Most M’sians don’t know how to invest, so she created an app that aims to change that

Vespid is an app that aims to promote financial literacy by offering a simple "practice investing" platform for Malaysians.

Majoring in Economics with a minor in Statistics, Kuching-born Edrea Lee had graduated from the University of Michigan, Ann Arbor during pandemic times in 2020. Despite the uncertain job market, she landed a role in Deloitte in the US.

However, a year later, she was informed that she was not selected in the H1B permanent work visa’s lottery selection process.

Returning to Malaysia, Edrea joined Accenture Malaysia as a strategy analyst. Yet, two years in, she decided to pursue a Master of Science in Business Analytics at Imperial College London in the UK, which she’s still completing now.

“My goal for pursuing a Master’s was to gain a hard skill—namely data analytics—and also to take a break from the corporate world to reflect on my career choices and explore how to ramp up the process of building Vespid,” she said.

That’s right—all this while, throughout her professional career, Edrea has been running a startup on the side by the name of Vespid.

Venturing into Vespid

It started when a university friend introduced her to a platform called Robinhood, which features simple zero-commission stock trading to masses in the US.

Edrea and her friend had wondered, why isn’t there a Robinhood-like platform in Malaysia?

Vespid was established to answer that question. Aside from stock trading features, it would also educate Malaysians about stock investing, demystifying the perception that stock investing was like gambling.

“We chose the name Vespid, which is the scientific name for hornets or wasps that can live solitarily,” they said. “We wanted to empower Malaysians to be financially literate and be able to stand on their own two feet to make their own investing choices.”

Together with her initial co-founder, Edrea joined the University of Michigan Optimize Social Innovation Challenge, pitching Vespid as a simplistic and user-friendly stock investing platform for Malaysians.

They ended up winning some funding from this, giving them the confidence to start their entrepreneurial journey.

Image Credit: Vespid

Image Credit: Vespid“I took a calculated risk where I didn’t throw everything into just Vespid,” Edrea said. “I still made sure I had a steady income in the day while I worked on Vespid.”

That’s why, even today, she balances her day job with building a startup.

“Of course this means I work extra hard, because I work on Vespid after work. But entrepreneurship was, and is, always tough and rough,” she reasoned.

Commitment aside, there were other challenges, such as the finance and investment industry in Malaysia being highly regulated and very expensive. There was a high fee and capital required to even qualify for a licence to run a stock trading platform certified by the Securities Commission (SC).

At the time, the founding team comprised just fresh grads who were 22 and 23. They were unfamiliar with the landscape, but they were also ambitious, and would cold-message connections on LinkedIn and Facebook to understand the landscape.

Eventually, they managed to launch a beta simulation stock trading platform with 80 to 100 testers. The feedback was quite positive, especially with the UI/UX and educational content.

Yet, that’s not what Vespid is doing today.

Pivoting to greener pastures

The decision to pivot came after the InvestSmart event at Mid Valley Exhibition Centre in 2022.

“During this event, I came across MooMoo who was marketing their plans to enter Malaysia and the region by 2023,” Edrea said.

A global simplistic, user-friendly, and low commission trading platform, MooMoo was obtaining the certification to be a licensed stock trading platform from SC.

This is exactly what Vespid was trying to achieve in the past two years.

Quickly, she understood that MooMoo would likely become a major player in the stock trading platform scene in Malaysia with its lucrative offerings.

Paired with all the other obstacles, the founder was no longer confident that Vespid’s concept would still hold water.

“Like all young adults and working professionals going through quarter life crisis, we as Vespid also went through an identity crisis of what we should become and be at this point,” she said.

But Vespid still had an element that users enjoyed—the bite-sized educational content on stock investing.

Gamifying personal finance literacy

Reportedly, only 36% of Malaysians understand basic financial concepts such as interest rates, inflation, and risk diversification. This financial illiteracy has made Malaysians vulnerable to scams, losing almost RM1.3 billion to scams in 2023.

