GBTA Survey: Economy, Not Covid, Chief Threat to '23 Travel Volume

International business travel recovery has reached the halfway mark as economic concerns now overshadow Covid-19 as the key obstacle to business travel, according to a Global Business Travel Association poll of 594 member travel buyers and suppliers.

International business travel recovery has reached the halfway mark as economic concerns now overshadow Covid-19 as the key obstacle to business travel, according to a Global Business Travel Association poll of 594 member travel buyers and suppliers.

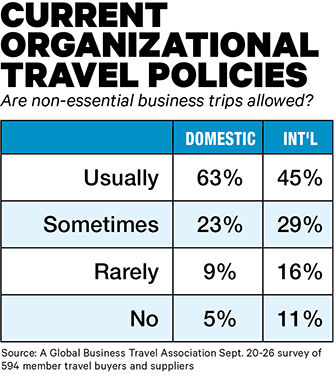

Travel managers in the survey on average said their domestic business travel volumes have reached 63 percent of their 2019 levels, and international travel reached an average of 50 percent of 2019 levels. About a quarter of buyers surveyed said international travel has surpassed 70 percent of pre-Covid-19 volumes. A solid majority said their company now allows non-essential business travel, 86 percent for domestic and 74 percent for international.

"We continue to see progress as business travel makes its way back to being a $1.4 trillion global industry, pre-pandemic," GBTA CEO Suzanne Neufang said in a statement. "It is also important to understand the context of global business travel's recovery. Asia is still opening its borders, international business travel in general started picking up only earlier this year across the globe, and the U.S. has only permitted unrestricted travel since June."

In terms of expectations for 2023, only 4 percent of travel suppliers in the survey said Covid-19 would be the most likely culprit in reduced business travel bookings, compared with 80 percent who were more concerned about tighter or frozen travel budgets due to high inflation or a recession, according to GBTA.

At this point, however, both buyers and suppliers think 2023 will be a stronger year for business travel than this year. Nearly 80 percent of travel managers said their employees will take more business trips in 2023 than this year, and about two-thirds said both internal and external travel will increase year over year in 2023. Among suppliers, 80 percent said they expect their corporate clients' travel spending will be up next year, and 85 percent said bookings will be higher year over year.

Hybrid office/remote work setups, with employees expected to report to the office on some days, continue to be the dominant model, in use by about two-thirds of the survey's respondents, GBTA reported. Only 12 percent said they are back in the office full-time, while 20 percent said their companies are fully remote. Those with hybrid or fully remote set-ups do not expect a large impact on business travel, with 72 percent saying it would not affect the number of business trips their employees take. The remainder were evenly split in saying it would result in either more or less travel, according to GBTA.

GBTA conducted the survey from Sept. 20 through Sept. 26. About half the respondents were either travel managers and buyers or other procurement and sourcing professionals; a third were travel suppliers; 10 percent worked with travel management companies; and the rest were classified as "other."

AbJimroe

AbJimroe