StarTrader Review 2024 with Rankings By Dumb Little Man

StarTrader Review Forex brokers provide platforms where traders can buy and sell foreign currencies. These brokers offer various financial instruments, such as currency pairs, stocks, and commodities. StarTrader stands out as a Forex broker that supports over 200 CFDs on diverse assets, including currency...

| |

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like: User Experience Profit Potential Reliability Broker Expertise Cost-effectivenessBy integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies StarTrader as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

StarTrader Review

Forex brokers provide platforms where traders can buy and sell foreign currencies. These brokers offer various financial instruments, such as currency pairs, stocks, and commodities. StarTrader stands out as a Forex broker that supports over 200 CFDs on diverse assets, including currency pairs, stocks, indices, metals, and commodities.

In this review, we delve deep into StarTrader, aiming to present a comprehensive analysis that highlights its advantages and limitations. Our goal is to furnish readers with crucial insights concerning the broker’s services. This includes information on the types of account options, deposit and withdrawal processes, and commission structures. Combining expert analysis with real user experiences, we provide a well-rounded view to assist you in deciding whether StarTrader is the right choice for your trading needs.

What is StarTrader?

StarTrader is a Forex broker that provides access to over 200 CFDs on a wide array of assets including currency pairs, stocks, indices, metals, and commodities. This makes it a versatile option for traders interested in a diverse range of financial instruments. The broker is designed to cater to both beginners and experienced traders.

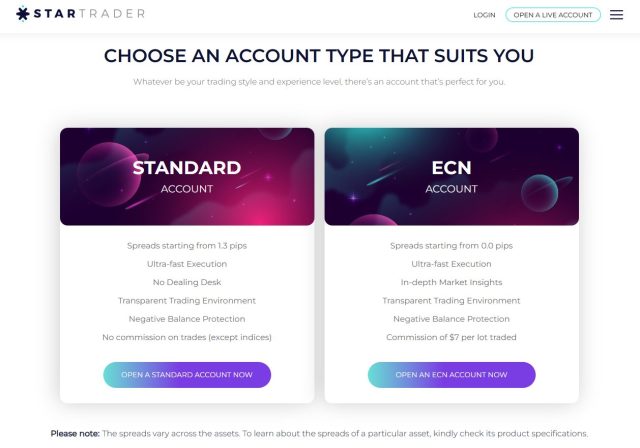

StarTrader offers several trading account types, notably STP and ECN, with each requiring a minimum deposit of $50. The STP account features spreads starting from 1.3 pips, while the ECN account offers spreads from as low as 0 pips, with a commission of $7 per full lot. These features highlight the broker’s commitment to providing competitive and transparent trading conditions.

Traders at StarTrader can utilize the popular MetaTrader 4 and MetaTrader 5 platforms, which are well-known for their robustness and wide range of functionalities. Additionally, the broker offers flexible leverage, up to a maximum of 1:500 for most asset types, enhancing the trading power of its clients.

Safety and Security of StarTrader

The safety and security of StarTrader are paramount, especially given its status as an officially registered broker. This registration ensures a baseline of trustworthiness and regulatory compliance. The broker has established offices in several key locations worldwide, including Saint Vincent and the Grenadines, Hong Kong, Australia, Cyprus, and Seychelles, underscoring its global reach and commitment to adhering to international trading standards.

StarTrader is regulated by several respected authorities, such as the Australian Securities and Investments Commission (ASIC), the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA), and the Financial Services Authority (FSA) in Seychelles. These regulatory bodies are known for their strict oversight and rigorous standards, which help protect the interests of traders and enhance the overall security of their investments. This information has been meticulously verified through extensive research by Dumb Little Man, ensuring its reliability and relevance for potential traders.

Pros and Cons of StarTrader

Pros

30-day free demo account Low minimum deposit of $50 Competitive low spreads and fees Ultra-fast order execution No trading restrictions Trade sizes ranging from 0.01 to 100 lots Free VPS under simple conditionsCons

Only offers CFDs Limited analytical tools Only economic calendar availableSign-Up Bonus of StarTrader

StarTrader offers an attractive sign-up bonus for new clients who open a live trading account. To qualify, traders need to join the Bonus Promotion and make an initial deposit of at least $100. This introductory incentive is designed to welcome new traders and give them a robust start in their trading endeavors.

