US Dollar Dynamics: Inflation’s Impact and Key Currency Pairs

Dollar’s Recent Surge After a lackluster performance earlier in the month, the U.S. dollar index (DXY) climbed 0.23% to 105.31 this past week. This rise was supported by an increase in U.S. Treasury yields and a cautious approach from...

Dollar’s Recent Surge

After a lackluster performance earlier in the month, the U.S. dollar index (DXY) climbed 0.23% to 105.31 this past week. This rise was supported by an increase in U.S. Treasury yields and a cautious approach from traders awaiting the U.S. consumer price index (CPI) for April, due this Wednesday.

If the trend of higher-than-expected inflation continues, the dollar might strengthen further. Upcoming data from the Bureau of Labor Statistics could confirm this trend, with forecasts suggesting modest increases in both headline and core CPI.

Dollar Vulnerabilities

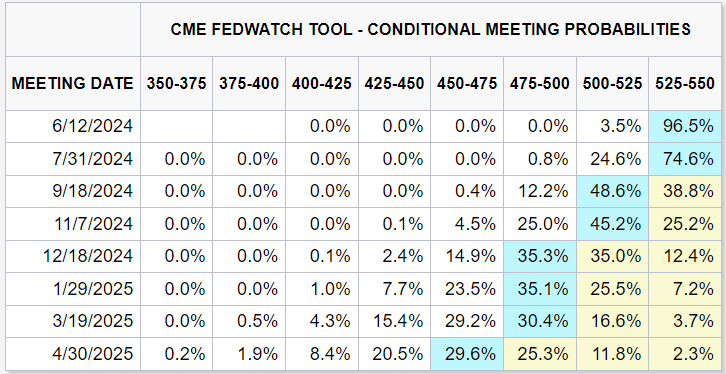

For those betting against the dollar, only a CPI report that meets or falls below expectations could weaken the currency further. Lower-than-expected inflation figures might fuel speculation about the Federal Reserve cutting rates in September, a move currently seen as a 48.6% likelihood by traders.

FOMC Meeting Probabilities

Source: CME Group via DailyFX.com

Source: CME Group via DailyFX.comInterest Rate Implications

A surprise increase in CPI might lead to higher yields and delay the Fed’s easing actions, possibly extending into late 2024 or 2025. As other central banks may begin rate cuts, sustained higher rates in the U.S. could support the dollar in the short term.

