Snapchat still coping with ad challenges brought on by Apple

App hopes new conversion tools will prove to brands that its ads are working.

Snapchat posted more than $1 billion in ad sales in the first quarter but continued to feel the effects of “platform changes,” such as Apple’s anti-tracking rules, in parts of the mobile advertising business. On Thursday, Snapchat released its quarterly finances, and the company acknowledged ongoing challenges to direct-response advertising, partly because of changes to privacy and data rules on platforms like Apple iPhones.

Snapchat executives said that, in general, it was a “challenging” quarter, referring to global issues such as inflation and geopolitical unrest. But Snap’s ad business has been dealing with disruptions to the online ecosystem, too. Apple’s app-tracking policies, which took effect last year, cut apps off from data that marketers use to track when ads lead a consumer to a sale. Snapchat has felt the effects ever since and said it was still working on ways to help advertisers see when ads work, through new tools like its “conversions” platform, which shows how often ads lead to an action from a consumer.

“We continued to work through platform policy changes, which are primarily impacting direct-response advertising partners, and we believe that we are building effective measurement solutions for advertisers to prove the efficacy of their campaigns,” Jeremi Gorman, Snap’s chief business officer, said in the earnings announcement. “We have experienced signal loss,” Gorman said, referring to the degradation of data coming from platforms like Apple. “They put a serious onus on advertisers to adapt."

Gorman highlighted the beauty brand Nice One as the type of advertiser using its conversions platform. “Some advertisers who have invested early in our first-party solutions are seeing signs of success,” Gorman said.

Read more: Google plans Android ad data limits, following Apple's lead

All mobile apps that make money from selling ads, including Meta’s Facebook and Instagram, have had to contend with Apple’s changes. The social media companies have been racing to develop their own tools that could show advertisers results, and prove to brands that their platforms are working.

Snapchat has been on a push in recent weeks to show advertisers how its ads are more effective than marketers might detect through traditional means. Earlier this month, Snapchat issued a blog post about “evolving measurement for a new age of marketing.” “Snapchat, relative to spend, contributes disproportionately more to both attributable conversions and revenue,” the company said in its post.

Snapchat also announced some new advertising products in its earnings call on Thursday. Snap CEO Evan Spiegel talked about bringing ads to Snap Map, which is a platform within Snap for friends and businesses to share their locations in real time.

Snapchat said its brand advertising business grew at a “relatively slower rate” of 26% year-over-year in the first quarter. In the fourth quarter, revenue in the brand advertising business rose 49% from a year earlier.

Snapchat is still growing, though, with revenue up 38% year over year to $1.06 billion, mostly from ad sales. The user base also grew—up 18% year over year to 332 million daily active users.

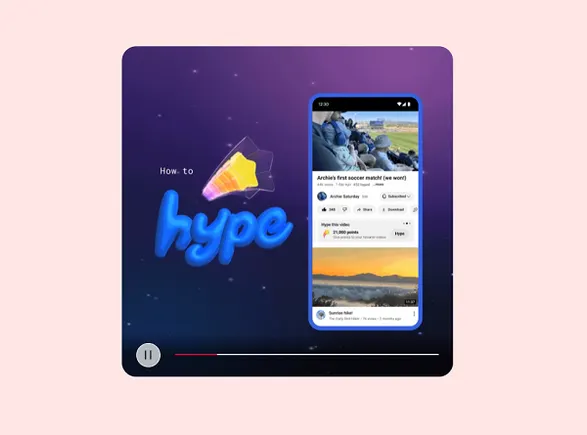

Last quarter, Snapchat had a series of product updates. Snapchat started running mid-roll ads in some videos from the most popular accounts on the platform. Snapchat shares revenue with creators in that program.

Snapchat is hosting a “partner summit” next week. Snapchat also will host a NewFront at the IAB’s annual advertising sales event next month. NewFronts are a moment when digital media properties try to entice advertisers to commit set ad budgets for the year ahead. Gorman said Snapchat has fared well, so far.

TV Upfronts and Newfronts 2022 calendar

“Our work with agency and advertising partners over the past year has resulted in upfront commitments for 2022 that are more than 60% higher than the total upfront commitments made in 2021,” Gorman said. “We view upfront commitments as a signal of strong confidence from agency and advertising partners as we become a part of their always-on, performance-oriented advertising strategies.”

Astrong

Astrong