Once the account is funded, traders receive a 30% bonus on their initial deposit. This bonus can reach up to a maximum of $15,000, depending on the amount deposited. This substantial bonus enhances the trading potential of new clients, allowing them to explore more trading opportunities with increased capital right from the start.

Minimum Deposit of StarTrader

StarTrader sets a low minimum deposit requirement, making it accessible for a broad range of traders. With an entry threshold of just $50, this policy enables both novice and experienced traders to start trading without a significant initial investment. This low deposit requirement is part of StarTrader’s commitment to making financial trading accessible to a wider audience.

StarTrader Account Types

StarTrader offers a variety of account types to suit different trading styles and needs. Our team at Dumb Little Man has conducted thorough research and tested these account options to provide accurate insights.

Demo Account: Available for free and valid for 30 days, this account is equipped with $100,000 in virtual dollars. It offers real-time market quotes, allowing new traders to practice trading under actual market conditions without financial risk. STP Account: Requires a minimum deposit of $50 and offers leverage up to 1:500. Traders enjoy spreads starting from 1.3 pips and no trading fees. This account provides access to a comprehensive pool of financial instruments and supports trade sizes from 0.01 to 100 lots. ECN Account: Also with a minimum deposit of $50, this account offers leverage up to 1:500 for most instruments and up to 1:20 for CFDs on stocks. Spreads begin at 0 pips, with a trading commission of $7 per lot. It features no restrictions on trading strategies and methods, supports all types of orders, and includes 24/5 support.These accounts have been specifically designed to meet the diverse needs of traders, from beginners to seasoned professionals, enhancing their trading experience with StarTrader.

StarTrader Customer Reviews

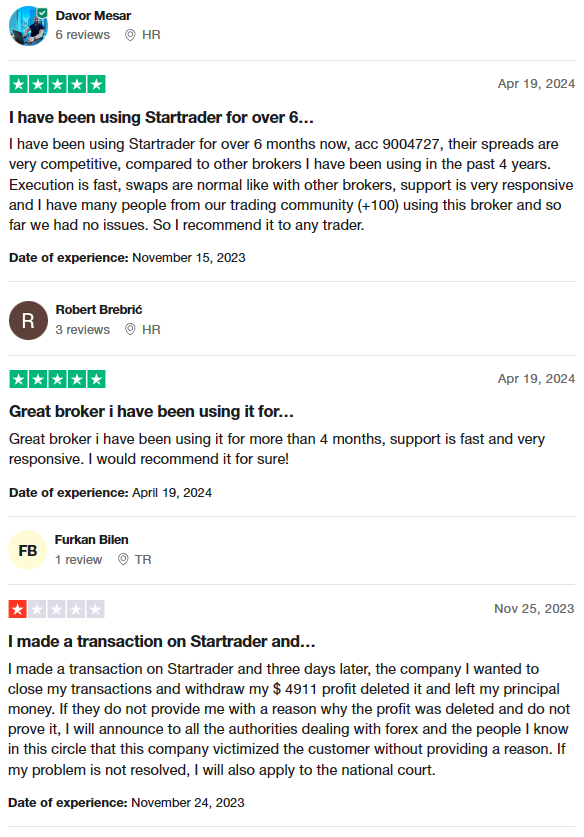

StarTrader customer reviews generally reflect a positive sentiment. Many users, some with over six months of trading experience on the platform, have praised the broker for its competitive spreads and fast execution. The support team is noted to be very responsive, enhancing user satisfaction. A large number of traders from a trading community have reported no issues, recommending StarTrader as a reliable choice for other traders. However, there are concerns from a customer regarding an issue with transaction deletion and profit withdrawal, highlighting potential challenges with dispute resolution. This mixed feedback underscores the importance of diligent customer service and transparent communication in maintaining trust and reliability in Forex trading.

