explained that while it is a great idea in practice, she has not seen many who have received these financial resources. “This suggests that while the intention is there, the accessibility of these funds might be lacking.”

It is also vital to create more funding opportunities and ensure that it can reach female entrepreneurs who could benefit from them. On top of that, giving them access to networks, mentorship, and training can help them leverage these funds effectively.

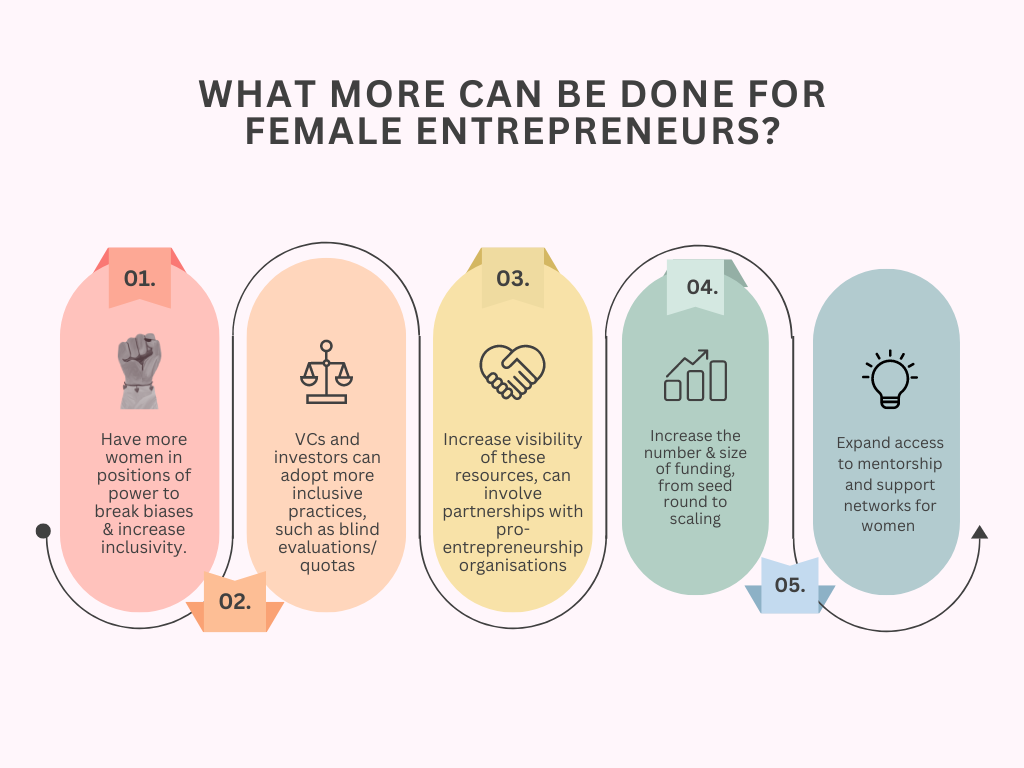

Anna’s thoughts on what more can be done for female entrepreneurs / Graphic credit: Vulcan Post

Anna’s thoughts on what more can be done for female entrepreneurs / Graphic credit: Vulcan Post Yuying added that this is more than just a women’s issue—by overlooking female entrepreneurs’ contributions, we’re ignoring the potential of half of the world’s population.

“Imagine the innovations, businesses, and solutions we’re missing out on by not fully supporting women in their entrepreneurial journeys,” she added.

Beyond closing the gender gap, Anna believes that all entrepreneurs, regardless of gender, are assessed on the strength of their ideas, execution, and the impact they can create.

Ultimately, the definition of capability remains the same across both genders. However, the number of hurdles they face is different.

We’re not saying that one has it worse than the other—instead, we need to acknowledge that granting accessibility to resources to those in need can help boost the growth of our local startups.

ANEXT Bank, a Singapore-based digital bank regulated by MAS, empowers startups with easy and accessible financing to fuel their business growth and expansion.

Read more stories about Singaporean startups here.

Featured Image Credits: Yuying Deng via LinkedIn, Zora Health

Lynk

Lynk