Shipping container fees are falling around the world, but not in the U.S.

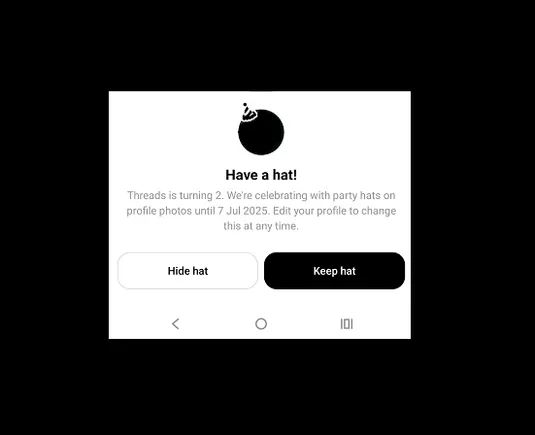

Port congestion has been a big factor in inhibiting the swift movement of containers out of the ports like New York.

An aerial view of big rigs are seen at the Port Jersey in Jersey City of New Jersey, United States on January 19, 2022.

Tayfun Coskun | Anadolu Agency | Getty Images

Late container charges known as detention and demurrage (D&D) in the United States are the highest in the world, according to a recent report by Container xChange, and are out of sync with D&D charges that have been falling around the globe.

Detention is the charge the merchant pays for holding an ocean carrier's container outside the port, terminal, or depot, beyond the contracted free time. In this portion of the contract, an ocean carrier stipulates how long a merchant can have the container before charges are imposed.

Demurrage is the charge related to a merchant's use of the container while in the port. The merchant is allotted a certain amount of "free time" to have the container in the port before charges are incurred. The merchant pays the ocean carrier a fee if the merchant goes beyond the amount of contracted "free time." This charge is to motivate merchants to move their containers out of the port.

Port congestion has been a big factor in inhibiting the swift movement of containers out of the port. Recently, the Port of New York and New Jersey announced it would levy new charges against ocean carriers to encourage them to move empty containers out of port and free up space for the processing of containers more efficiently.

The delay in picking up and dropping off containers is increasing detention and demurrage charges. According to Container xChange, the Port of New York and New Jersey ranks No. 1 in the world in charges.

The high rates and the delays at the ports come as no surprise to the Federal Maritime Commission (FMC), which has been investigating reports of carriers charging container charges even when the shipper or trucker cannot return the container due to terminal congestion.

"I will ask that this investigation be broadened and intensified to cover instances where shippers and truckers are being forced to store containers or move them without proper compensation," FMC chairman Daniel Maffei said. "The Commission will ask the carriers that have fallen the most behind in picking up their empties what their plan is to rectify the situation. Whatever their answers may be, I will do everything in my power to ensure that carriers do not receive involuntarily subsidized storage for empty containers that belong to them."

Pervinder Johar, CEO of supply chain optimization company Blume Global, said merchants need to be more nimble and cast a wider net in choosing a port of import for their freight.

"Technology can offer you a real-time analysis of a port," Johar said. "You can see the overall port performance. You have data on the vessels, at dock, anchorage, or docking soon. Then you have how long the containers are waiting. There is also dwell time on rails and truck pick-ups. All this enables a merchant to make an informed decision. Unfortunately, we find with some shippers they are rigid in their port selections. Being nimble gives you the opportunity to avoid paying D&D."

Johar said data can also help merchants keep track of the status of a container. "You can have multiple companies involved in moving your container. You need to be able to keep track of all the parties involved," he said.

The CNBC Supply Chain Heat Map data providers are artificial intelligence and predictive analytics company Everstream Analytics; global freight booking platform Freightos, creator of the Freightos Baltic Dry Index; logistics provider OL USA; supply chain intelligence platform FreightWaves; supply chain platform Blume Global; third-party logistics provider Orient Star Group; marine analytics firm MarineTraffic; maritime visibility data company Project44; maritime transport data company MDS Transmodal UK; ocean and air freight rate benchmarking and market analytics platform Xeneta; leading provider of research and analysis Sea-Intelligence ApS; Crane Worldwide Logistics; and air, DHL Global Forwarding; freight logistics provider Seko Logistics; and Planet, provider of global, daily satellite imagery and geospatial solutions.

Aliver

Aliver