StarTrader Fees, Spreads, and Commissions

StarTrader offers distinct fees, spreads, and commissions structures, catering to various types of traders. Clients who choose the STP account benefit from a floating spread that starts from 1.3 pips, which is competitive within the industry. For those opting for the ECN account, the broker provides a raw spread starting from 0 pips, although a commission of $7 per lot is charged, reflecting the direct access to market prices.

When it comes to deposit and withdrawal methods, StarTrader supports a range of options including credit or debit cards, bank transfers, and both electronic and cryptocurrency wallets. Notably, the broker does not impose any fees on these transactions, regardless of the method chosen by the client. However, it’s important to note that there may be third-party fees, especially from banks for international transfers, typically around $20. This detail is crucial for clients to consider when managing their trading funds.

Deposit and Withdrawal

StarTrader‘s deposit and withdrawal processes have been thoroughly tested by a trading professional at Dumb Little Man, ensuring that the information provided is accurate and reliable. Trading on a demo account involves virtual money, which means there are no real profits to be earned. However, once traders switch to a real trading account, they engage in actual transactions and can earn real profits based on successful market forecasting.

For traders looking to withdraw their profits, StarTrader offers a straightforward process. Requests for withdrawals must be submitted through the user account on the broker’s website and are usually processed quickly. The broker supports multiple withdrawal methods including bank transfers, Mastercard and Visa cards, various electronic payment systems, and cryptocurrency wallets with USDT stablecoin support.

Importantly, StarTrader does not charge any fees for withdrawals. While most withdrawal methods see funds credited within a day, international bank transfers may take between 3-5 days. This efficient and cost-effective withdrawal process enhances the trading experience by making access to funds both easy and economical.

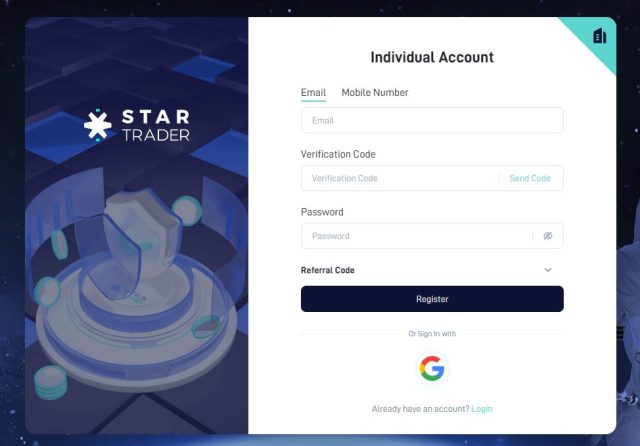

How to Open a StarTrader Account

Visit the StarTrader website and select your preferred language from the interface options in the top right corner, then click “Open a user account.” Enter your email address or phone number to receive a verification code, set up a password, and if applicable, enter a promo code; click “Register” once verified. Once logged in, your dashboard will automatically include a demo account; select “Create” under the account setup section, choose your trading platform (MT4 or MT5), account type (STP or ECN), and if desired, opt into the PAMM service, set your account currency, establish and confirm your trading password, then click “Next.” Answer questions regarding your main source of income, trading experience, and any U.S. residency. Fill in your personal details like first name, last name, gender, date of birth, and identification number, and upload a verification document such as a passport or national ID. Access the “Payment” section, select the “Deposit” area, and deposit funds using your preferred method as guided by the instructions. Proceed to the “Platform” section to download the appropriate trading platform, either MT4 or MT5, and explore additional services like joining a PAMM account or engaging in copy trading.StarTrader Affiliate Program

The StarTrader Affiliate Program offers a lucrative opportunity for both individuals and legal entities interested in promoting the broker’s services. Participants need to apply through the designated section on the StarTrader website. Once approved, affiliates receive a referral link and multilingual marketing materials to help in their promotional efforts.

