M’sia dreams of being a global hub for VCs by 2030, here’s how it’ll be made a reality

Here's what our government is doing to turn Malaysia into an attractive hub for local venture capitalists and global ones by 2030.

Venture capital (VC) has long been recognised as a cornerstone of innovation and economic growth, fostering the development of cutting-edge technologies and driving entrepreneurial endeavours.

With a bold vision to position itself as a premier regional VC hub by 2030, Malaysia is embarking on a transformative journey fueled by strategic interventions.

Here are three main initiatives the Malaysian government is implementing to make it easier for VCs to invest in our startups and stimulate economic growth, according to the Malaysia Venture Capital Roadmap.

Improving ease of doing business

Making business easier and more attractive is the name of the game, especially when it comes to moving money across borders.

To truly capture the attention of local and foreign investors, Malaysia is committed to streamlining the cross-border capital flow process. That means providing more information about where the money goes and setting clear rules for startups and investors to follow without too much fuss.

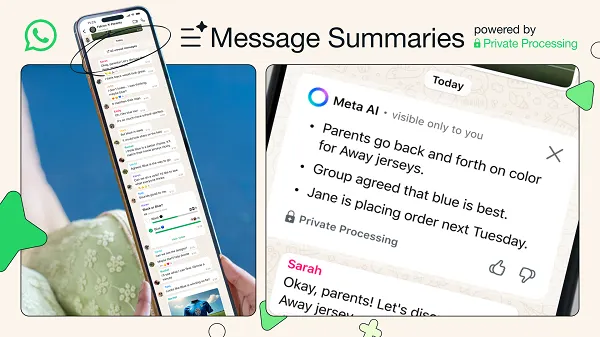

Image Credit: Vulcan Post

Image Credit: Vulcan PostBesides that, we’ll have a centralised platform where all stakeholders involved in funding can converge to discuss opportunities and challenges.

This will not only save time but also ensure alignment among stakeholders. Plus, there will be dedicated folks to smooth out the relationship between startups and investors, akin to having a guide through the paperwork jungle.

In addition, Malaysia’s getting serious about making sure there is a conducive regulatory structure for VCs harmonising onshore and offshore legal structures. By sticking to global standards, Malaysia is showing it’s open for business to investors from all over.

And let’s not forget about increasing VC exit options. Making it easier for investors to cash out means more people joining the game.

Malaysia encourages market participation by offering more options like secondary sales and easing up on the requirements for getting listed.

Improving funding accessibility

To begin with, Malaysia has some funds we aim to invest, but we’re not randomly distributing them. We’re consolidating them into what’s known as a National Fund of Funds (FOF).

Employing a strategic allocation of government funds enables us to invest smarter, ensuring the money goes where it’s needed most without any waste.

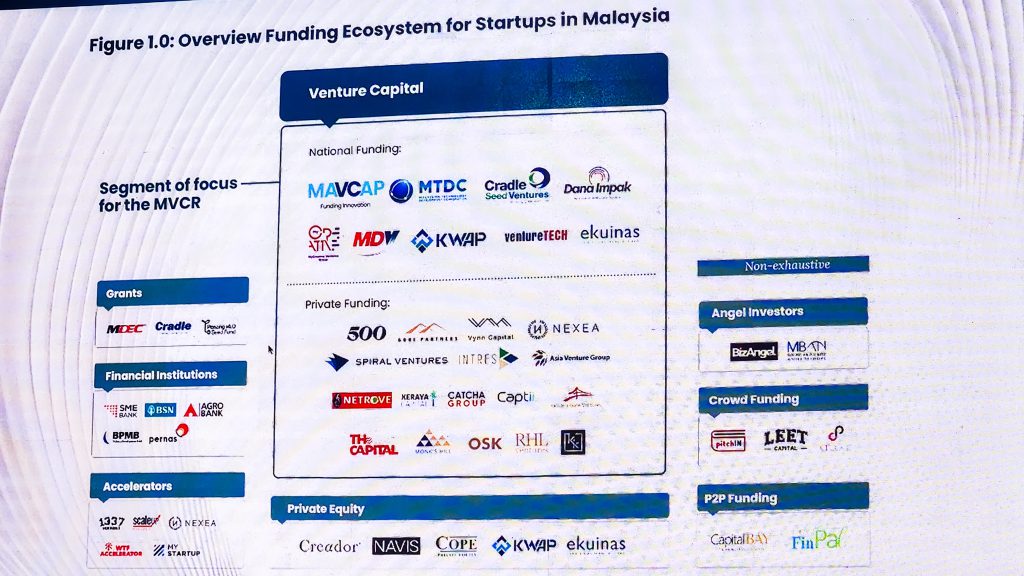

Image Credit: Vulcan Post

Image Credit: Vulcan PostHowever, Malaysia isn’t stopping there. The nation is enhancing the attractiveness of matching FOF schemes by smoothing out how we hand out the money and making some clear rules for who gets what. The goal is to ensure that the funds generate the greatest impact and facilitate sustainable business growth.

Besides, increasing participation of government-linked investment companies (GLICs), government-linked companies (GLCs), and corporates further diversifies the funding pool.

By unlocking liquidity from GLICs, GLCs, and corporates through education, awareness programmes, and co-funding initiatives, Malaysia will stimulate greater participation within the VC ecosystem, reducing dependency on government funds.

