When does arbitrage become market manipulation? India crackdown brings issue into focus

When does arbitrage edge into illegality? The line between arbitrage and market manipulation has long been one of the greyest areas in financial markets.

A screen shows the Dow Jones Industrial Average after the close of trading on the floor at the New York Stock Exchange after the closing bell in New York City, U.S., April 4, 2025.

Brendan McDermid | Reuters

The line between arbitrage and market manipulation has long been one of the grayest areas in financial markets — and India's recent action against high-frequency trading giant Jane Street has brought this murky boundary into sharp focus.

Jane Street disputed the findings from India's regulator, claiming that its actions were "basic index arbitrage trading."

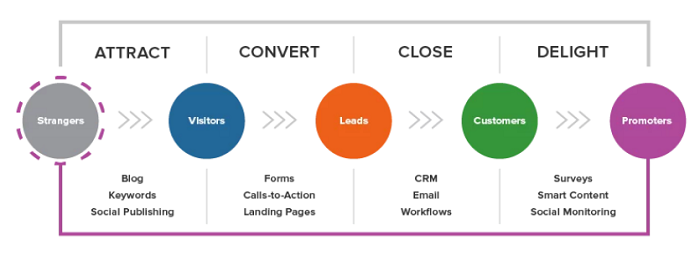

Arbitrage, at its core, is like spotting a mismatch and trying to make a profit out of it — and it is perfectly legal. It refers to the simultaneous buying and selling of an asset in different markets to exploit price differences.

Market manipulation, by contrast, is an illegal act designed to deceive or distort the free and fair operation of markets — typically by influencing prices or misleading appearances of supply and demand for unfair advantage.

But when does arbitrage edge into illegality?

According to experts whom CNBC spoke to, the distinction hinges on intent and market impact.

If you're the one pushing prices out of alignment — especially in less liquid markets — to profit on the other side, then that's manipulation.

Pradeep Yadav

finance professor at the University of Oklahoma

On July 3, India's Securities and Exchange Board (SEBI) temporarily blocked Jane Street Group from participating in the country's securities markets, accusing the U.S. high-frequency trading firm of large-scale market manipulation. This includes tactics to manipulate India's Nifty 50 index in order to profit from sizable positions in index options.

According to SEBI's 105-page interim order, the firm allegedly bought large volumes of stocks and futures tied to the Nifty Bank Index, which tracks the performance of India's banking sector, during the early hours of trading. It then placed significant wagers anticipating a decline in the index later in the session.

SEBI added that Jane Street subsequently sold off those earlier purchases, pushing the index lower and increasing the profitability of its options positions. The regulator argued that this was part of a "deliberate strategy to manipulate indices" for the benefit of its larger and more lucrative options bets.

SEBI said that the intensity and sheer scale of the intervention, coupled with the rapid unwinding of positions "without any plausible economic rationale," was deemed manipulative.

Jane Street informed employees in an internal email that it planned to challenge the ban and would later deposit $567 million into an escrow account on July 14, as directed by SEBI, not before requesting permission to resume trading in the country and the lifting of restrictions.

The key: mens rea

As the legal back-and-forth commences, industry veterans said the difference between legal arbitrage and illegal manipulation isn't always clear-cut.

The intention behind wrongdoing in trades — known as mens rea, which means "guilty mind" in Latin — is key to determining manipulation, said Pradeep Yadav, finance professor at the University of Oklahoma. He also pointed out that creating an arbitrage opportunity by influencing prices in a less liquid market is what crosses the line into illegality.

"Arbitrage turns into market manipulation when you are creating the arbitrage by manipulating the less liquid side of the market," he said, explaining that the options market in India is very liquid thanks to the large volume of buyers and sellers. However, the country's spot and futures markets are less so, which renders it easier to push prices by placing large enough trades.

This kind of arbitrage, while aggressive, is legal and often beneficial to market efficiency.

V Raghunathan

Former SEBI board member

SEBI's case hinges on two claims. First, Jane Street intentionally distorted the less liquid cash market to profit on the more liquid options market. Indeed, SEBI, in its interim order against Jane Street, cited an earlier judgement from a case, "Nobody intentionally trades for loss. An intentional trading for loss per se, is not a genuine dealing in securities."

Second, that its profits came entirely from options, with consistent losses in stocks and futures, suggesting the trades were designed to move prices rather than reflect genuine market views.

"Mens rea is the demonstration of ill intent to manipulate the market… if prices are already misaligned, arbitraging them is fine. But if you're the one pushing prices out of alignment — especially in less liquid markets — to profit on the other side, then that's manipulation," said the professor, who added that in a normal arbitrage situation, the size of one's stock trade and their options trade would be proportional. The imbalance, in his view, suggested it was not a case of classic arbitrage.

A statue of Justitia holds a weighing bowl in front of a district court.

Picture Alliance | Picture Alliance | Getty Images

Other experts also emphasized that the fine line between market manipulation and arbitrage lies in intent.

However, V Raghunathan, a former SEBI primary market board member, believes that Jane Street's actions were within the legal realm. Jane Street thrives in exploiting minute inefficiencies — for example, in ETF pricing versus underlying securities, or between exchanges, he said.

"This kind of arbitrage, while aggressive, is legal and often beneficial to market efficiency," he told CNBC.

He cited the example of latency arbitrage — where firms profit from tiny time delays in market data across venues — as being criticized as parasitic or predatory, but hardly illegal.

That said, Raghunathan noted that the broader concern is whether Jane Street's strategies came close to manipulation — in either intent or the letter of the law.

Get a weekly roundup of news from India in your inbox every Thursday.

Subscribe now

Like other experts whom CNBC spoke to, Raghunathan established market manipulation as deliberately misleading or influencing prices and trading volumes to create artificial trends or unfair advantages, such as pump-and-dump schemes and wash trading.

"In short, unless Jane Street is found to be placing deceptive orders, like spoofing, abusing confidential information, or manipulating prices to create artificial moves — none of which it has been accused of — it would not be considered to have engaged in market manipulation," he said.

Paul Rowady, director of research at Alphacution Research, said that the lines between manipulation and arbitration also depend on the regulator's teeth. In the U.S., similar allegations would hinge on whether a firm engaged in spoofing or deception.

"Trading aggressively is not a crime," he said.

Market watchers also echoed that the Jane Street case spotlights the vulnerabilities of India's market structure — including liquidity imbalances between spot and options markets — which sophisticated players can legally exploit but which regulators may now seek to tighten.

According to SEBI, a recent study of 9.6 million individual equity derivative traders revealed that 91% lost money last year.

As a former U.S. SEC litigator, Howard Fischer puts it, arbitrage is akin to "looking at one's neighbor's house, seeing he keeps stacks of newspapers and lit candles everywhere, and taking out fire insurance on his home."

"Manipulation is giving him a July 4th present of firecrackers and propane tanks," Fischer, who is now a partner at law firm Moses & Singer, said.

The distinction lies in intent: arbitrage exploits inefficiencies; manipulation tries to manufacture them.

Tekef

Tekef