Nvidia dragged to worst day since March 2020 after Super Micro plunge

Super Micro Computer shares plunged on Friday as investors peeled back their holdings of one of the stock market's hottest names.

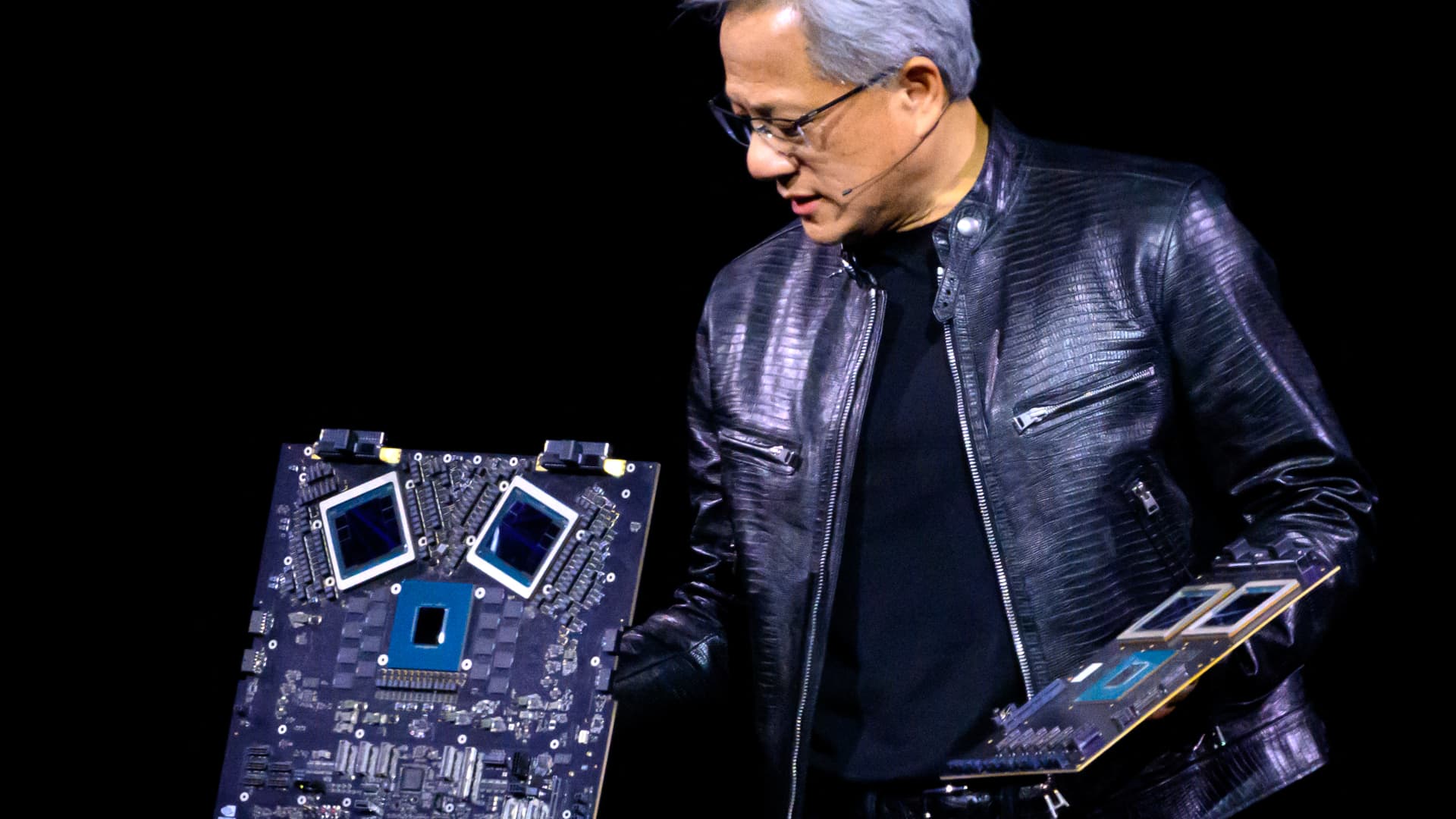

Nvidia founder and CEO Jensen Huang displays products onstage during the annual Nvidia GTC Conference at the SAP Center in San Jose, California, on March 18, 2024.

Josh Edelson | Afp | Getty Images

Nvidia shares fell 10% on Friday, the worst day for the chipmaker since March 2020, when the company's value was one-twelfth of its current $1.9 trillion market cap.

The stock plunge wasn't tied to any news out of Nvidia. But Super Micro Computer, one of the vendors that build Nvidia-based servers, saw shares drop 23% Friday after the company broke from its recent pattern of providing preliminary results, and announced it would report earnings later this month.

In January, Super Micro increased its sales and earnings guidance 11 days before announcing second-quarter financials. The company will report fiscal third-quarter results on April 30.

Super Micro and Nvidia were the two worst performers in the S&P 500 on Friday. Super Micro was added to the index in March.

Similar to Nvidia, Super Micro has seen its sales skyrocket of late on the back of insatiable demand for Nvidia-based computers that are used to build artificial intelligence programs such as ChatGPT.

In addition to those two names, investors scaled back their holdings of many semiconductor stocks ahead of earnings later this month.

The chip-focused VanEck Semiconductor Index fell 4.5%, and Arm shares fell 17% on Friday. Arm sells a kind of intellectual property for chips that's seen as complementary to Nvidia graphics processor-based AI servers. AMD, Nvidia's primary GPU competitor, saw shares fall 5%.

Shares of Super Micro are still up about 151% this year after climbing 246% in 2023. The stock's move on Friday was its steepest drop since Aug. 9, 2023, when it fell 23.4%. Nvidia shares are up over 58% so far in 2024.

While Super Micro is getting a big boost from its ties to Nvidia, the market remains highly contested, with competitors including Dell and Hewlett Packard Enterprise planning to build systems using Nvidia's latest generation of Blackwell graphics processing units.

Don't miss these stories from CNBC PRO:

ShanonG

ShanonG