Morgan Stanley: In 2030, the average S’porean household may be richer by S$1.2M. Here’s how.

Disclaimer: Unless otherwise stated, any opinions expressed below belong solely to the author. Morgan Stanley's findings and forecasts reported below should not be treated as financial advice. Investment banking giant Morgan Stanley has just given Singapore a huge vote...

Disclaimer: Unless otherwise stated, any opinions expressed below belong solely to the author. Morgan Stanley’s findings and forecasts reported below should not be treated as financial advice.

Investment banking giant Morgan Stanley has just given Singapore a huge vote of confidence, publishing a very positive forecast for the city’s investment scene over the next five years and predictions on how it is going to impact not only the country’s economy and international standing, but also the lives of regular Singaporeans.

In a post published yesterday (July 9) by its research arm, titled “Singapore’s Next Chapter,” the bank’s analysts described the investing boom that the country is about to experience:

Net household assets are expected to jump by as much as 70%, from S$3 trillion to S$5.1 trillion by 2030 Singapore’s MSCI stock index, measuring the large- and mid-cap companies listed in the city, could double in the next five years The net worth of the average household is predicted to rise to S$3.2 million, up from ca. S$2 million currently.But what’s so special about this period? Well, the strong outlook is reportedly based on three pillars: Singapore’s growing hub status, the government’s support of the domestic stock market and early adoption of technology.

The hub of Asia

Image Credit: aileenchik/ Shutterstock.com

Image Credit: aileenchik/ Shutterstock.comSingapore is already known as a hub for business, logistics, and trade, but its significance is only expected to grow even further.

Morgan Stanley highlighted the city-state’s role in finance, as well as in commodities, where it “already accounts for 20% of the world’s energy and metals trade, [and] could develop itself into a leading hub for liquid natural gas and carbon trading,” transportation and tourism, and even tech infrastructure.

On that last point, the bank’s analysts said that “the country is heavily investing in technology infrastructure to become a data and AI inference hub. Singapore, Malaysia and Japan are likely to get a majority of the tech sector’s US$100 billion in investments in Asia data centres and GenAI this decade.”

In addition, we should remember that the international tensions amid competition between the US, China, Europe and other countries make Singapore a welcome neutral ground on which to meet and to invest, with the city bridging the divide between the West and the Far East.

MAS reinforces the stock market

In February, the Monetary Authority of Singapore announced the Equity Market Development Programme, a S$5 billion injection into the domestic stock market, coupled with tax incentives (like a 20% corporate tax rebate for primary listings) to boost activity on SGX and encourage more companies to choose Singapore for their IPOs.

The money will start being deployed from the second half of this year to boost trading activity and attract more investors to actively take part in Singapore’s stock market.

The Straits Times Index has already had a very good year, hitting new records in 2025 following a rally of nearly 30% the past year, and Morgan Stanley predicts the optimism to continue through 2030 (barring extraordinary events, of course).

AI & robotics

Finally, MS researchers see Singapore’s keenness to adopt new technologies early as the final driver of its rapid growth, especially as we’re still in the middle of an AI revolution:

The country already ranks among the top 10 AI markets worldwide and is home to more than 80 AI research faculties, 150 AI R&D and product teams, and more than 1,000 AI start-ups. AI, humanoids and autonomous vehicles are likely to lead to wealth creation through productivity gains, higher company valuations and IPOs.

An excerpt from the Morgan Stanley reportThis is probably the least predictable pillar of the three, given the uncertainty surrounding the net benefits of AI deployment vs. the costs required, which continue to balloon amid global competition for the most advanced chips.

Nevertheless, in line with its hub status, Singapore is bound to be one of the places where advanced data centres will continue to be deployed, giving the city a significant slice of the AI pie, whether or not local companies will develop and sell intelligent products and services to end customers.

The wave that lifts all boats

That’s all very well, I’m sure you must be thinking, but what does it have to do with regular Singaporeans? What exactly is their share in the fruits of this anticipated investment boom?

As I mentioned, the average net worth of a Singapore household is expected to increase by a whopping S$1.2 million, or about 60%, in just five years. It’s not just how much more local households will own, but the difference in their assets over their liabilities.

In other words, Singaporeans will get considerably richer (even if some of this wealth is not cash, of course).

Naturally, since it’s an “average,” it means that there will be those who are going to make a lot more than others. Not everybody is about to become a millionaire, especially if they haven’t invested their money wisely before.

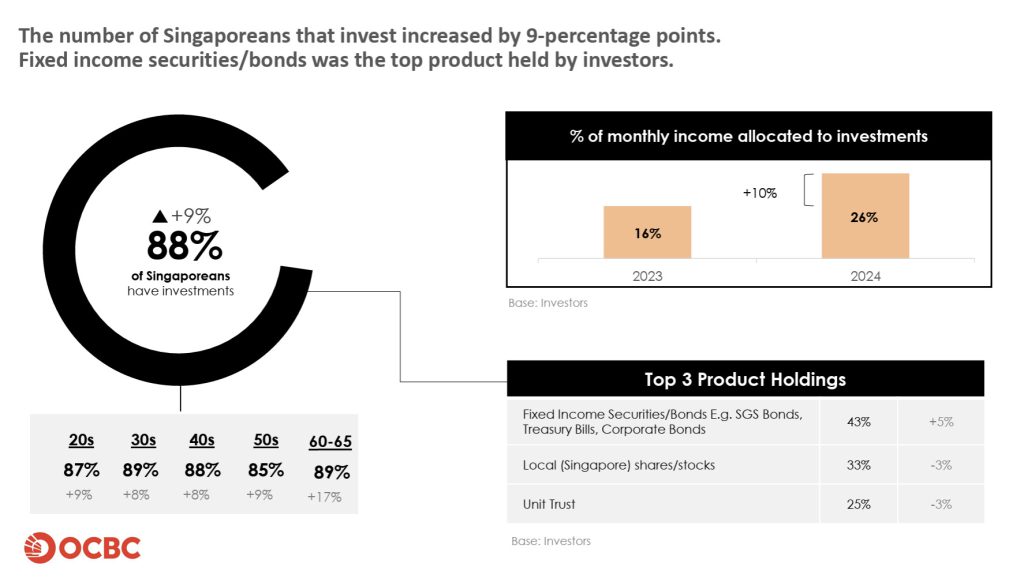

That said, according to OCBC’s Financial Wellness Index, Singaporeans set aside as much as a quarter of their income for investments, which 88% have some exposure to, and a third holding local stocks.

Other surveys have also estimated that about half of Singaporeans have some exposure to the stock market, whether through direct stock ownership or unit trusts.

Beyond individual portfolios, all Singaporeans benefit from greater returns on the investment of domestic reserves under management by Temasek, which contributes to annual NIRC (net investment returns contribution) and makes its way to the national budget.

Virtually everybody has a share in the real estate market as well. Even if it’s only through HDB, the appreciation of housing helps to erode the relative burden of any mortgages you have to pay off, increasing your net worth as a result.

That’s why, in one way or another, practically every Singaporean is going to benefit, with the share of these future returns reflecting their share of the assets.

But with a potential 60 or 70% ROI, most people should be quite happy—as long as researchers at Morgan Stanley are right in their predictions.

Read other articles we’ve written on Singapore’s current affairs here.Featured Image Credit: Google Street View

JaneWalter

JaneWalter