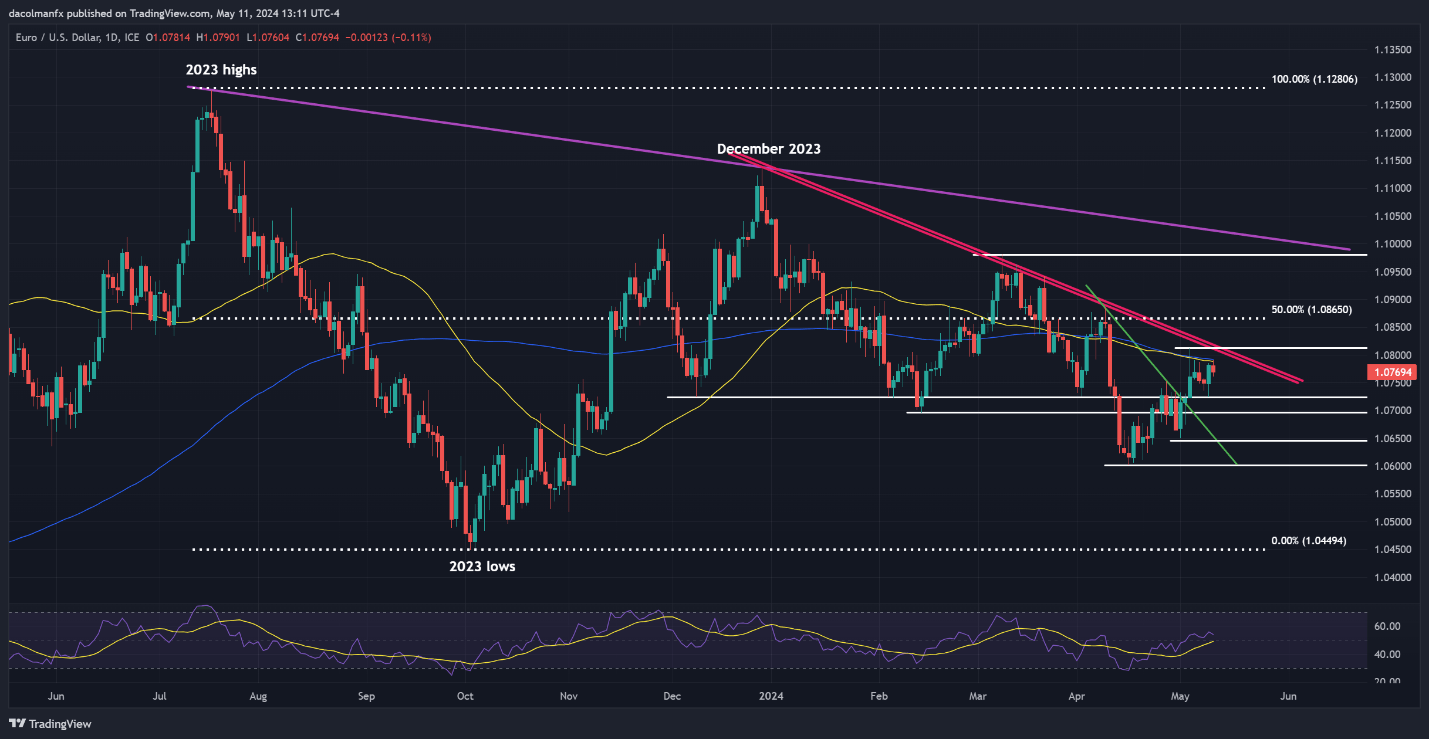

EUR/USD Analysis

Last week, EUR/USD faced resistance at its 50-day and 200-day moving averages, set at 1.0790. If bears fail to maintain this resistance, the pair could approach the 1.0810 trendline. Stronger movements could reach 1.0865, a significant Fibonacci retracement level.

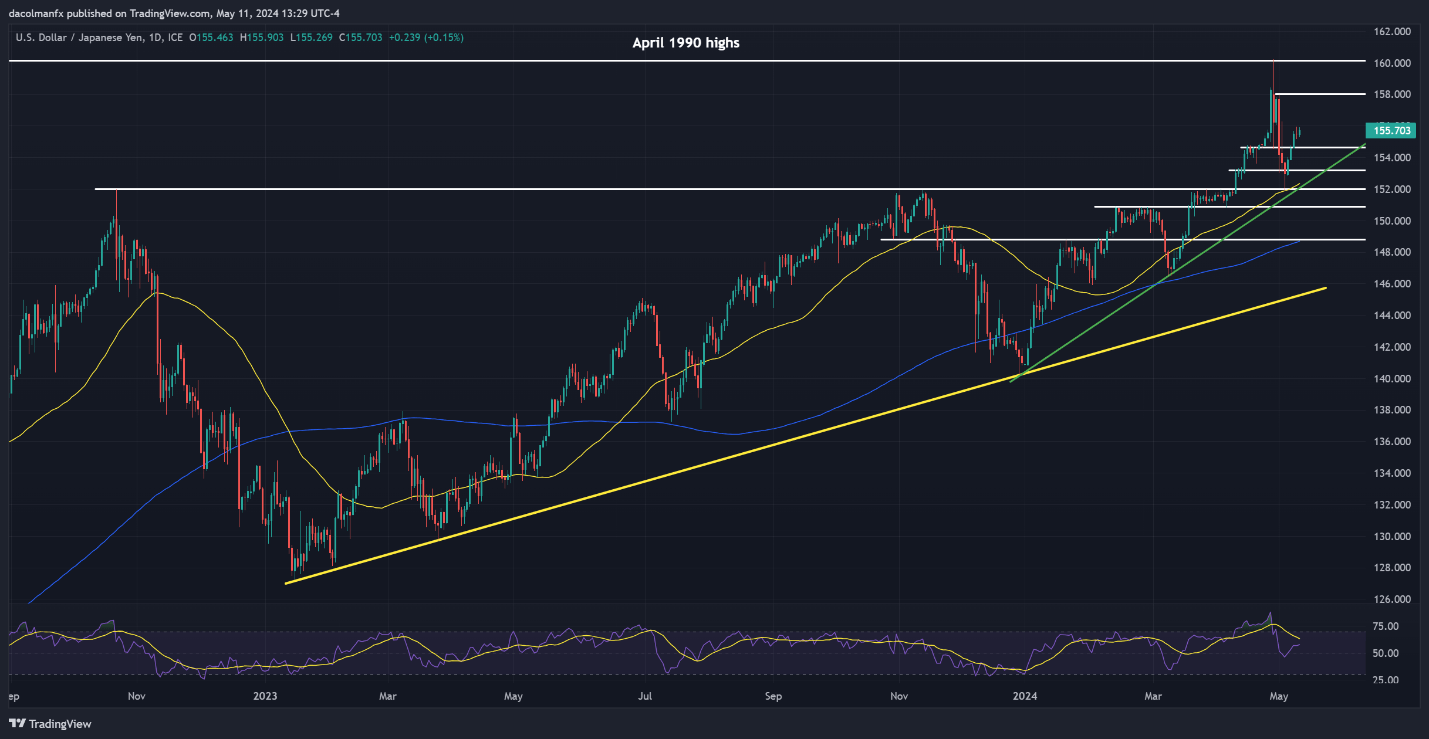

USD/JPY Analysis

USD/JPY showed renewed strength, surpassing 155.50. Resistance is expected at 158.00 and 160.00. However, any rally faces the risk of Japanese FX intervention, which could sharply reverse gains.

