Senate Republicans press S&P and other credit firms for methodology on corporate ESG ratings

Sen. Pat Toomey of Pennsylvania sent letters to over a dozen ESG ratings firms requesting details about their ratings standards.

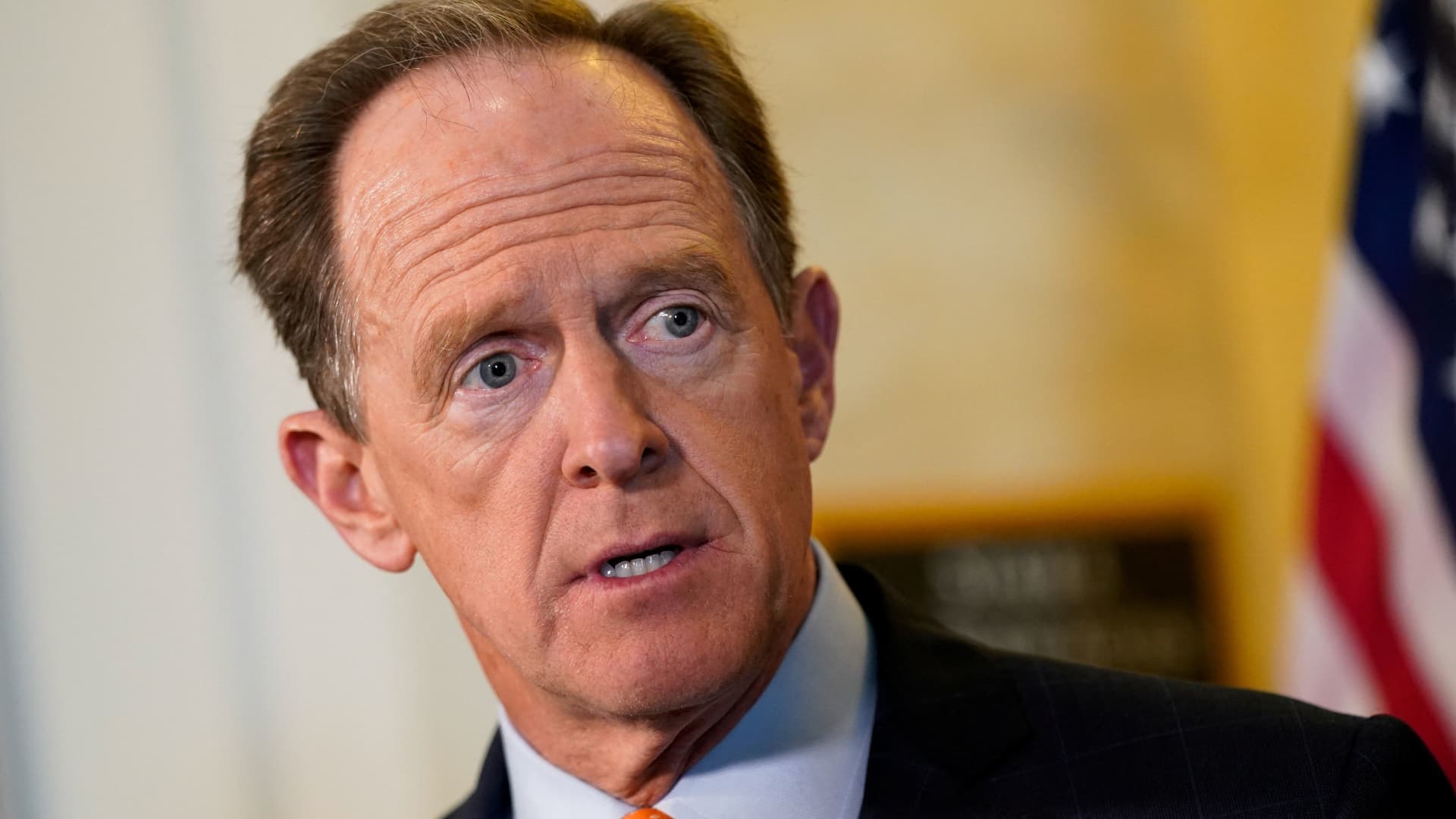

Ranking member Senator Pat Toomey (R-PA) queries the witness during the Senate Banking, Housing, and Urban Affairs Hearing to examine the President's Working Group on Financial Markets report on Stablecoins in Washington, D.C, U.S., February 15, 2022.

Bill O'Leary | Reuters

Ratings firms that assign environmental, social and governance ratings to companies — a multi-billion dollar endeavor — are coming under scrutiny in the Senate.

Retiring Sen. Pat Toomey, R-Pa., the ranking member of the Senate Committee on Banking, Housing and Urban Affairs, sent letters to over a dozen ratings firms requesting transparency in the methods used to assign ESG ratings to companies, according to a statement Wednesday.

ESG ratings assess how companies align with sustainability goals such as greenhouse gas emissions, labor practices or water sustainability. In May, the Securities and Exchange Commission proposed two rule changes to prevent misleading or deceptive claims by U.S. funds for ESG qualifications and to increase disclosure requirements for those funds.

The proposed changes followed a set of rules introduced by the SEC in March that required publicly traded companies to disclose how climate change risks affect their business and provide more details about their impact on the environment as well as carbon emissions.

In the statement, Toomey said ESG ratings firms have a unique ability to influence valuable global ESG assets. These assets received approximately $649 billion in investments in 2021 and comprise about 10% of worldwide fund assets.

The senator requested copies of non-proprietary methodologies used by the firms to assess ratings by Sept. 28 in letters sent to credit raters. He also asked for descriptions of compliance burdens on the rated companies, data collection methods, possible political biases and conflicts of interest by Oct. 5.

Toomey said that, though ESG ratings firms consider information beyond the extensive public disclosures that firms are required to make under federal securities laws, many consider information that is "not material or financially relevant" under those laws.

The letters were sent to ratings firms MSCI, ISS, Bloomberg, Sustainalytics, Moody's, Carbon Disclosure Project, S&P Global, FTSE Russell, RepRisk, FactSet, Refinitiv, and Arabesque S-Ray.

Republicans on the Senate committee plan to press bank CEOs on ESG issues during an annual oversight meeting of the nation's largest banks on Thursday, an aide for Toomey said.

ValVades

ValVades