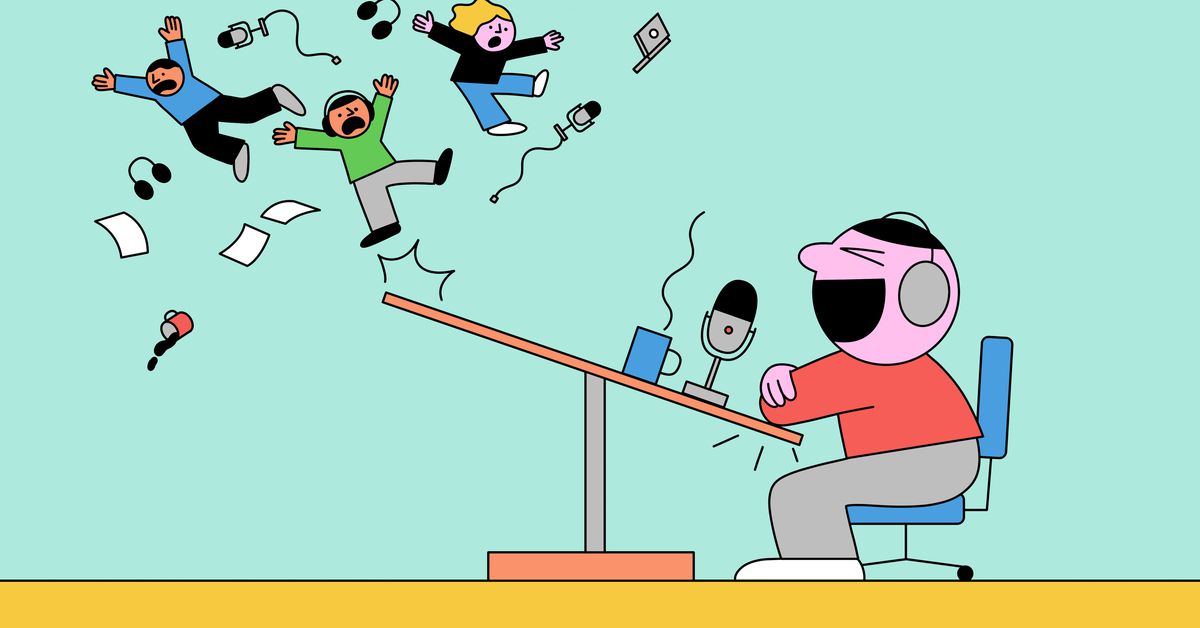

Elon Musk learns the hard way that being a Twitter troll is way more fun than being a mod

How many billions can users troll him out of? | Illustration by Laura Normand / The VergeThe most expensive forum drama of all time? Continue reading…

/cdn.vox-cdn.com/uploads/chorus_asset/file/24090215/STK171_VRG_Illo_1_Normand_ElonMusk_001.jpg)

I honestly did not think chaos would engulf Twitter so quickly, but I must admit: this rules. This owns so hard. Awoooou (wolf howl), Twitter is good again. We’re no longer locked in here with Elon Musk — Elon Musk has locked himself in here with us.

Musk took control of Twitter on October 27th. Since then:

Okay! So I have some thoughts about what the fuck is going on. First of all, Musk often changed his mind at Tesla, like when he decided he was going to close all the brick-and-mortar Tesla stores, then reversed himself, or the time he decided that Tesla was going to accept Bitcoin until, uh, it didn’t. Teslas were going to be built by an “alien dreadnought,” which didn’t work. The quick reversals are not unusual for Musk. It’s just that Tesla is a business Musk built around his fandom, who are more understanding of this kind of behavior.

Twitter, however, is an acquisition and is not necessarily full of Musk fans. That means it’s a much less forgiving environment for Musk. Like, an early subset of Twitter users are Something Awful forum goons — the most prominent of whom is Dril — and they love fucking with people. Plus, Musk’s Twitter Blue plan to devalue verification check marks motivated a bunch of people who didn’t like Musk to go out with a bang by impersonating him, largely because they knew it would make him mad. And it probably did! Certainly, that would explain why his very first policy change was to increase punishment for impersonation.

