Market Direction: Key Insights for the Coming Week

This week is expected to be low-key until Wednesday, with hardly any significant data points until then. The key events include the 20-year Treasury auction, the release of Fed minutes, Nvidia’s earnings, and the expiration of VIX options, all...

This week is expected to be low-key until Wednesday, with hardly any significant data points until then. The key events include the 20-year Treasury auction, the release of Fed minutes, Nvidia’s earnings, and the expiration of VIX options, all scheduled for Wednesday. Prior to that, Monday and Tuesday are expected to be relatively quiet.

For fans of the Federal Reserve, there’s much to look forward to. Raphael Bostic is set to make multiple appearances, starting with an interview on Bloomberg TV at 7:30 AM ET on Monday, followed by remarks at the Atlanta Fed Financial Markets Conference at 8:45 AM, and ending the day with a panel at 7 PM ET. His engagements continue into Tuesday and Thursday, offering numerous insights into Fed policies.

Fed Governor Chris Waller will also be active this week, discussing the economic outlook on Tuesday and the concept of _R—the neutral rate_**—on Friday. His comments could indicate a higher than expected R, reflecting on recent market dynamics.

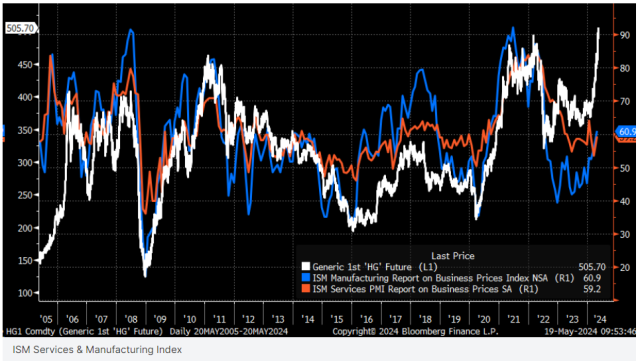

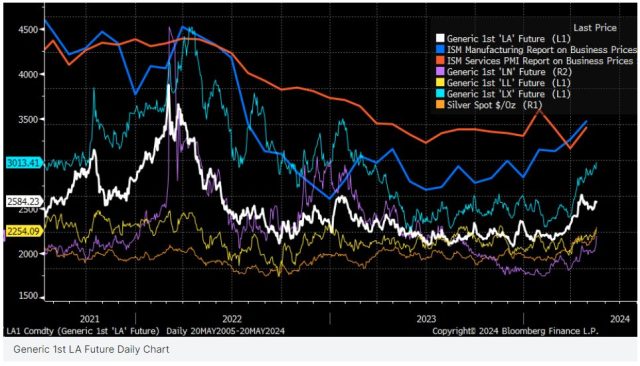

In the commodities market, copper prices have surged to over $5, a near 40% increase since early February, signaling potential inflation pressures. This rise in commodity prices, including silver, lead, zinc, and nickel, hints at broader market trends that could impact inflationary expectations.

Source: investing.com

Source: investing.comThe recent performance of oil prices also warrants attention. Oil has broken a downtrend in its RSI and maintained support at $78.50, suggesting a possible upward movement towards $85, which could further influence inflation rates and 10-year yields. These are closely tied to oil price movements, with the 10-year rates likely to rise if oil prices climb.

Source: investing.com

Source: investing.comEven gasoline shows signs of an upward trend, with a break in its downtrend RSI and a rebound in price, completing a head and shoulders pattern.

Source: investing.com

Source: investing.comSimilarly, natural gas prices are on the rise, appearing to breakout, which aligns with bullish trends in the energy sector, notably seen in the XLE stock index showing signs of a bull flag pattern.

Source: investing.com

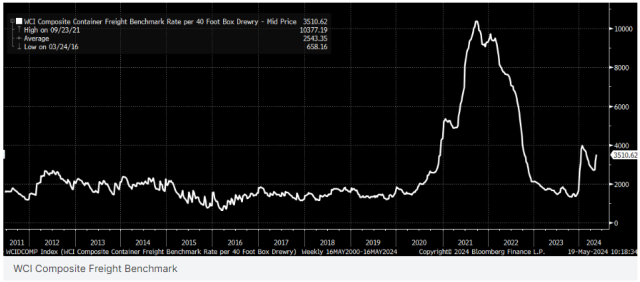

Source: investing.comThis is further corroborated by a recent increase in shipping rates, as per the WCI Composite Freight Benchmark, suggesting that metal prices and shipping rates are moving in tandem with energy prices.

Source: investing.com

Source: investing.comAll these factors combined—the movements in commodities, energy prices, and shipping rates—suggest that inflation rates could climb in the coming months, potentially challenging the notion that current monetary policy is sufficiently restrictive.

Source: investing.com

Source: investing.comWith Chris Waller’s commentary on R* this week, investors should pay close attention as his insights could reveal whether the Fed’s current policy settings are adequate to tackle the impending inflationary pressures.

Source: investing.com

Source: investing.comAs markets react to these indicators, the financial landscape looks set to shift, prompting a reassessment of current economic strategies and investments.

Source: investing.com

Source: investing.comUltimately, the culmination of these economic signals indicates a pivotal week ahead, as investors and policymakers alike gauge the potential for changes in market conditions and policy adjustments.

Source: investing.com

Source: investing.comThis analysis aims to provide investors with a concise overview of the pivotal events and market signals for the week, highlighting the potential shifts in market dynamics and policy implications.

AbJimroe

AbJimroe

![Run An Ecommerce SEO Audit in 4 Stages [+ Free Workbook]](https://api.backlinko.com/app/uploads/2025/06/ecommerce-seo-audit-featured-image.png)