Senate Banking Chairman Brown to introduce bill closing 'shadow' banking loophole after Elon Musk says Twitter will process payments

Sen. Sherrod Brown, D-Ohio, presented a bill Tuesday that aims to level the playing field between traditional banks and large companies practicing banking.

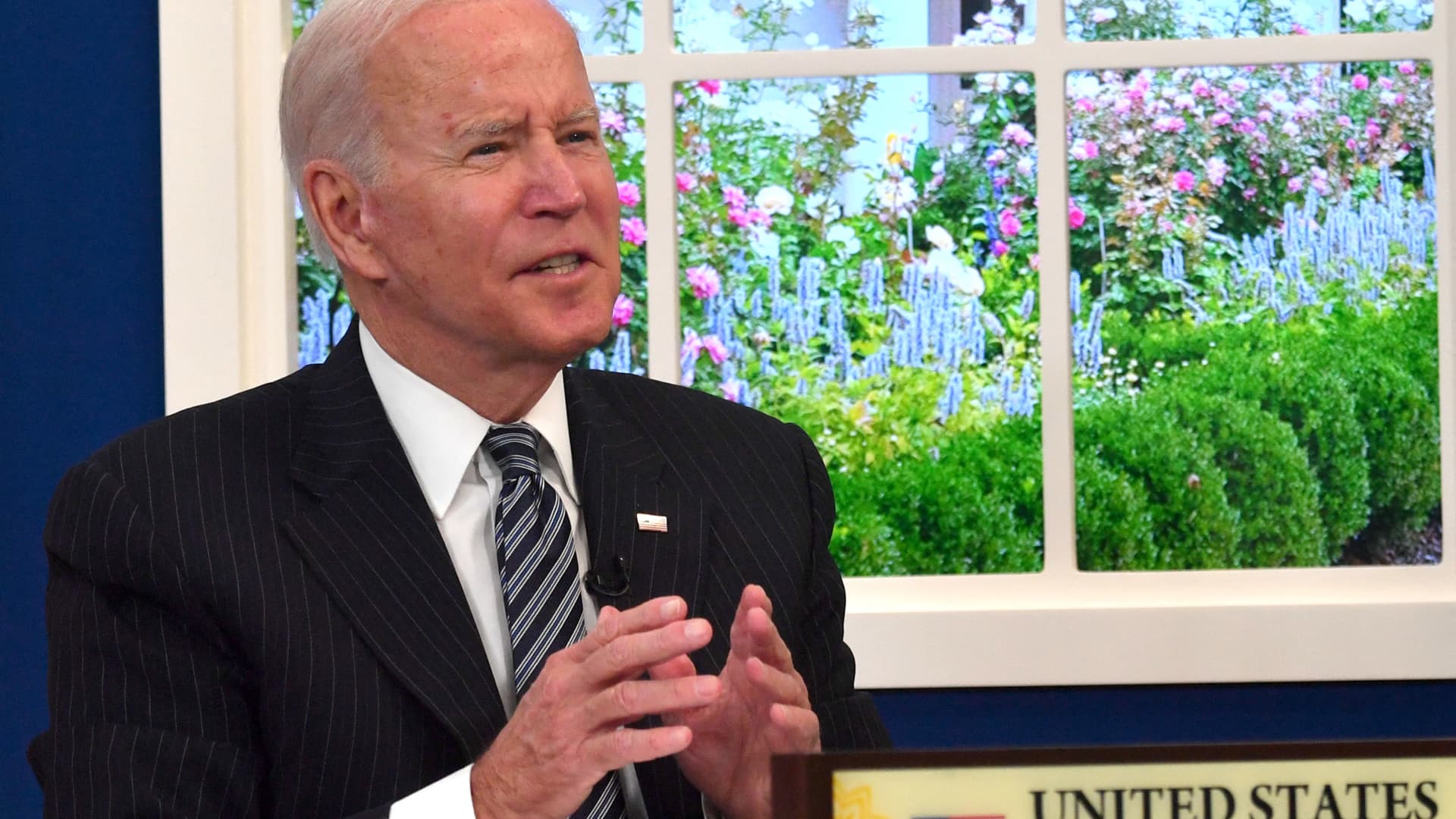

U.S. Sen. Sherrod Brown (D-OH) speaks to members of the media outside a briefing on the latest development of the COVID-19 outbreak to Senate members at Dirksen Senate Office Building March 12, 2020 on Capitol Hill in Washington, DC.