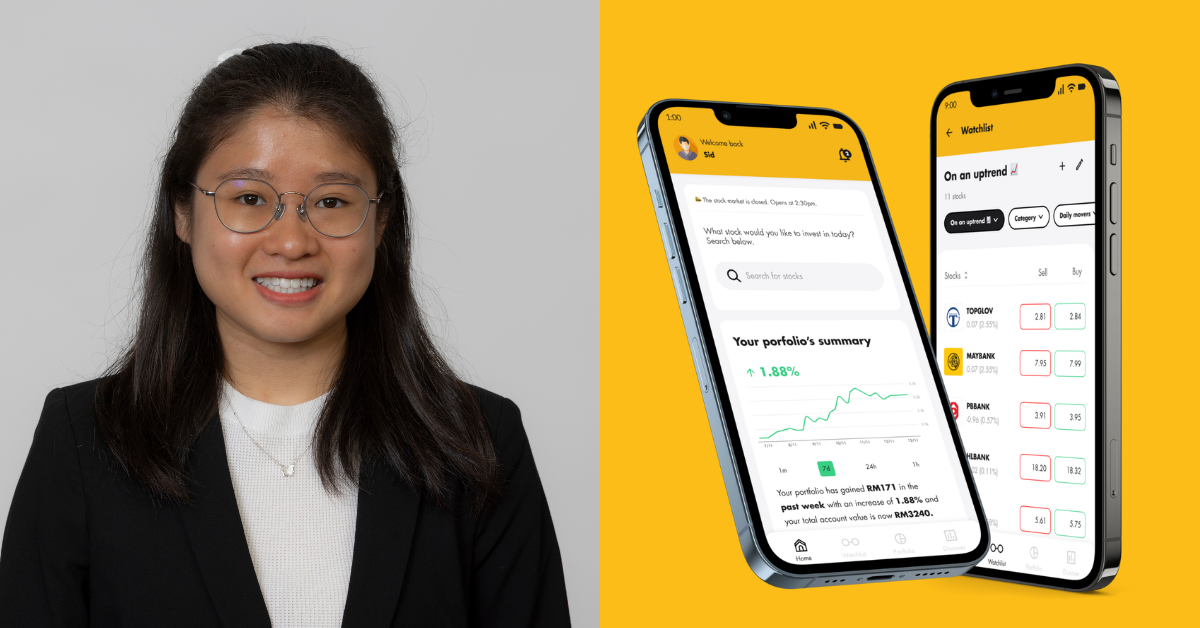

Image Credit: Vespid

Image Credit: VespidVespid wants to change this by creating a gamified platform for Malaysians to learn about financial concepts.

“Considering how Malaysians love playing games online and spinning Shopee coin wheels, we hypothesised that the best ways to engage Malaysians was through games that came with rewards,” Edrea said.

Thus, Vespid exists today as a one-stop gamified personal finance learning platform for Malaysians, targeting youths aged from 12 to 34. Think Duolingo but for financial literacy.

“We have lots of influencers and websites that teach about personal finance but these platforms lack personalisation and engagement,” Edrea said.

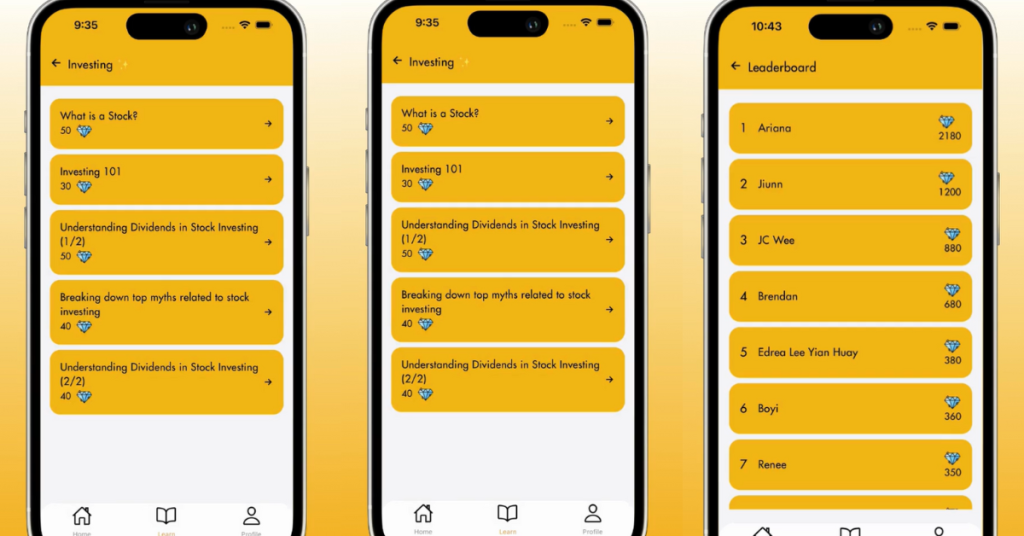

Image Credit: Vespid

Image Credit: VespidThe current beta app features flashcards, quizzes, and a leaderboard as well as a referral system. There’s around 27 sets of flashcards and quizzes cutting across investing, budgeting, insurance, and identifying scams.

