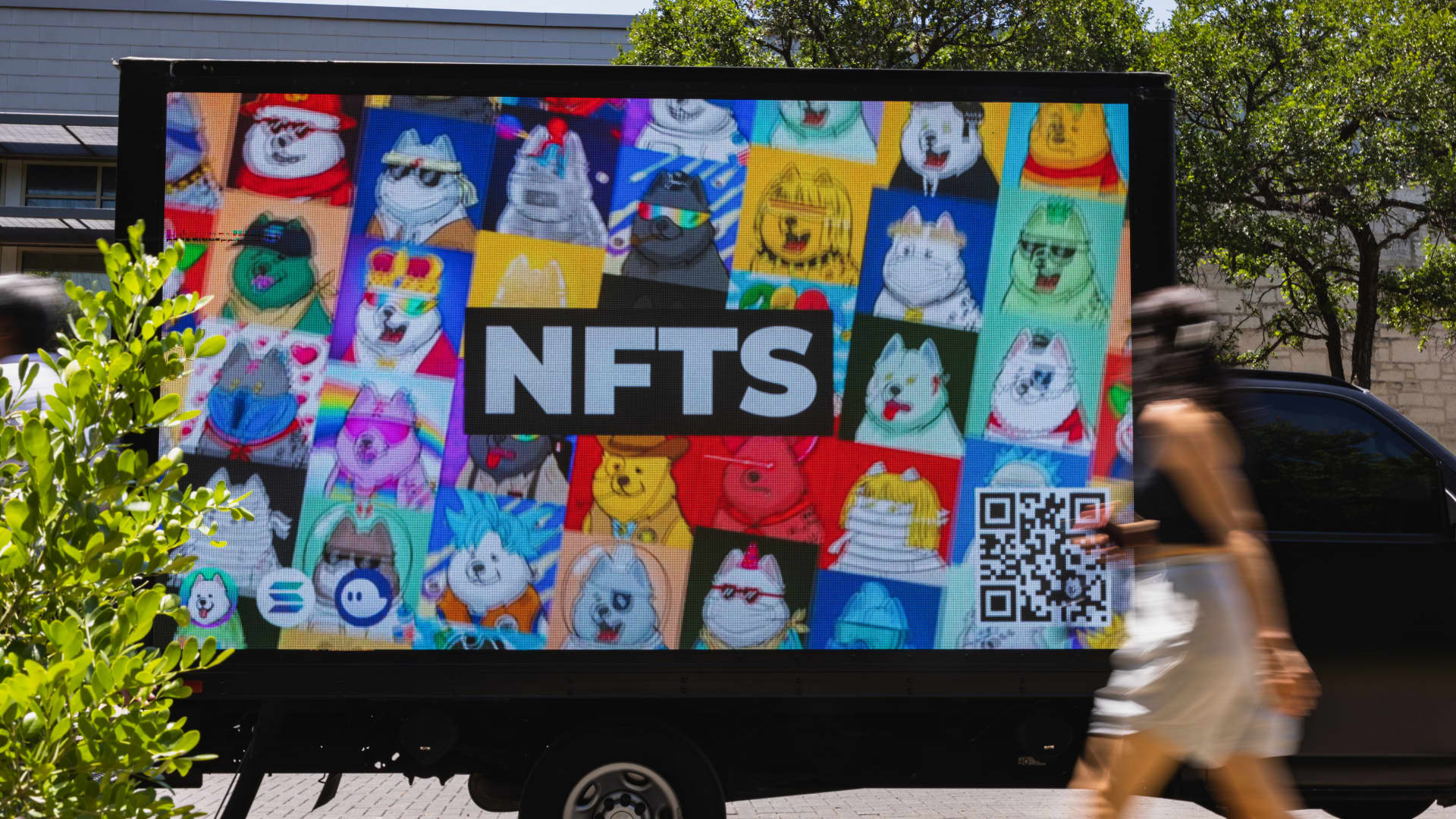

The IRS may tax certain NFTs at a higher rate in the future — here’s what to know

The IRS is considering whether or not to tax NFTs the same way it taxes other tangible collectibles such as artwork and gems. Here's what to know.

You may have to pay higher taxes on certain non-fungible tokens (NFTs).

The Internal Revenue Service wants the public to weigh in on its plan to tax some NFTs the same way it taxes tangible collectibles such as artwork or precious metals. Taxpayers have until June 19 to comment on the proposal.

Currently, the IRS treats NFTs and cryptocurrency as property for federal income tax purposes, according to the agency's website. It characterizes an NFT as "a unique digital identifier that is recorded using distributed ledger technology and may be used to certify authenticity and ownership of an associated right or asset."

That means if you sell an NFT for less than the amount you paid for it, you can use those losses to offset profits you've earned from other investments, known as capital gains. You're also able to reduce your regular income by up to $3,000 if your losses exceed your annual capital gains.

Capital gains are typically taxed at a lower rate than income you earn from your job or side gig. The tax rate for long-term capital gains — or what you pay on an asset you've held for more than a year before selling it — can range from 0%, 15% or 20%, depending on your income level.

However, net profits earned from selling a collectible are subject to a higher tax rate of 28%. The IRS defines a collectible as tangible personal property, such as any work of art or any rug or antique. So, if the IRS decides to treat NFTs as collectibles for tax purposes, sellers may be faced with a higher tax bill.

In order to determine whether a specific NFT is a collectible, the IRS plans to conduct a "look-through analysis," which is a process that helps the agency figure out if an NFT represents ownership of an asset it already considers to be a collectible.

Say you own an NFT that certifies ownership of a gem. The NFT would be considered a collectible because gems fall under the IRS's definition of tangible collectibles, the agency's website explains.

For the current tax season, the IRS plans to use this analysis to determine when an NFT is treated as a collectible until the agency issues additional guidance in future months.

The NFT market started the year off with a sizable surge in trading volume, according to NFT and DeFi tracking company DappRadar's latest report.

In the first quarter of 2023, the NFT market's trading volume reached a total value of $4.7 billion on 19.4 million NFT sales, according to the report. That's up from trading volume of $1.9 billion on 18 million sales in the fourth quarter of 2022.

DON'T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Take this survey and tell us how you want to take your money and career to the next level.

JimMin

JimMin