Is P2P financing right for you? We unpack the pros & cons every M’sian investor should know.

We unpack the pros and cons, as well as benefits and risks, of peer-to-peer (P2P) financing that every investor in Malaysia should know.

[This is a sponsored article with CapBay.]

Nowadays, everyone seems to be on the lookout for new ways to make their money work for them. One method that has gained traction in Malaysia in recent years is peer-to-peer (P2P) financing, which lets investors fund SMEs while earning potentially high returns.

Not to be confused with equity crowdfunding, P2P financing provides financing to SMEs, which later translates into investment notes for investors to invest in. In return, investors are repaid with profit.

Several P2P platforms are already in the market, including CapBay, a leading player in Malaysia alongside others like Crowdfundr and Microleap.

As with any investment, it’s essential to weigh the benefits and risks involved. In partnership with CapBay, we’ll break them down in this article, and show how the platform eases the barrier for investors to get started.

Pros of P2P financing

1. High returns for investors

If you’re hoping to earn higher returns than a typical savings account or fixed deposit, P2P financing might fit the bill.

Take CapBay for example: It offers net returns of up to 10% per annum, depending on your investment portfolio and your risk tolerance.

2. Easy to diversify investments

When it comes to managing investment risk, diversification is key and P2P platforms make it easier to spread your funds across various businesses. This way, if one investment note doesn’t perform well, it won’t hit you as hard.

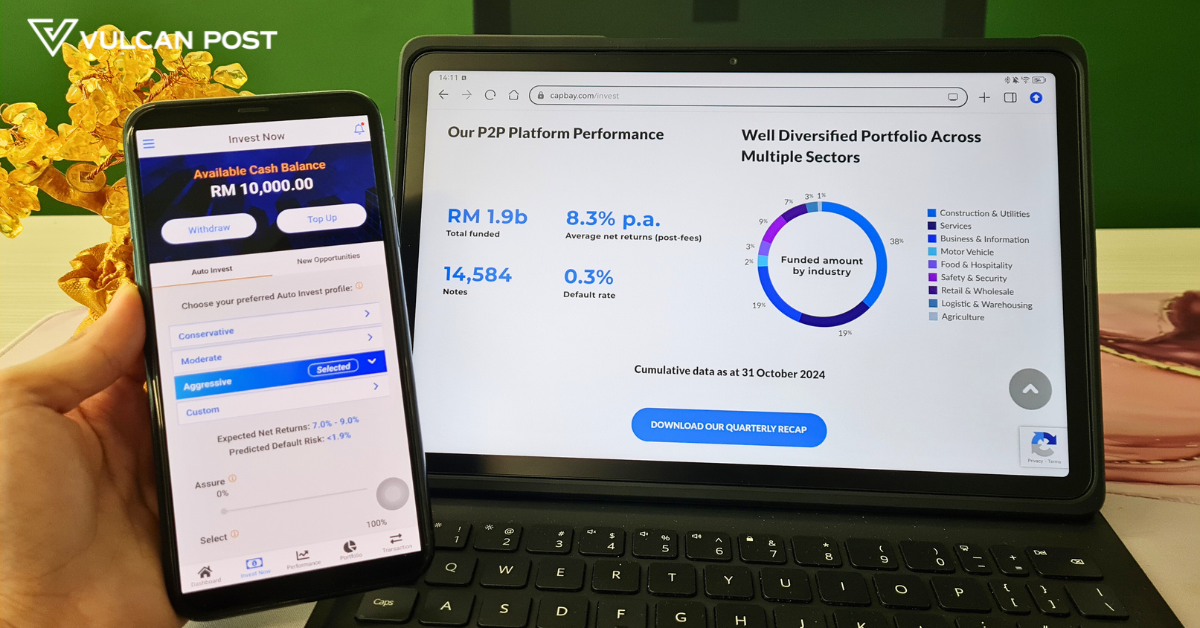

Image Credit: CapBay

Image Credit: CapBayCapBay simplifies this process too with its Auto Invest feature. Using an automated algorithm, this feature spreads your investments based on your risk appetite—Conservative, Moderate, or Aggressive.