Elevating Malaysia’s VC talent pool

No VC ecosystem can thrive without a skilled and knowledgeable talent pool. Malaysia’s roadmap addresses this by seeding new fund managers.

By nurturing local talent, fostering industry-academia collaborations, and providing avenues for international expertise, Malaysia aims to build a cadre of professionals capable of driving the country’s VC industry to new heights.

But we’re not just looking inwards—we’re also looking outwards. In a bid to attract top-tier VC talent from around the globe, Malaysia is enhancing its visa schemes.

Flexible eligibility criteria, accelerated processing timelines, and seamless collaboration among government agencies are making it easier than ever for skilled professionals to call Malaysia home.

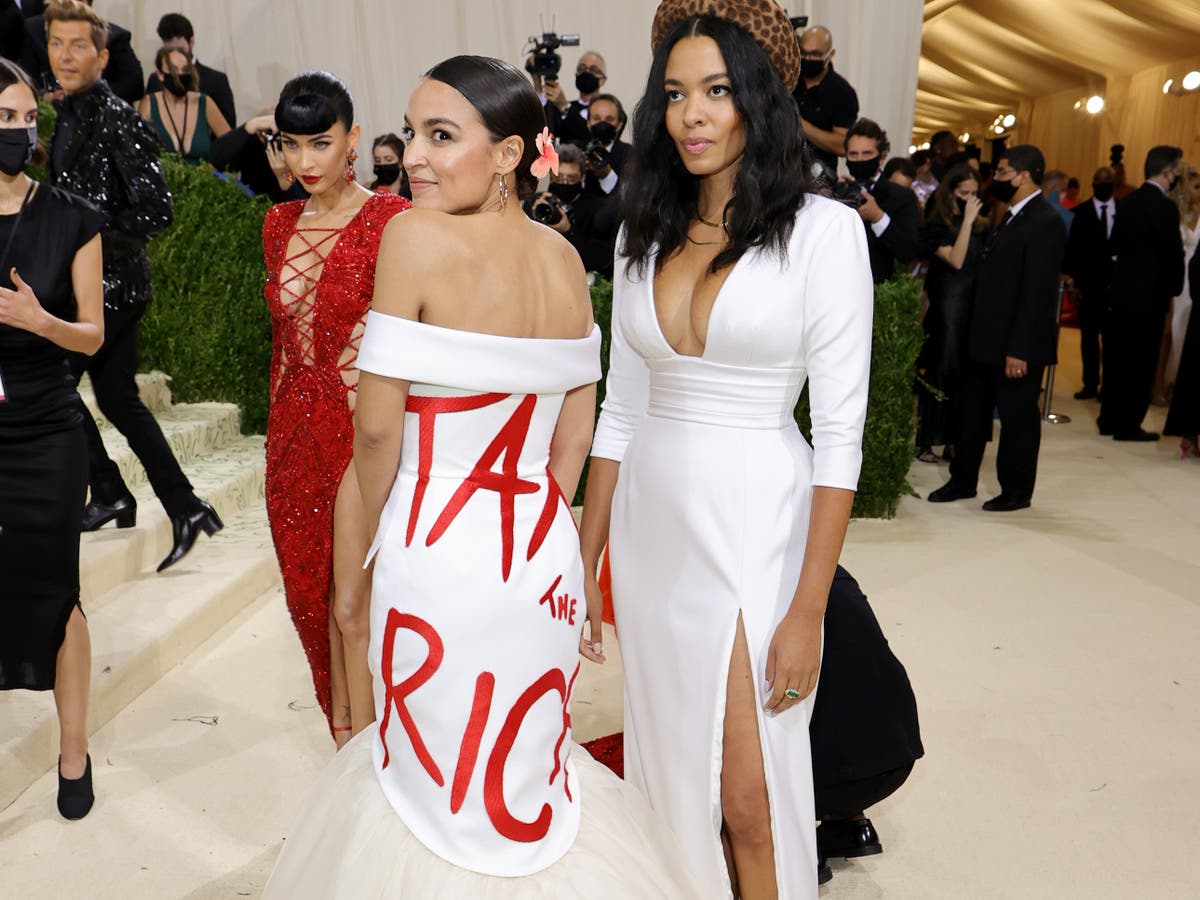

Image Credit: Vulcan Post

Image Credit: Vulcan PostMoreover, the government is solidifying Malaysia’s position as a global VC hub and enriching its talent pool in the process by rolling out the red carpet for foreign VC talent.

Behind every successful VC firm is a dedicated team of support functions keeping the wheels turning. Recognising the importance of these unsung heroes, Malaysia is incentivising foreign VC support functions and upskilling local service providers.

Through tailored incentives, upskilling programmes, and collaborative initiatives, Malaysia is laying the groundwork for a self-sufficient VC ecosystem, fostering cooperation among key players and propelling the country to the forefront of the VC landscape.

If executed properly and with all these things in place, dare we say that the country could very well be on track to realise its vision of becoming a preferred regional VC hub by 2030.

Learn more about Malaysia Venture Capital Roadmap here. Read other articles we’ve written about Malaysian startups here.Featured Image Credit: Kl20 Summit 2024

AbJimroe

AbJimroe

.jpg&h=630&w=1200&q=100&v=a905e78df5&c=1)