Affiliates are tasked with distributing these materials across various online platforms to increase visibility and attract new traders to StarTrader. Successful referrals who register and verify as traders start generating ongoing commissions for the affiliate based on a percentage of the fees the broker earns from their trading activities. Additionally, StarTrader offers a one-time payment option for affiliates, enhancing the flexibility of the program.

The program does not limit the number of referrals an affiliate can make. Furthermore, additional bonuses are awarded for reaching referral milestones at 10, 20, 50, and 100 referrals. This structured reward system not only incentivizes broader participation but also significantly boosts the potential earnings for active affiliates.

StarTrader Customer Support

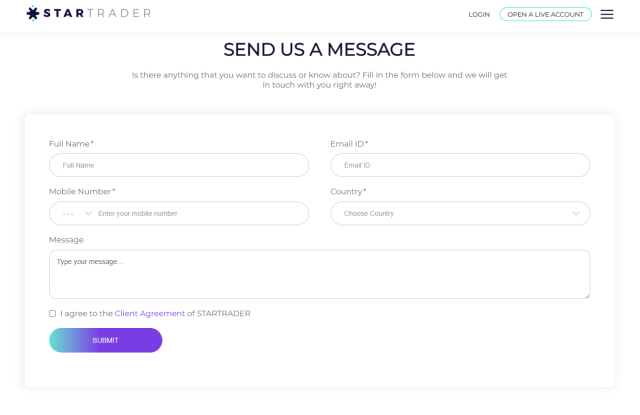

StarTrader‘s Customer Support is accessible through a variety of channels, ensuring that traders can easily reach out for assistance. According to an evaluation by Dumb Little Man, the support team can be contacted via email, through tickets on the website, and live chat both on the main site and within the user account. These options provide direct and efficient ways to resolve any issues or inquiries that traders may have.

In addition to traditional support methods, StarTrader maintains active official accounts across multiple social media platforms, including Facebook, X, LinkedIn, Instagram, YouTube, and TikTok. Traders can communicate with support specialists through these channels as well. It’s also recommended for users to subscribe to StarTrader’s social media accounts to receive the latest updates and news about the broker, enhancing their trading experience with timely and relevant information.

Advantages and Disadvantages of StarTrader Customer Support

|

|

StarTrader vs Other Brokers

#1. StarTrader vs AvaTrade

StarTrader offers a versatile trading environment with access to over 200 CFDs, including metals and commodities, alongside competitive spreads and a low entry threshold. AvaTrade, on the other hand, caters to a larger audience with more than 1,250 financial instruments and a significant global presence, enhanced by rigorous regulation and licensing. AvaTrade’s broader instrument range and higher regulatory standards provide a more secure and diverse trading environment, especially suitable for traders looking for a variety of trading options and high safety levels.

Verdict: AvaTrade may be better for traders seeking a more extensive range of instruments and stronger regulatory protections.

#2. StarTrader vs RoboForex

StarTrader focuses on providing a straightforward trading experience with a choice between STP and ECN accounts, tailored for both new and experienced traders. RoboForex stands out with its extensive range of over 12,000 trading options and multiple trading platforms, including MetaTrader, cTrader, and RTrader. This broker is ideal for those who appreciate technological diversity and a vast array of trading choices. RoboForex’s commitment to providing personalized trading conditions and its innovative approach through contest-driven engagements on demo accounts make it a unique choice.

Verdict: RoboForex is likely a better option for traders who value a wide selection of trading platforms and the flexibility to experiment with trading strategies in a risk-free manner through contests.

#3. StarTrader vs FXChoice

While StarTrader offers an accessible platform with flexible leverage and multiple account types, FXChoice focuses more on serving experienced traders with its professional ECN accounts and a comprehensive suite of services for automated trading. FXChoice’s approach to catering to seasoned traders with tight market spreads and a robust regulatory framework under the FSC of Belize highlights its appeal to a more niche, professional market segment.