Shenanigans are fun, but here’s the thing to keep in mind: Twitter is loaded with debt from the acquisition and needs to pay roughly $1 billion a year on it. In 2021, Twitter made $5 billion in revenue and did not turn a profit. “This isn’t complicated,” says Mike Roberts, a professor at the Wharton Business School at the University of Pennsylvania. “He owes a bunch of money, and he’s gotta raise money somewhere, somehow. What I wonder is about the ability of Twitter to pay this debt.”

So Musk has to figure out how to make money while people scream at him and impersonate him. Fun job!

Now, one way to free up cash is to fire a lot of people. The problem with doing that, though, is that you lose a bunch of the engineers who could build cool shit to make Twitter more attractive. This is maybe not a major problem, as all tech companies are cutting people loose right now, so Musk can hire new talent on the cheap if he has to.

But this does not solve a bigger problem, which is revenue. Last year, 89 percent of Twitter’s revenue — about $4.5 billion — came from advertising. The rest of the company’s income came from other streams, such as data licensing.

Let’s focus on the advertising problem for a minute. A lot of brands have paused their spending, and one ad exec who was on a call with Musk called his behavior “petulant and thoughtless.” This is an immediate problem because the fourth quarter is the most important one for any business that relies on advertising — including this here website. So a lot of major advertisers are pulling out of Twitter during a crucial period for the company to make money, something Musk himself has acknowledged. “Twitter has had a massive drop in revenue,” he tweeted.

It does get worse, and this part isn’t Musk’s fault. When the economy slows down, companies spend less money on advertising. So even if Musk weren’t doing wild stuff to alienate advertisers, such as tweeting conspiracy theories about Paul Pelosi, Twitter might have been in trouble anyway. But Musk has essentially identified himself and his company as a loose canon, which means that anyone looking to trim advertising spend might be inclined to cut Twitter first.

Now, Twitter did set up Tips — a way to send cash to people you like — but it doesn’t take a cut of that money. It does take a cut of the revenue from Super Follows, a way to make your tweets a subscription service, but Twitter’s share is dwarfed by the fees taken by Apple for in-app purchases.

This is the internet, and there’s forum drama

So in terms of revenue, the action, at least right now, is mostly around Twitter Blue, a premium-tier version of Twitter that lets users, among other things, edit their tweets. Musk raised the price of that product to $8, which may not be enough to cover its costs. Let’s do some back-of-the-envelope math, shall we? A year of Twitter blue is $96, which I am going to round to $100 for the purposes of simpler math. If 10 million people sign up for a year, that’s $1 billion in revenue right there. Easy, right?

Well, no, because this is the internet, and there’s forum drama. Blue users get a blue check mark, which looks exactly like the check mark verified users get — but Twitter Blue customers don’t have to verify their identity, which is how an account with a blue check mark and the display name “Nintendo of America” managed to put up a tweet of Mario flipping the bird. To an unwary user, that might look sufficiently like the actual Nintendo account to do brand damage.

But Musk doesn’t mind. When our own Tom Warren took a screenshot of the tweet, a user replied, “The beauty of this is each account that gets verified paid $8. Twitter keeps the money and suspends the account. It’s genius and I hope more folks do this. It’s free money for Twitter.” Musk himself replied to that user with a bullseye emoji, a smiley face wearing sunglasses, and a bag of money emoji.

I don’t think a lot of advertisers would want to come back to someone with that attitude toward impersonation, even without an economic downturn. The open question to me is whether users want to stay in that environment — one that’s just gotten a new layer of hoaxing and scammers. Billionaire Mark Cuban has already complained that the influx of new checkmarked users has made his mentions miserable. Cuban’s thoughts are one reason people stay on the platform — drive him off, and Twitter is less valuable.