Alex Wong | Getty Images

Senate Banking Committee Chairman Sherrod Brown will introduce a bill Tuesday that aims to close the so-called shadow banking loophole that allows retail and tech companies to offer banking services without the same stringent oversight as other financial institutions.

The Close the Shadow Banking Loophole Act comes about a month after Twitter's new CEO Elon Musk shared his plan to transform the social media platform into a payment service and reportedly registered with the Treasury Department as a payments processor.

Allowing tech and commercial companies to act as banks without proper oversight "will only open doors for predatory lending, invasions of consumer privacy, and broader financial instability," Brown, D-Ohio, said in a press release. "To protect consumers' pocketbooks and ensure a strong banking system for Main Street, we need to ensure all banking institutions play by the same rules," he added.

Sens. Chris Van Hollen, D-Md., and Bob Casey, D-Pa., co-sponsored the bill. The measure complements a House bill, approved by the Financial Services Committee in June, that would close the loophole for so-called industrial loan companies, or ILCs, by subjecting them to the same regulations as federally insured banks.

The Independent Community Bankers of America, Americans for Financial Reform and the Bank Policy Institute are among 18 banking industry advocates that back the bill.

"The ILC loophole allows large commercial and technology firms to own full-service banks while skirting regulatory oversight—threatening the financial system, endangering consumers and the economy, and creating an uneven regulatory landscape," ICBA President and CEO Rebeca Rainey said in a statement. "The Close the Shadow Banking Loophole Act will ensure a safe and sound financial system and protect the longstanding U.S. policy separating banking and commerce."

The bill was first introduced in 2007 as large commercial companies began exploring banking without being regulated like other parent companies of traditional banks, a senior democratic aide told CNBC. But interest soon died down during the 2008 financial crisis.

Twitter is one of several non-bank companies that sought to enable banking services for users through state-chartered ILCs. Unlike all other bank holding companies, the holding companies of ILCs are not subject to consolidated oversight by the Federal Reserve.

"In principle, you can use a direct messaging stack for payments. And so that's definitely a direction we're going to go in, enabling people on Twitter to be able to send money anywhere in the world instantly and in real-time," Musk told Twitter employees in November.

Jack Dorsey, Musk's predecessor at Twitter, also was involved in financial services through his separate payments company Square. In 2020, Square reportedly held back 20% to 30% of the money collected from consumers who used it for credit card transactions.

Other companies that have applied for ILC charters include eCommerce marketplace Rakuten, Ford Motor Company and financial services firm Edward Jones. The Federal Deposit Insurance Corporation approved ILC deposit insurance applications for Square and Nelnet, a student financial services company, in 2020.

Supporters of the legislation argue the loophole gives ILCs a competitive edge over traditional banks. The senator's bill aims to ensure all banking entities receive the same oversight.

Backers of the bill also note that the potential for large companies to purchase banks could pose issues for consumer data privacy and create conflicts of interest.

On Dec. 1, the House Select Committee on the Coronavirus released a staff report about certain fintech companies' roles in approving fraudulent Paycheck Protection Program loan applications. At least one company, Kabbage Inc. from American Express, is an ILC.

"It's not really good for like local economies, and both from the consumer side and from the banking and financial services side," a senior Democratic said of lack of oversight for shadow banks.

"If a huge company like Facebook or something like that, acquires a bank ... they don't really have an investment in a particular community like a community bank, or even a regional bank does. They're just looking to monetize their data, and that could be problematic," the aide said.

AbJimroe

AbJimroe