We’ve been using AEON Bank & its debit card since it launched, is it worth signing up for?

We tried the new AEON Bank, Malaysia's first Shariah-compliant digital bank, and used its Debit Card-i Card that earns 3x AEON Points.

The second digital bank in Malaysia to join the party, AEON Bank was launched nearly a month ago now.

During this time, I’ve been familiarising myself with the digital bank and its offerings. In fact, it saved me when I forgot my wallet and needed to withdraw some cash from the ATM, as it was the only card I had on me. (I did have to pay a RM1 service fee, though.)

But that anecdote aside, here’s what my experience using AEON Bank over the past few weeks was like.

Perks galore

The first question that one may ask when thinking of making a new account is: What’s in it for me?

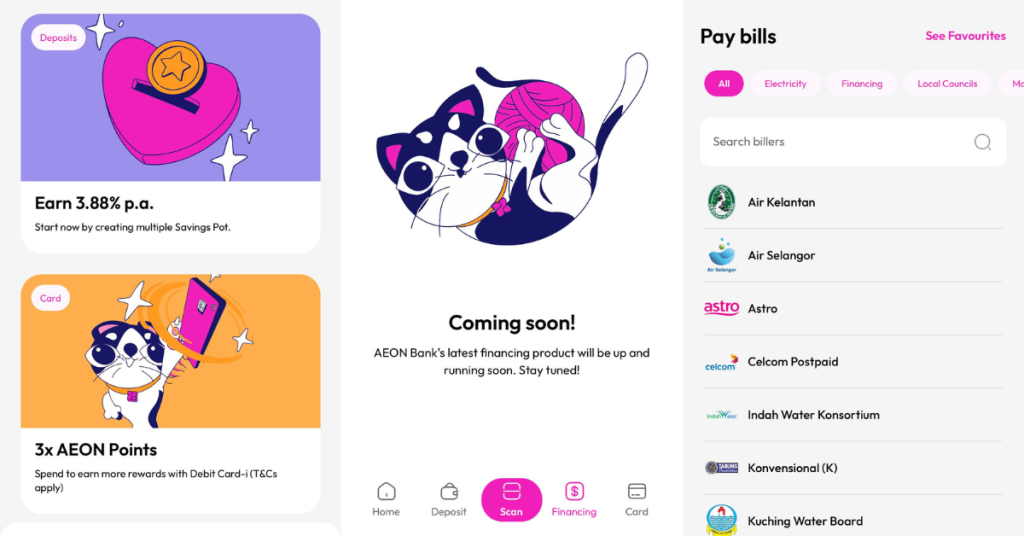

Off the bat, a big plus point is the profit rate of 3.88%, which is higher compared to the interest rate offered by the other digital banks currently available (GXBank and Boost Bank).

The difference, though, is that AEON Bank will only deposit your returns at the end of the month.

Aside from the profit rate, another way to “earn” is by spending. When spending with AEON Bank’s debit card, users will earn 1 AEON Point for every RM1 spent.

On top of that, from now until August 31, 2024, users can earn 3x AEON points when spending with their debit card. That means if you spend RM100 during this promotional period, you’ll earn 300 points.

With 200 points equalling to RM1, this is equivalent to a 1.5% cashback.

There’s also an ongoing campaign right now whereby you’ll get 3,000 points (worth RM15) upon sign-up.

As a frequent AEON shopper, it’s also nice to know that you can earn an extra point when shopping at AEON Stores, AEON MaxValu Prime, AEON Wellness, and AEON Big Hypermarkets.

By displaying your AEON Points Programme membership barcode within the AEON Bank application to the cashier or self-service check-out scanner at the locations, you’ll be awarded an extra AEON Point for every RM1 spent.

Currently, AEON Bank is waiving its one-year membership fee (RM12) for its AEON Points Programme.

As you can see, a lot of these perks are being offered to early adopters, so if you’re hoping to get a piece of the rewards pie, you should join now. (No, I was not paid to say that.)

And of course, the digital bank is Shariah-compliant, and the only one on the Malaysian market so far.

That doesn’t just mean that Muslims will have ease of mind while using it—for non-Muslim users, you can also rest assured that this means the bank holds true to socially responsible practices, designed to prevent social harm while protecting individuals.

A fun and intuitive interface

Out of all the digital banks I’ve tried thus far, I will say that the branding and user interface of AEON Bank has been the most on point.

This is a bit of a subjective thing, but I just love the bright, clean look and the adorable illustrations. Where apps like GXBank had given off a more tech-forward and alluring vibe, I adore the friendliness of the AEON Bank app.