You can see how that turns into a death spiral pretty quickly

Incidentally, Twitter is under a consent decree with the federal government requiring full documentation, in writing, of any foreseeable risks of “any product or service affecting commerce.” The changes to Twitter Blue rolled out less than two weeks after Musk bought Twitter. Do you think there’s full documentation about its risks? Sounds like Twitter’s lawyers are worried!

And that’s before we get to Musk’s paywall ambitions. Essentially, he’s told advertisers he wants to de-rank people using Twitter’s free product and make users pay for reach. Your average person won’t pay for reach, but people shilling newsletters, crypto scams, and other annoyances will. That might get Musk the revenue he wants, but it also degrades the site and potentially means fewer users stick around, making it less valuable for marketers, making them less likely to pay their $8… You can see how that turns into a death spiral pretty quickly.

But I don’t know that he’ll stick to that plan because he’s not especially known for sticking to plans. What I do know is that Musk has a lot of money, and he can give himself some runway to turn Twitter around by simply paying Twitter’s debt himself. So when Musk offloaded $3.9 billion of Tesla shares this week, I figure he was putting aside some cash for Twitter’s loans.

There’s a plausible world in which Musk just continues to offload Tesla shares to fund his Twitter experiments. (This is maybe not a great outcome for Tesla shareholders.) After all, he doesn’t have to keep advertisers happy, and as long as he’s paying interest, no one particularly cares where the money comes from. As long as he’s got the billions to pay off Twitter’s loans and whatever else, he’s got runway to remake the app into what he wants it to be — whatever that is.

Musk owns the hellsite and has been giving its rather hostile user base the tools for effectively trolling him out of billions of dollars

Let’s talk about the loans for a hot minute. The Twitter debt is currently held by the banks that helped facilitate this deal — unusual since, generally, they try to find buyers for the debt. But Musk’s lawsuit and delayed closing made that harder, and they’re stuck with the loans on their balance sheets. When they got into this situation, interest rates were lower. By the time the deal closed, though, the appetite for debt had changed, says Anant Sundaram, a professor at Dartmouth’s Tuck School of Business.

And it’s risky debt to boot, B1 rated, which is “on the lower end of the junk rating spectrum,” says Wharton’s Roberts. “Investor appetite for this debt clearly isn’t as large as it was four months ago.” And when Moody’s rated Twitter’s debt, it cited Twitter’s governance — i.e., Elon Musk — as a major driver of risk.

So for the banks, offloading Twitter’s debt now means taking an immediate loss. Banks may choose to hang on to the debt for a while to see whether the market conditions change. But if Twitter is obviously shitting the bed, unloading that debt gets even harder. Now, Musk is the richest guy in the world, so banks might be willing to negotiate terms with him about debt repayment. But I do wonder how long they want to hold these loans and who might buy them. If banks can’t place the debt, that probably does make it difficult for any other leveraged buy-outs in tech to get done.

“I sometimes get the feeling that people underestimate him, and maybe some of it is deserved because he always seems to live on the financial edge with every business he gets involved in,” says Sundaram. “But I’m willing to give him the benefit of the doubt.” Sundaram notes that none of us know what Musk’s financial model for Twitter is; perhaps he factored in losing a third or more of his users. Moderation problems that make Twitter a ghost town, like Truth Social or Parler, are the worst-case scenario, Sundaram says. “Then he’s finished.”

Look, I’m sorry, but this is extremely personal as someone who loves Twitter. It is the funniest possible thing, and it is perfect for Twitter. Musk owns the hellsite and has been giving its rather hostile user base the tools for effectively trolling him out of billions of dollars. As much as users disliked Jack Dorsey, he was not the kind of person you could effectively troll — and his slow approach to product rollout made it a lot harder to tank the site by shitposting alone. Elon Musk’s Twitter, on the other hand, might just be the greatest show on earth, not least because every poster knows it is totally possible to make him mad online.

Astrong

Astrong

![Run An Ecommerce SEO Audit in 4 Stages [+ Free Workbook]](https://api.backlinko.com/app/uploads/2025/06/ecommerce-seo-audit-featured-image.png)