Launched in March 2024, the beta app has gotten around 70+ downloads. However, the number of active and returning users has been very low. To increase active users, Vespid is working on new gamification features such as a streaks system.

Monetising the business

Thus far, the startup has not monetised its beta app yet.

“This is one of the struggles we face, which is to convert users engaging with the content for free to subscribe and pay for the content,” she said.

As such, the team is focusing on a B2B business model, aiming to engage with organisations who might be willing to pay a monthly subscription to digitise and make engaging personal finance content for their customers or employees.

“In the future, we foresee that Vespid can also be used as a marketing and user acquisition tool by organisations to educate future and new users on their products,” Edrea added.

For now, the startup has been surviving on the RM40,000 funds obtained from the Optimize Social Innovation Challenge.

That said, the team is hoping to raise around RM60K to ramp up operations and development to secure their first B2B customer in the next one to two years.

Looking to the future

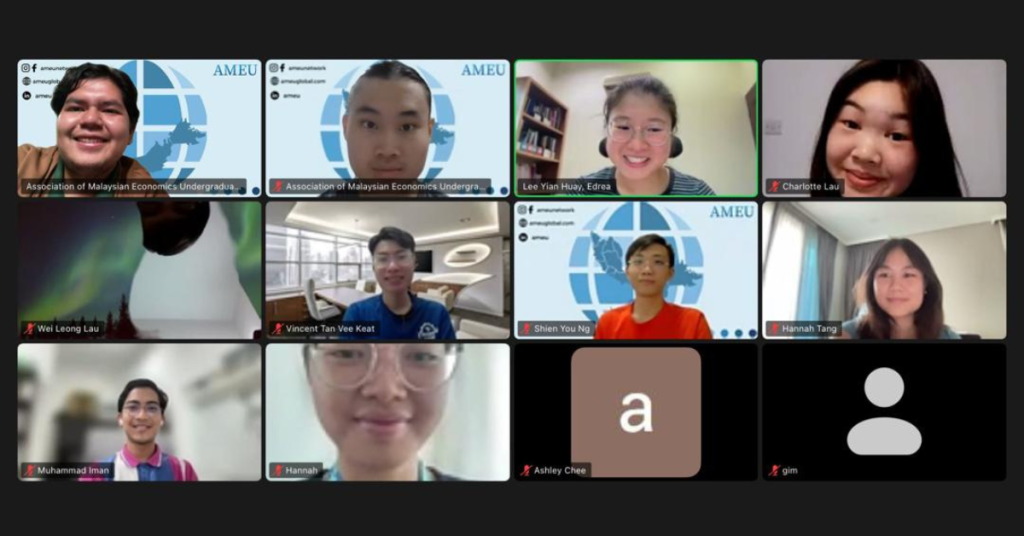

Currently, Vespid comprises two co-founders, Edrea and Riza. Based in the US, Riza is their technology lead. They’re currently enrolled in the MyHeart Innovate Accelerator run by Beyond4tech in partnership with Talentcorp and Cradle.

Through this, Edrea aims to shape Vespid into a more sustainable business model and build connections in hopes of securing the first B2B customer.

Image Credit: Vespid

Image Credit: Vespid“The biggest challenge for us as an early-stage startup is to maintain the discipline and time commitment to building Vespid, given we all still have a day job,” Edrea said.

The founder shared that she’s proud of her team for taking risks to build Vespid despite family and personal commitments.

“Over the past four years, I have learnt that to overcome the challenge of maintaining discipline and commitment is to find purpose in the work we do, and surround ourselves with those who believe in our purpose as well and can motivate us to go through this journey together,” the 26-year-old founder said.

“The goal is to achieve a point where Vespid is up and running, making its first dollar and more, before we can work on it full time.”

Learn more about Vespid here. Read other articles we’ve written about Malaysian startups here.Featured Image Credit: Vespid

Troov

Troov