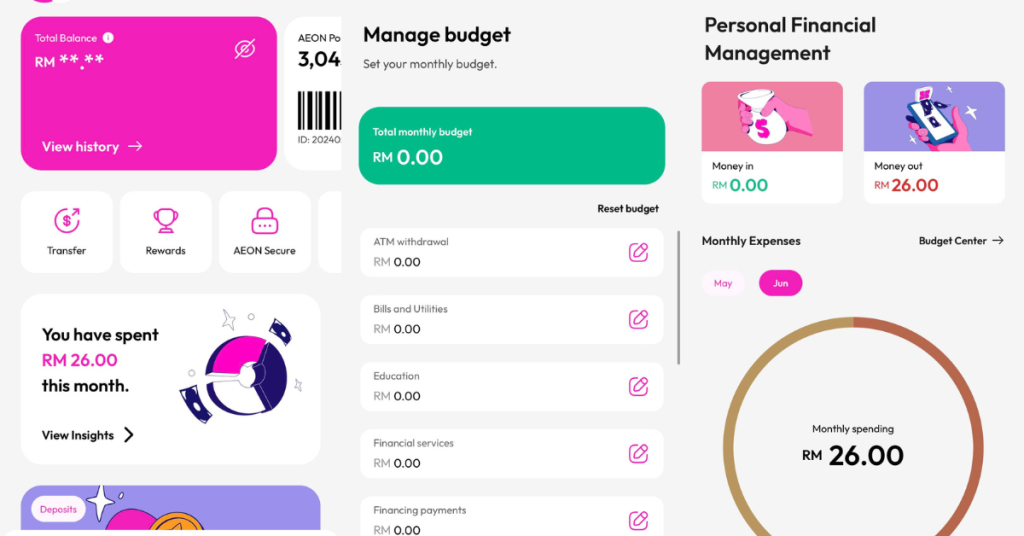

Another thing that this bank features is the Personal Financial Management tab that reminds me of the MAE app’s expense tab.

Here, you can also access the Budget Centre, where you can add budgets for ATM withdrawals, Bills and Utilities, Retail & Shopping, F&B, and all sorts of other categories.

On the topic of bills, AEON Bank actually enables users to pay bills directly through the app, which is a nice addition.

However, the app doesn’t always categorise the payments accordingly. For example, my payment to a café was logged under “Groceries” and I can’t seem to be able to change that.

Compared to GXBank, I would say AEON Bank’s app actually offers a more holistic experience and outlook on your finances, which is a great plus.

Taking it out on the town

Setting up an account on AEON Bank is super simple, as is with the other digital banks—ease of access is the name of the game, after all.

Something cool about the setup process is that the bank gives you a chance to personalise the last four digits of your account number. I requested for 0001, and they actually gave it to me.

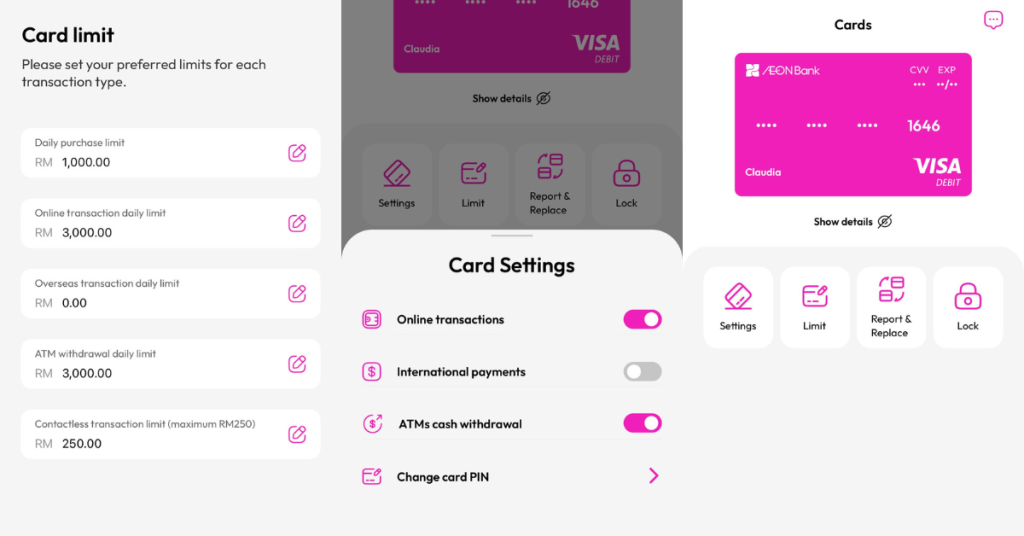

Requesting for a physical card was super easy as well, and it arrived in my mailbox just a couple of days later. Activating it only takes a few taps on the app, and the card tab lets you adjust the card limit while offering other security features such as locking the card.

One thing I have to comment on is that the card is so, so bright. I mean that literally. When I flash it, people tend to comment on just how loud it is. The fuchsia tone is quite glaring, yes, but I suppose it matches the rest of the app. Well, rest assured that you won’t ever lose it in your wallet.

The app already has DuitNow QR transfers enabled, so even if you don’t have your card with you yet, you can still easily pay at most stores. You won’t earn any AEON Points when you pay via QR, though.

All that said, there are a few downsides to the app so far that I’ve faced. The major one is that adding money into your account is not as seamless.

Now, this might be a strategy to prevent you from overspending, but I personally find it to be a bit of a pain. Unlike Boost Bank and GXBank which has an easy “Add Money” button, there’s no such thing on the AEON Bank app.

Instead, you’d need to DuitNow the money from another bank. No, it’s not the end of the world, but it certainly adds that extra bit of friction that could end up making or breaking your experience.

A bright future ahead

In any case, AEON Bank has been promising thus far. I love the approachability of the app and its loyalty programme really is quite rewarding, especially during this promotional period.

I’m excited to see more products being launched, particularly in the financing realm. It’ll be cool to see AEON Bank grow further into its mandate of Shariah-compliant financial inclusion.

Learn more about AEON Bank here. Read other articles we’ve written about digital banking here.

MikeTyes

MikeTyes