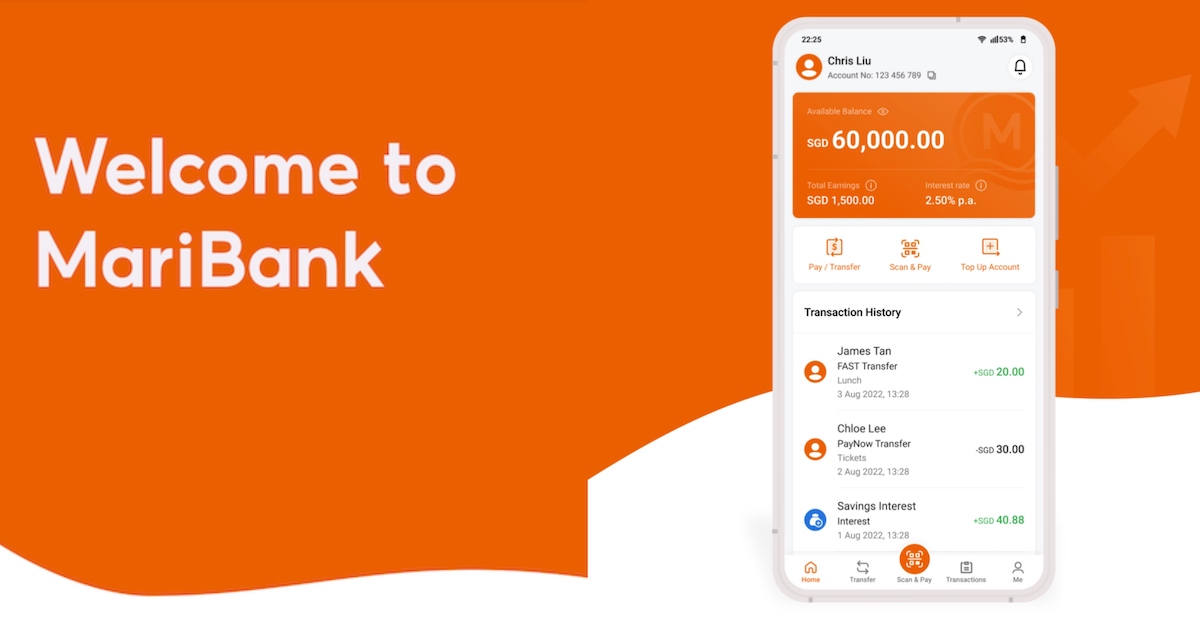

Sea joins the digital banking race with MariBank’s launch to the public on an invite-only basis

The Mari Savings Account offers an interest rate of 2.5% per year with no minimum deposit or spend, with interest accrued daily.

Tech giant Sea, the parent company of Shopee and Garena, has quietly opened its digital bank called MariBank to the public on an invite-only basis. MariBank had previously been limited to just Sea group employees since the third quarter of 2022.

One reason for Sea’s restricted phase is due to the Monetary Authority of Singapore (MAS)’s policy, which aims to minimise the impact of initial operational issues and allows banks to fine-tune their business before catering to the broader public.

This move by Sea comes after the launch of other digital banks in Singapore. MAS had previously awarded two digital full bank licenses in Singapore to both Sea and the the Grab-Singtel consortium in December 2020, enabling them to serve retail and corporate customers.

Grab-Singtel launched its digital bank called GXS Bank last August on an invite-only basis too.

Singapore’s other digital banks — Ant Group’s ANEXT and Green Link Digital Bank — are wholesale banks that can serve micro, small and medium-sized enterprises and non-retail clients.

Trust Bank is another digital bank that also operates online-only but holds a full bank license, allowing it to function in a similar way to traditional lenders. It is backed by Standard Chartered Bank and FairPrice Group.

Who can sign up for an account?