Verdict: FXChoice might be the preferable choice for experienced traders looking for advanced trading conditions and specialized services that support high-volume trading strategies. Conversely, StarTrader could be more suited for traders seeking broader account options and a more straightforward entry into Forex trading.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

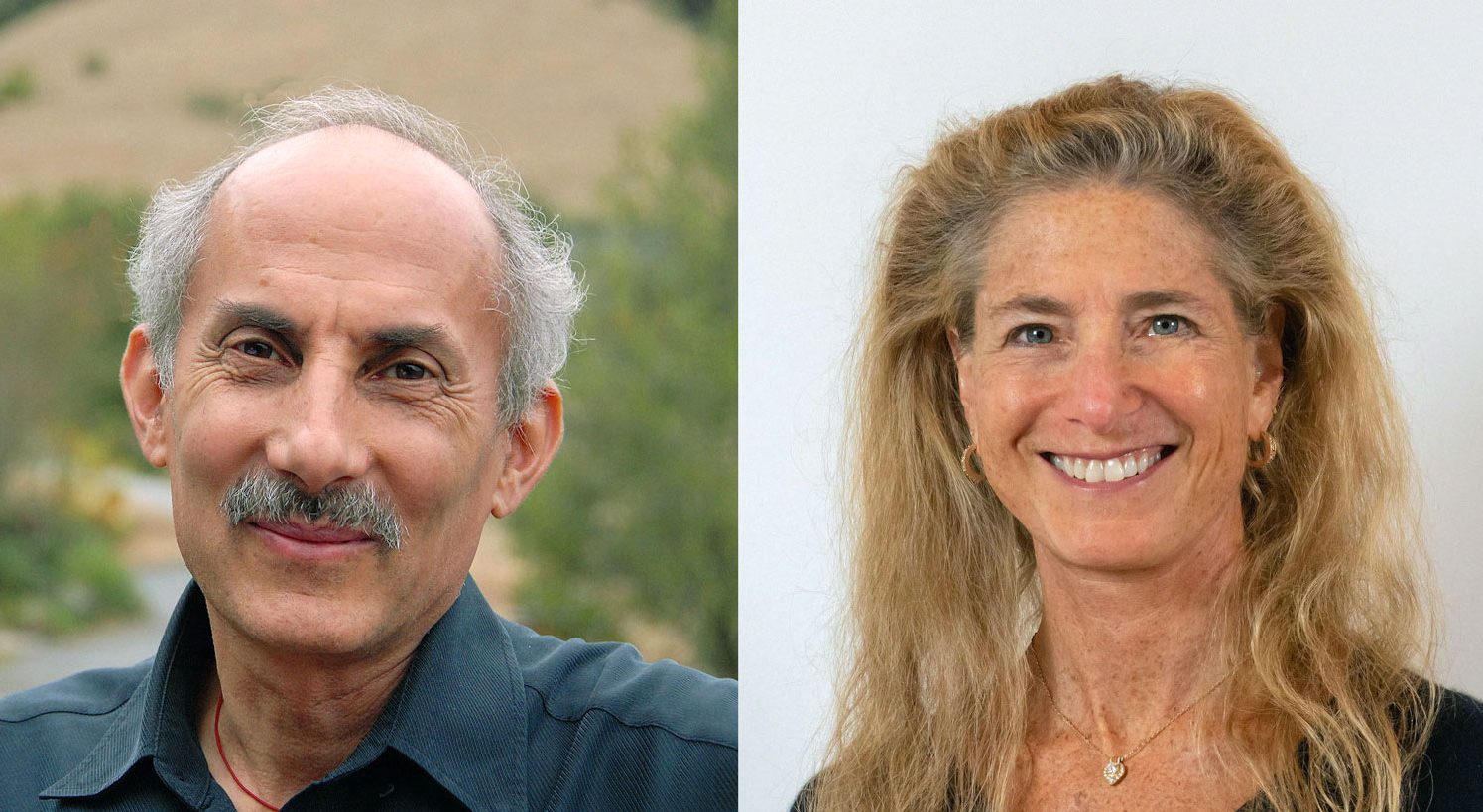

Choose Asia Forex Mentor for Your Forex Trading Success

If you are eager to build a successful career in forex trading and aim for significant financial returns, Asia Forex Mentor is the leading choice for top-notch forex, stock, and crypto trading education. Ezekiel Chew, celebrated for his influence on trading institutions and banks, is the key figure behind Asia Forex Mentor. Ezekiel is notable for consistently securing seven-figure trades, distinguishing him significantly from other educators in the sector. Below are the key reasons we recommend this program:

Comprehensive Curriculum: Asia Forex Mentor delivers a thorough educational program that spans forex, stock, and crypto trading. This detailed curriculum provides learners with the essential skills and knowledge to succeed in these varied markets.

