Walmart launches Rewards, giving shoppers more deals while brands get more data

Walmart Rewards fueled by Ibotta should sweeten pot for advertisers like P&G by collecting more data.

Walmart is edging closer to a full-fledged loyalty program with the launch of Walmart Rewards, which gives customers cash back via supplier-funded deals that could help the retailer capture data from tens of millions of additional people.

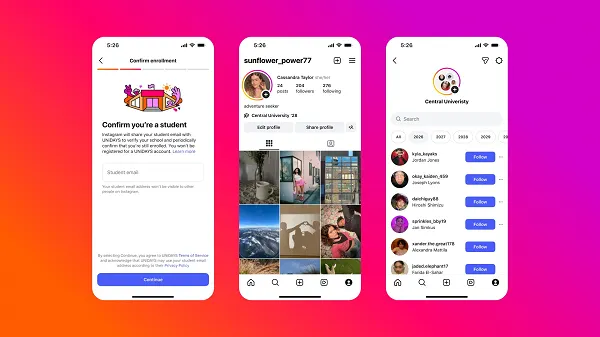

The program, an outgrowth of Walmart's previous collaboration with Ibotta, is expected to be announced tomorrow. It's already being used by some marketers such as Procter & Gamble Co. and could fuel more brand spending via the Walmart Connect media business. That's because it will give brands something new to advertise—the rebates they’re offering—and generate more targeting opportunities through better data. Ibotta is an online promotions program that lets people accumulate rebate offers from brands based on purchases across multiple retailers.

A spokeswoman for Walmart acknowledged the program was under development but declined to provide further detail.

The rewards are available only to people using the Walmart app to make purchases online or in-store via Walmart Pay, so it captures purchase data for program users. Amazon and club store retailers already can link all, or virtually all, of their purchases to individual members or customers. Most supermarket and drug store competitors have loyalty programs that accomplish the same thing. And all that data has fueled the explosive growth of retail media.

'Important strategic initiative'

“It’s an important strategic initiative for Walmart, which was seeing itself get farther and farther behind CVS and Target, which have the best loyalty programs in mainstream food, drug and discount store retail,” said Burt Flickinger, managing director of consultancy Strategic Resource Group.

He also sees the Rewards move complementing the Walmart partnership with Paramount+ announced last week, which gives Walmart+ members a free streaming subscription at no additional charge at a time when Amazon is raising prices for Prime.

The Walmart+ membership program, which provides free home delivery and other incentives for a $98 annual or $12.95 monthly fee, captures nearly all purchase data from members. But it’s still only used by 6% of U.S. adults, according to a CivicScience survey last week. That compares to 54% of adults with access to Amazon Prime video, now at $139 annually or $14.99 monthly as part of overall membership.

People need to be Walmart+ members to use Rewards at this point, and they need to use the app and their accounts at checkout in store. The accumulated rewards could help people pay for their annual or monthly membership, and the program should encourage more people to sign up.

Playing catch up

“This is Walmart playing catch up” to other retailers on loyalty data, said Sarah Hofstetter, president of e-commerce analytics provider Profitero. But that additional data should be valuable to advertisers, she said.

“Having more ways to unlock data and targeting via Walmart will be great, if the buyer knows how to use all of those tools,” Hofstetter said. It’s another move toward complexity and walled gardens at a time when marketers prefer simplicity, she said. That mainly means retail media buyers need to get better at understanding the varying rules of sellers. “It raises the bar for excellence in retail media buying,” she said.

Walmart historically never had a loyalty program, Flickinger said, because of the added expense and deal complexity of getting manufacturers to fund it and the incongruity of item-level deals with the retailer’s everyday low price (EDLP) positioning.

But Walmart Rewards is all about item-level deals. An early brand marketer using the program last week was P&G, which offered deals on Tide and Pantene, the latter for $3 in rewards for people buying three products at once.

Walmart has previously tried a variety of other ways to capture more sales data linked to individual customers, from its Walmart Pay wallet to branded credit cards to the discontinued Savings Catcher competitive price matching program. It also launched a deal with Ibotta last year allowing Walmart purchases and offers on them to generate rewards when shoppers scan their receipts that go into a wallet alongside those from purchases at other retailers.

Ibotta and Walmart Global Tech are handling the technology behind Walmart Rewards. Similar to the closed-loop cashback system Ibotta powers for Kroger Co. as part of its loyalty program, the white-labeled Walmart program will generate rebates that can only be used on future Walmart purchases, said Bryan Leach, founder and CEO of Ibotta.

120 million 'digitally engaged' Walmart shoppers

People who’ve never signed up for Ibotta accounts can still use Walmart Rewards, Leach said. Only about 4 million to 5 million people now are using their Ibotta for Walmart purchases, he said, “though they’re spending billions of dollars a year.” But the Walmart Rewards program could help reach 120 million digitally engaged Walmart shoppers and the 150 million people who shop at Walmart weekly.

“We don’t know what percentage of that 120 million will begin using a rewards program,” Leach said. “However, a very high percentage of other retailers’ digitally engaged shoppers are active in their rewards programs.”

He cited Kroger, Albertsons, Safeway and Target, with its Target Circle program, as “getting very high percentages of their total addressable digital audience to engage in rewards, and we’re hoping to exceed those percentages” with Walmart.

BigThink

BigThink