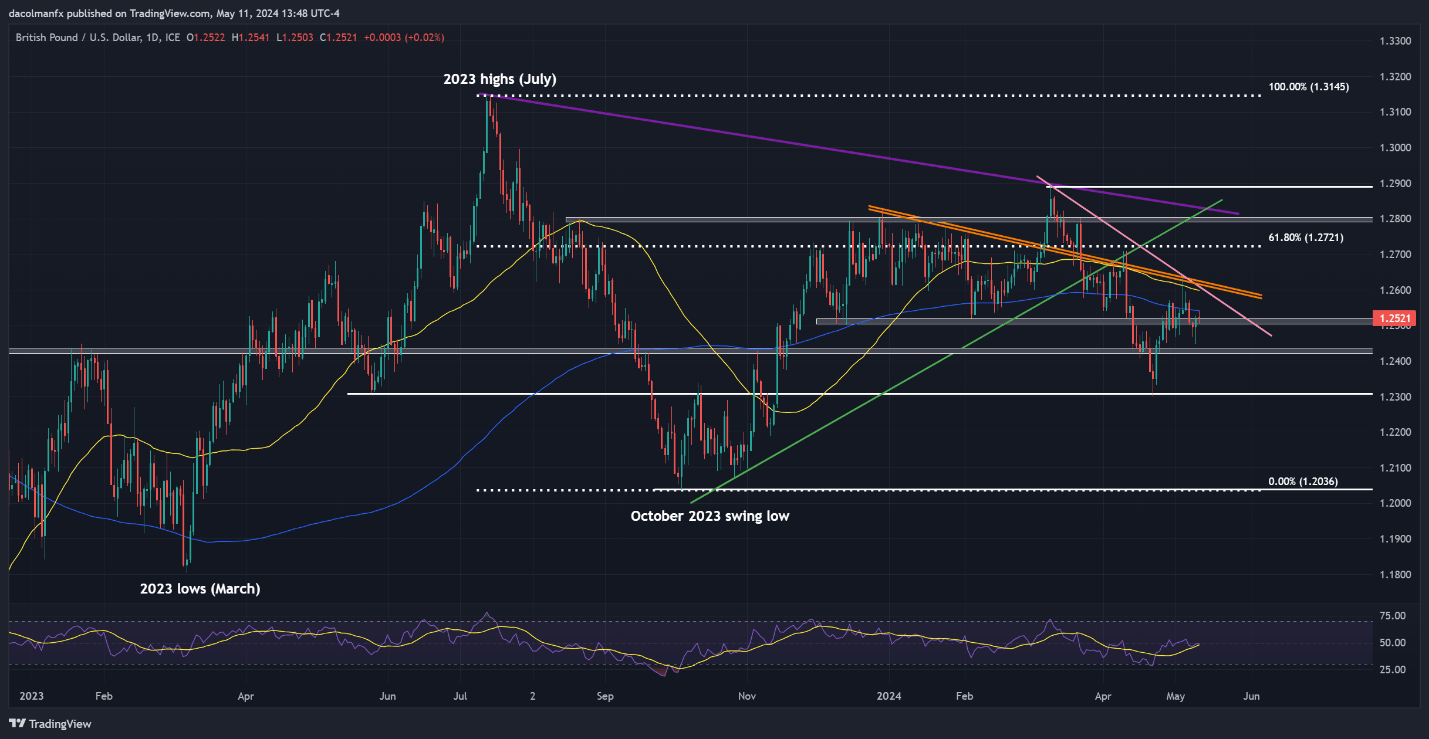

GBP/USD Analysis

GBP/USD managed to maintain above the 1.2500 support last week. Bulls need to defend this level to prevent a drop towards 1.2430 or even lower to April’s lows at 1.2300. On the upside, breaking above the 200-day SMA could challenge resistance at 1.2600 and 1.2630, potentially leading to a rally towards 1.2720.

This analysis provides investors with a detailed look at potential movements in major currency pairs, helping them strategize based on upcoming economic data and market sentiment.

Koichiko

Koichiko