Proven Track Record: The effectiveness of Asia Forex Mentor is proven by its history of cultivating consistently profitable traders across different markets, validating the quality of their teaching methods and mentorship.

Expert Mentor: At Asia Forex Mentor, students receive guidance from an expert mentor with proven success in forex, stock, and crypto trading. Ezekiel offers personalized support, helping students master the complexities of each market confidently.

Supportive Community: Enrollment in Asia Forex Mentor grants access to a collaborative community of ambitious traders focused on succeeding in forex, stock, and crypto markets. This network promotes collaboration, the exchange of ideas, and peer learning, enriching the educational journey.

Emphasis on Discipline and Psychology: Trading success requires a disciplined mindset. Asia Forex Mentor emphasizes psychological training to assist traders in managing their emotions, coping with stress, and making informed decisions under pressure.

Constant Updates and Resources: With the ever-changing landscape of the financial markets, Asia Forex Mentor keeps students informed with the latest trends, strategies, and insights. Ongoing access to these valuable resources ensures traders stay competitive.

Success Stories: Asia Forex Mentor is proud of its many success stories, with numerous students enhancing their trading skills and achieving financial independence through its comprehensive education in forex, stock, and crypto trading.

Asia Forex Mentor stands out as the premier institution for those looking to excel in forex, stock, and crypto trading, aiming to forge a lucrative career and attain financial success. With its extensive curriculum, experienced mentors, practical training approach, and supportive community, Asia Forex Mentor equips aspiring traders with the tools, trading strategy, and guidance necessary to become proficient professionals in diverse financial markets.

Conclusion: StarTrader Review

In conclusion, our team of trading experts at Dumb Little Man has conducted a thorough review of StarTrader, revealing both its strengths and areas where caution is advised. StarTrader excels in providing a diverse range of trading options, including over 200 CFDs across multiple asset types such as currencies, stocks, and commodities. This extensive selection, combined with competitive spreads and a robust trading platform, establishes StarTrader as an attractive option for both novice and experienced traders.

However, potential users should be mindful of some drawbacks. The limited availability of customer support on weekends could be a significant inconvenience, particularly for those who trade on a 24/5 schedule and may require assistance during off-peak times. Additionally, while StarTrader promotes a no-fee structure on deposits and withdrawals, traders should remain aware of possible third-party fees that can affect overall transaction costs, especially in international banking scenarios.

>> Also Read: Tradiso Review 2024 with Rankings By Dumb Little Man

StarTrader Review FAQs

What types of trading accounts does ForexChief offer?

ForexChief provides several types of trading accounts to cater to various trader needs, including standard and cent accounts for beginners, as well as direct access accounts for more experienced traders seeking lower spreads and higher execution speeds. Each account type is designed to offer specific benefits, ensuring that traders of all levels find options that suit their trading strategies.

Does ForexChief provide educational resources for new traders?

Yes, ForexChief offers a comprehensive suite of educational materials aimed at new and inexperienced traders. This includes detailed guides on basic trading concepts, advanced strategies, and analytical techniques. Additionally, ForexChief provides access to webinars and seminars to further support traders in developing their understanding of the markets and refining their trading skills.

How does ForexChief ensure the security of trader funds?

ForexChief prioritizes the security of client funds through stringent measures. It uses segregated accounts to keep client funds separate from the company’s operating funds. Furthermore, ForexChief adheres to international regulatory standards, providing an additional layer of security and peace of mind for traders.

Aliver

Aliver