There are several factors contributing to the algorithm such as issuer exposure, portfolio size, and cash balance. “Our Auto Invest feature is designed to give a hassle-free investment experience. Once the risk profile is chosen, the investments will run its course, selecting notes that fit the risk profile of our investors,” CapBay’s team shared.

3. High liquidity

Compared to certain traditional investments, P2P financing offers higher liquidity, making it easier to convert the investment back into cash.

Some P2P financing platforms even provide shorter tenures than the industry standard of 12 to 18 months. For example, CapBay offers P2P notes with tenures of up to six months.

This means that investors can enjoy quicker returns on investments, enhancing liquidity and making it easier to reinvest more frequently.

4. Shariah-compliant investment opportunities

If you prefer to invest in Shariah-compliant notes, don’t fret.

There are P2P financing platforms such as CapBay providing Shariah-compliant products to support businesses aligned with Islamic principles.

Since late 2023, the platform has been offering a Shariah-compliant P2P investment option called CapBay P2P Islamic. This option lets you invest in halal businesses while earning competitive returns.

Cons of P2P financing

1. Still new and unregulated in certain regions

With P2P financing being relatively new, it’s understandable to be concerned about platform security and credibility.

Image Credit: CapBay

Image Credit: CapBayIn Malaysia, however, P2P platforms like CapBay are regulated by the Securities Commission (SC), who enforce strict guidelines to ensure financial services operating in the country are secure and credible.

“Due to our robust alternative credit data and AI-powered credit scoring, our investors shouldn’t be worried about the funds that were invested in these businesses as we are able to maintain the lowest default rate since inception,” CapBay stated.

2. Capital requirements aren’t the same everywhere

Just like traditional investment opportunities, the capital requirements for P2P financing aren’t fixed across the board. Some platforms like Capsphere require as low as RM50, while others like Alixco require a higher amount of RM200.

For CapBay, the platform has a minimum capital requirement of RM10,000.

It may seem like a large sum, but the team explained that this allows for better diversification when using their Auto Invest feature. With a higher capital, you’re able to reduce the impact of defaults and achieve more stable returns.

Image Credit: CapBay

Image Credit: CapBay3. There could be risks of default

As an investor, you’re rightfully concerned about the risk of default, especially since P2P financing offers investment notes to underserved SMEs.

To mitigate this, platforms like CapBay conduct rigorous risk management and credit assessments before approving businesses for financing.

This is probably how CapBay has maintained the industry’s lowest default rate at 0.3% (as of October 2024), compared to the average rate of 2% to 3%.

If a default happens, CapBay explained that they’ll handle the recovery process with their experienced legal and recovery team. “Any funds recovered will be credited back to investors on a rank pari-passu basis based on the investment allocation amount, net of any recovery costs.”

Did you know: Pari-passu means “equal footing”, and in finance, it means two or more parties that are treated the same in regard to a financial claim or contract. This term can apply to many different areas of finance.

Investopedia4. Platform fees could lower investment profits

Another downside of P2P investment is platform fees that can eat into your returns. The fees vary across different platforms.

For example, CapBay charges a service fee between 10% and 30% on the gross profits earned by investors.

While this might seem steep at first, it’s not out of reason. For example, CapBay’s service fees are only applied to the profits, not the principal investment. Plus, they don’t charge other fees like sales or annual management fees.

Certain platforms like CapBay and Nusa Kapital also transparently showcase the expected returns after all fees, so you’ll have a clearer idea of your gains.

-//-

Unlike volatile market-linked investments, P2P financing offers expected rates of returns so it’s more predictable. But there is still the risk of defaults, and being a relatively new alternative investment option, regulations may change over time.

If you’re considering getting into P2P financing, CapBay’s platform offers a solid foundation to build on, with flexibility to match your risk preferences.

Whether you’re a new or seasoned investor, CapBay’s tools and support can help you navigate this exciting investment opportunity with confidence. Currently, the platform is offering full service fee rebates for new investors when you sign up from now until March 31, 2025.

Learn more about CapBay here. Read other finance-related topics here.Featured Image Credit: Vulcan Post

Astrong

Astrong