Image Credit: MariBank

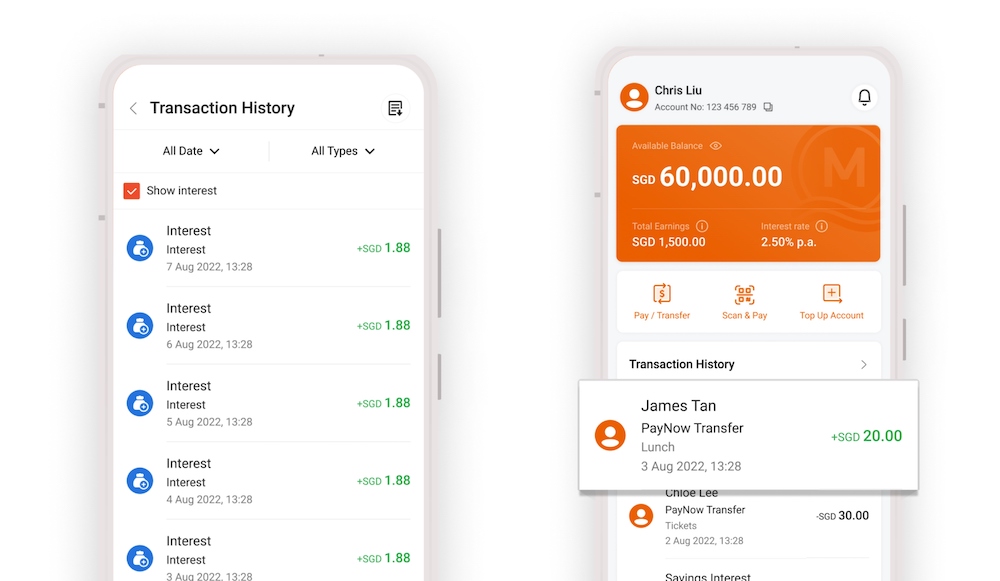

Image Credit: MariBankSea now offers a Mari Savings Account with an interest rate of 2.5 per cent per year, with no minimum deposit, salary credit requirement, or minimum spend amount. Interest is accrued daily and calculated based on the previous day’s balance.

Customers can also send and receive money instantly through PayNow in the bank’s app and pay at stores that accept PayNow QR codes.

To open a Mari Savings Account, customers must be a Singaporean or permanent resident and be at least 18 years old. The bank’s invitations are currently limited to users of its ecosystem such as Shopee customers and individual sellers.

Those who have received an invitation can download the MariBank app from the Apple App Store, Google Play Store, or Huawei AppGallery.

What does this digibank launch mean for Sea?

Sea has until now largely been quiet about its digital bank. It had previously stated that its digibanks were still in “a very nascent stage.” Sea also has a license in Malaysia under a consortium and operates SeaBank in Indonesia and the Philippines.

Group chief corporate officer Yanjun Wang said at an earnings call last November that Sea had started some pilot programs for MariBank, where it had opened up limited features to employees.

Sea’s latest development comes after it recorded its first quarterly profit of US$422.8 million (S$570 million) for the fourth quarter ended December 31, following aggressive cost cuts and layoffs over the past year. This profitability could be attributed to the company’s strong financial management and its digital banking strategy, which enables it to diversify its revenue streams.

MariBank’s invite-only launch is part of Sea’s overall strategy to expand its offerings and tap into Singapore’s rapidly growing fintech market.

With its successful launch, MariBank is expected to challenge existing digital banks, as well as traditional brick-and-mortar banks. As Singaporeans become more comfortable with digital banking, MariBank’s innovative services are likely to appeal to a younger, tech-savvy demographic.

Sea’s entry into the digital banking space is significant because it highlights the increasing importance of technology in banking. Sea is also well-positioned to tap into this growing market and expand its digital ecosystem beyond e-commerce and gaming.

As the bank rolls out its services progressively, it will be interesting to see how it fares in a highly competitive digital banking landscape.

Featured Image Credit: MariBank

Tfoso

Tfoso