Shiba Inu In Danger Zone: 15% Price Crash Incoming?

The price of Shiba Inu (SHIB), the self-proclaimed “Dogecoin killer,” has been caught in a technical tug-of-war, with bears attempting to push it lower and bulls clinging to signs of hope. Analysts are scrutinizing the memecoin’s chart pattern and...

The price of Shiba Inu (SHIB), the self-proclaimed “Dogecoin killer,” has been caught in a technical tug-of-war, with bears attempting to push it lower and bulls clinging to signs of hope. Analysts are scrutinizing the memecoin’s chart pattern and on-chain data to decipher its next move.

Descending Triangle Looms: Will SHIB Fall Or Fly?

A descending triangle formation has emerged on SHIB’s 3-day chart. This pattern typically indicates a potential price decline, as the asset’s price gets squeezed between converging support and resistance lines. The big question for SHIB holders: will the price break below support and continue its descent, or will it defy gravity and break out of the triangle, sparking an uptrend?

Falling Demand Raises Concerns For Shiba Inu

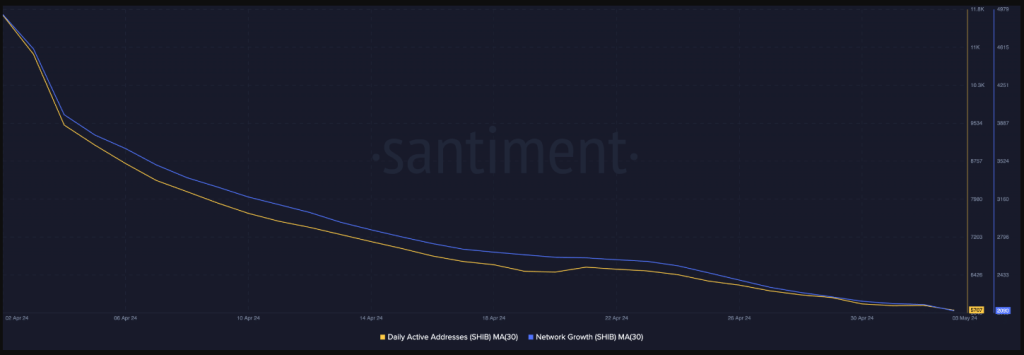

Adding fuel to the bearish fire, SHIB has witnessed a significant drop in demand. Data from Santiment reveals a worrying trend: the daily active addresses for SHIB have plummeted by more than 50% over the past month. This suggests a shrinking user base and potentially lower trading volume, which can put downward pressure on the price.

Source: Santiment

Source: Santiment

New Investors Give SHIB The Cold Shoulder

Further dampening spirits is the sharp decline in new addresses joining the SHIB party. According to on-chain data, the number of new addresses created daily to trade SHIB has nosedived by 51% in the same period. This lack of fresh blood entering the market could exacerbate the selling pressure.

SHIB’s High Valuation: A Recipe For Sell-Off?

Another factor causing concern is SHIB’s Market Value to Realized Value (MVRV) ratio. This metric compares the current market price with the average acquisition price of all SHIB tokens. Currently, SHIB’s MVRV ratio sits at a lofty 38%. When this ratio is high, it suggests the asset might be overvalued, potentially triggering existing holders to cash in on their profits and contribute to a sell-off.

SHIB monthly price action. Source: CoinMarketCap

SHIB monthly price action. Source: CoinMarketCap

A Silver Lining?

Despite the prevailing bearish sentiment, a glimmer of hope flickers for SHIB. The coin’s weighted sentiment has surprisingly turned positive recently, indicating a shift in market perception. This newfound optimism could translate into a price breakout, defying the descending triangle’s bearish implications.

Related Reading: Bitcoin Update: $120 Million Futures Liquidated As Price Takes A Beating

Can Bullish Sentiment Propel SHIB To Higher Ground?

If the positive sentiment persists, analysts predict a potential price surge for SHIB, reaching $0.00003. This would be a welcome change for investors who have witnessed a recent price slump.

Meanwhile, SHIB’s Fibonacci retracement level shows that the memecoin’s price may drop further 15% to trade at a low of $0.000018 if the bears continue to put pressure on it and it falls below support.

SHIB investors now have more cause for concern as this underscores the possible repercussions of a bearish breakthrough.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Koichiko

Koichiko